Region:Middle East

Author(s):Shubham

Product Code:KRAD6761

Pages:80

Published On:December 2025

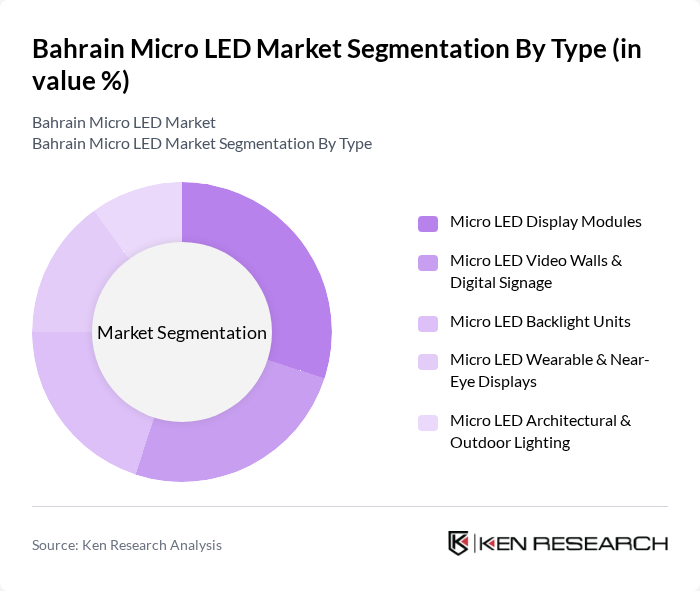

By Type:The market is segmented into various types, including Micro LED Display Modules, Micro LED Video Walls & Digital Signage, Micro LED Backlight Units, Micro LED Wearable & Near-Eye Displays, and Micro LED Architectural & Outdoor Lighting. Each of these subsegments caters to different applications and consumer needs, with specific technologies driving their growth.

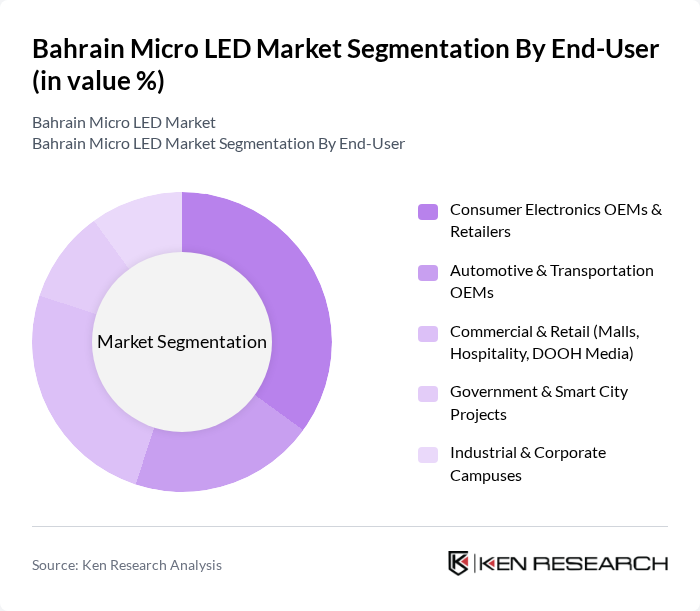

By End-User:The end-user segmentation includes Consumer Electronics OEMs & Retailers, Automotive & Transportation OEMs, Commercial & Retail (Malls, Hospitality, DOOH Media), Government & Smart City Projects, and Industrial & Corporate Campuses. Each segment reflects the diverse applications of micro LED technology across various industries.

The Bahrain Micro LED Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc. (LG Display & LG Business Solutions), Sony Group Corporation (Crystal LED), Leyard Optoelectronic Co., Ltd., Unilumin Group Co., Ltd., Absen Optoelectronic Co., Ltd., TCL China Star Optoelectronics Technology Co., Ltd. (TCL CSOT), AUO Corporation, BOE Technology Group Co., Ltd., Innolux Corporation, Nichia Corporation, Epistar Corporation, Barco N.V., Christie Digital Systems, Local & Regional Middle East LED System Integrators (Selected Profiles) contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Micro LED market in Bahrain appears promising, driven by technological advancements and increasing consumer interest in high-quality displays. As manufacturers continue to innovate and reduce production costs, the accessibility of Micro LED technology is expected to improve. Additionally, the integration of Micro LED displays in emerging sectors such as automotive and smart home applications will likely enhance market growth. The focus on sustainability and energy efficiency will further propel the adoption of Micro LED technology in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Micro LED Display Modules Micro LED Video Walls & Digital Signage Micro LED Backlight Units Micro LED Wearable & Near?Eye Displays Micro LED Architectural & Outdoor Lighting |

| By End-User | Consumer Electronics OEMs & Retailers Automotive & Transportation OEMs Commercial & Retail (Malls, Hospitality, DOOH Media) Government & Smart City Projects Industrial & Corporate Campuses |

| By Application | Indoor Commercial Displays & Control Rooms Outdoor LED Billboards & Stadium Screens Smart City & Infrastructure Displays Automotive Cockpit & HUD Displays Wearables, AR/VR and Specialty Displays |

| By Distribution Channel | Direct Project Sales (EPC/System Integrators) Specialized AV & LED System Integrators IT & Electronics Distributors in Bahrain Online B2B Channels Retail & Showroom Channels |

| By Technology | Direct?View Micro LED Micro LED?on?Silicon (Microdisplay) Micro LED Backlight for LCD Mini LED / Transitional Technologies |

| By Region | Capital Governorate (Manama) Muharraq Governorate Northern Governorate Southern Governorate |

| By Policy Support | Smart City & Digital Infrastructure Programs Energy Efficiency & Green Building Incentives ICT & Innovation / R&D Grants Foreign Investment & Industrial Policy Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 80 | Store Managers, Product Buyers |

| Automotive Manufacturers | 60 | Product Development Engineers, Procurement Managers |

| Advertising Agencies | 45 | Creative Directors, Media Planners |

| Technology Distributors | 55 | Sales Managers, Supply Chain Coordinators |

| End-User Consumers | 130 | Tech Enthusiasts, General Consumers |

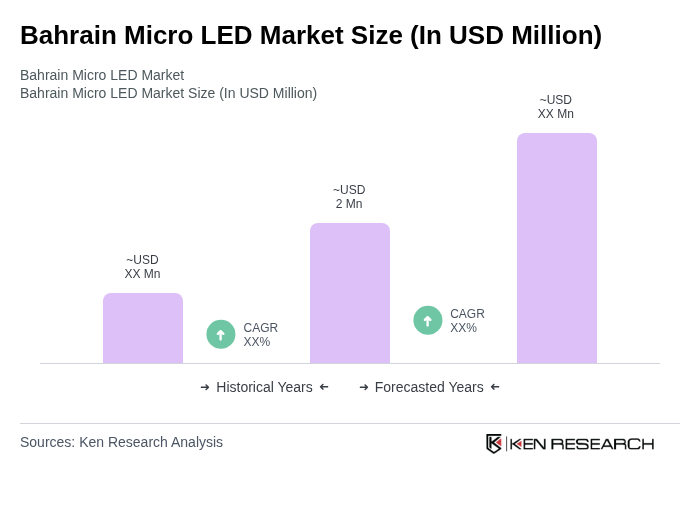

The Bahrain Micro LED Market is valued at approximately USD 2 million, reflecting a growing demand for high-resolution displays in consumer electronics, advertising, and smart city projects, supported by advancements in micro LED technology.