Region:Global

Author(s):Shubham

Product Code:KRAA3132

Pages:98

Published On:August 2025

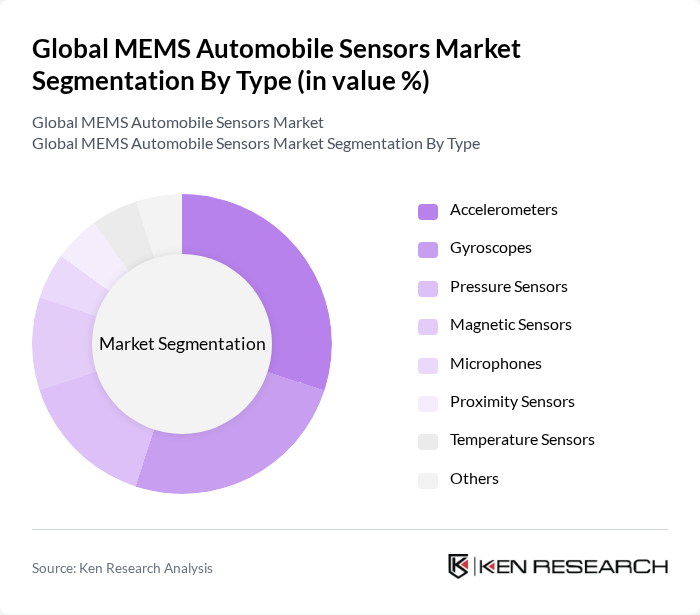

By Type:The MEMS automobile sensors market is segmented into accelerometers, gyroscopes, pressure sensors, magnetic sensors, microphones, proximity sensors, temperature sensors, and others. Accelerometers and gyroscopes are particularly dominant due to their critical roles in vehicle stability control, rollover detection, and navigation systems. The increasing demand for enhanced safety, vehicle automation, and real-time monitoring is driving the adoption of these sensors. As automotive technology advances, the reliance on these sensor types is expected to intensify, especially for applications in ADAS and autonomous vehicles .

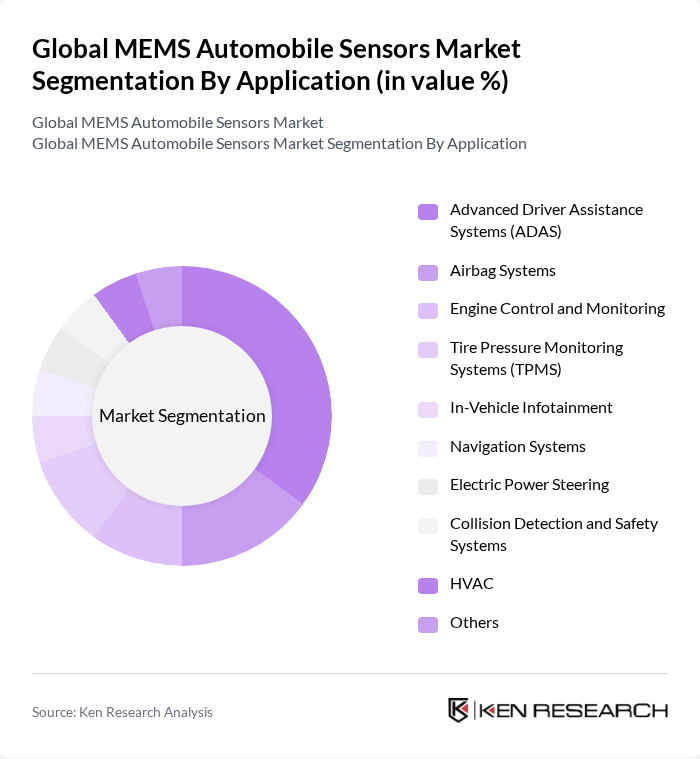

By Application:The applications of MEMS automobile sensors include advanced driver assistance systems (ADAS), airbag systems, engine control and monitoring, tire pressure monitoring systems (TPMS), in-vehicle infotainment, navigation systems, electric power steering, collision detection and safety systems, HVAC, and others. The ADAS segment leads the market, driven by the automotive industry's focus on safety, regulatory mandates, and the growing trend toward autonomous and connected vehicles. Demand for MEMS sensors in airbag deployment, tire pressure monitoring, and engine management is also rising as manufacturers seek to enhance reliability and compliance with safety standards .

The Global MEMS Automobile Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Denso Corporation, Murata Manufacturing Co., Ltd., Sensata Technologies, Inc., Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Texas Instruments Incorporated, Honeywell International Inc., MEMSIC, Inc., InvenSense, Inc. (TDK Corporation), Panasonic Corporation, Omron Corporation, Seiko Instruments Inc., Aptiv PLC, Continental AG, Hitachi Astemo, Ltd., TE Connectivity Ltd., Amphenol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The MEMS automobile sensors market is poised for significant advancements, driven by the increasing integration of smart technologies in vehicles. As the automotive industry shifts towards automation and connectivity, the demand for MEMS sensors will likely rise, particularly in autonomous vehicles. Additionally, the focus on sustainability will encourage innovations in eco-friendly sensor technologies, further enhancing their adoption. Collaborations between automotive and technology companies will also foster new developments, ensuring the market remains dynamic and responsive to emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Accelerometers Gyroscopes Pressure Sensors Magnetic Sensors Microphones Proximity Sensors Temperature Sensors Others |

| By Application | Advanced Driver Assistance Systems (ADAS) Airbag Systems Engine Control and Monitoring Tire Pressure Monitoring Systems (TPMS) In-Vehicle Infotainment Navigation Systems Electric Power Steering Collision Detection and Safety Systems HVAC Others |

| By Vehicle Type | Passenger Vehicles (Hatchback, Sedan, SUV) Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles Autonomous Vehicles Others |

| By End-User | Original Equipment Manufacturers (OEMs) Aftermarket |

| By Region | North America (U.S., Canada) Europe (Germany, France, UK, Italy, Spain, Russia, Netherlands, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Singapore, Thailand, Vietnam, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Technology | Analog MEMS Sensors Digital MEMS Sensors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle MEMS Sensors | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Sensor Applications | 60 | Fleet Managers, Technical Directors |

| Electric Vehicle MEMS Integration | 50 | R&D Specialists, Battery Technology Experts |

| Autonomous Driving Sensor Systems | 40 | Systems Engineers, Safety Compliance Officers |

| MEMS Sensor Market Trends | 45 | Market Analysts, Industry Consultants |

The Global MEMS Automobile Sensors Market is valued at approximately USD 5.2 billion, driven by the increasing demand for advanced driver assistance systems (ADAS) and the rapid adoption of electric vehicles, among other factors.