Region:Global

Author(s):Rebecca

Product Code:KRAB0238

Pages:100

Published On:August 2025

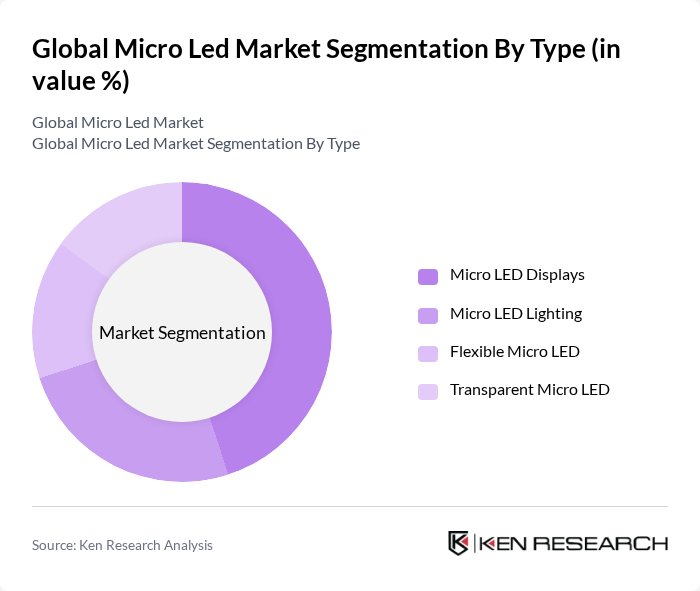

By Type:The market is segmented into Micro LED Displays, Micro LED Lighting, Flexible Micro LED, and Transparent Micro LED. Among these, Micro LED Displays lead the market due to their application in high-end televisions, smartphones, and wearables, driven by consumer demand for superior image quality, energy efficiency, and ultra-thin form factors. The trend toward larger screen sizes, higher resolutions, and flexible display designs in consumer electronics further supports the dominance of this sub-segment. Micro LED Lighting is also gaining traction in automotive and architectural lighting, while Flexible and Transparent Micro LEDs are emerging in next-generation display applications .

By End-User:The market is segmented into Consumer Electronics (Smartphones, TVs, Wearables), Automotive (Instrument Clusters, HUDs, Interior Displays), Commercial Displays (Digital Signage, Retail, Hospitality), Industrial & Medical Applications, and Aerospace & Defense. The Consumer Electronics segment is the most significant, driven by the increasing adoption of micro LED technology in smartphones, televisions, and wearables, where users seek enhanced display quality, energy efficiency, and durability. The Automotive segment is expanding due to the integration of micro LED in instrument clusters and head-up displays, while Commercial Displays benefit from the technology’s suitability for digital signage and retail environments .

The Global Micro Led Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Apple Inc. (including LuxVue Technology), Sony Group Corporation, LG Display Co., Ltd., Aledia S.A., VueReal Inc., Jade Bird Display (JBD) Inc., MicroLED Technologies Ltd., X-Celeprint Ltd., PlayNitride Inc., Epistar Corporation, ams OSRAM AG, Nichia Corporation, Rohm Co., Ltd., Lumens Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Micro LED market appears promising, driven by ongoing technological innovations and increasing consumer demand for high-quality displays. As manufacturers invest in research and development, advancements in production techniques are expected to enhance yield rates and reduce costs. Additionally, the integration of Micro LED technology in emerging applications, such as automotive displays and smart wearables, will likely expand market reach. The focus on sustainability and energy efficiency will further propel the adoption of Micro LED solutions across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Micro LED Displays Micro LED Lighting Flexible Micro LED Transparent Micro LED |

| By End-User | Consumer Electronics (Smartphones, TVs, Wearables) Automotive (Instrument Clusters, HUDs, Interior Displays) Commercial Displays (Digital Signage, Retail, Hospitality) Industrial & Medical Applications Aerospace & Defense |

| By Application | Television & Large Displays Smartphones & Tablets Wearable Devices (Smartwatches, AR/VR) Digital Signage & Advertising Automotive Displays Medical Devices |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Sales Online Retail Offline Retail Direct Sales |

| By Component | Micro LED Chips Driver ICs Substrates Packaging Materials Backplanes |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Technology Officers |

| Automotive Display Solutions | 60 | Engineering Managers, Procurement Specialists |

| Advertising and Signage Companies | 50 | Marketing Directors, Operations Managers |

| Research Institutions and Universities | 40 | Academic Researchers, Technology Analysts |

| Retail and Commercial Display Providers | 70 | Sales Managers, Product Line Managers |

The Global Micro LED Market is valued at approximately USD 1.05 billion, driven by the increasing demand for high-resolution displays across various sectors, including consumer electronics and automotive applications.