Region:Middle East

Author(s):Shubham

Product Code:KRAC2855

Pages:80

Published On:October 2025

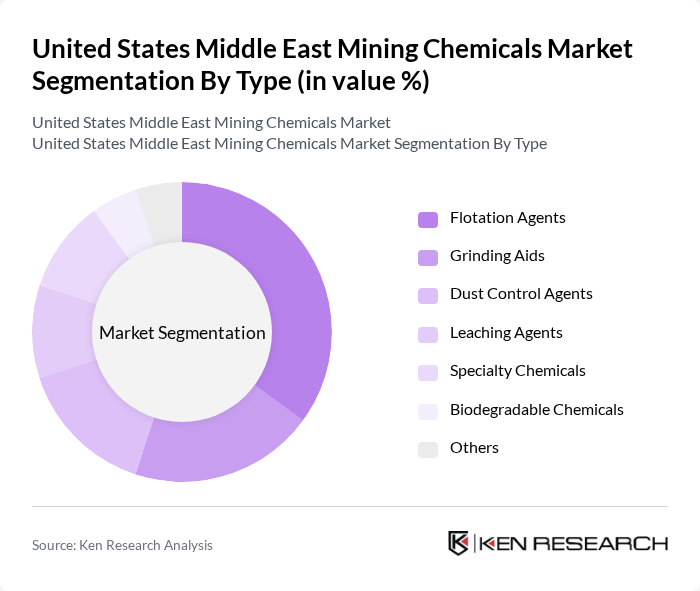

By Type:The market is segmented into various types of mining chemicals, including flotation agents, grinding aids, dust control agents, leaching agents, specialty chemicals, biodegradable chemicals, and others. Among these, flotation agents are the most widely used due to their critical role in mineral separation processes, which are essential for maximizing yield and efficiency in mining operations. The increasing focus on optimizing mineral recovery rates and the adoption of advanced flotation technologies have led to a higher demand for these agents, making them a dominant force in the market .

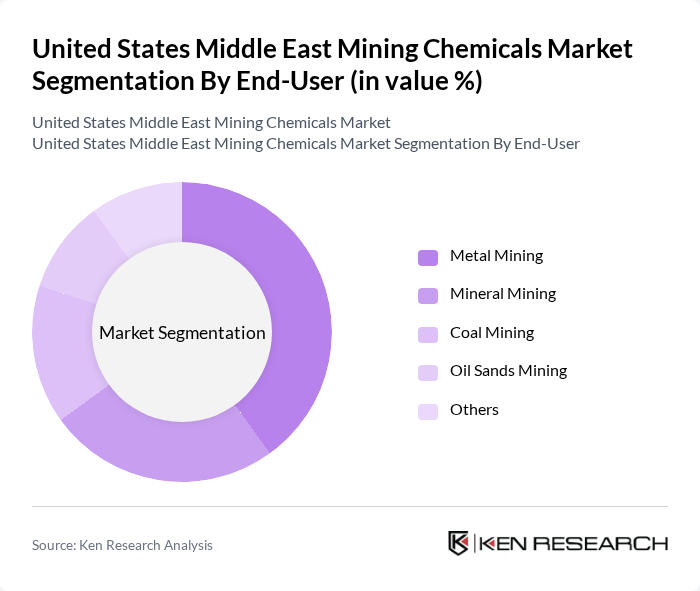

By End-User:The mining chemicals market is further segmented by end-user applications, including metal mining, mineral mining, coal mining, oil sands mining, and others. Metal mining is the leading segment, driven by the high demand for metals such as gold, copper, and aluminum. The increasing global consumption of these metals in various industries, including construction and electronics, has significantly boosted the demand for mining chemicals tailored for metal extraction processes. Recent growth in battery metals and rare earth mining also contributes to segment expansion .

The United States Middle East Mining Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Huntsman Corporation, Solvay S.A., AkzoNobel N.V., Dow Chemical Company, Orica Limited, SNF Group, Kemira Oyj, Albemarle Corporation, Ecolab Inc., FLSmidth & Co. A/S, Imerys S.A., Sika AG, Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mining chemicals market in the United States and the Middle East is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As companies increasingly adopt automation and digital technologies, operational efficiencies are expected to improve, leading to enhanced productivity. Furthermore, the growing emphasis on eco-friendly practices will likely spur innovation in the development of sustainable mining chemicals, aligning with global environmental goals and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Flotation Agents Grinding Aids Dust Control Agents Leaching Agents Specialty Chemicals Biodegradable Chemicals Others |

| By End-User | Metal Mining Mineral Mining Coal Mining Oil Sands Mining Others |

| By Application | Mineral Processing Explosives and Drilling Water Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northeast Midwest South West Others |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Operations in the Middle East | 45 | Mining Engineers, Operations Managers |

| Chemical Suppliers to Mining Sector | 38 | Sales Directors, Product Managers |

| Regulatory Bodies and Compliance Officers | 32 | Regulatory Affairs Managers, Environmental Compliance Officers |

| End-users of Mining Chemicals | 28 | Procurement Managers, Project Managers |

| Industry Experts and Consultants | 22 | Market Analysts, Industry Consultants |

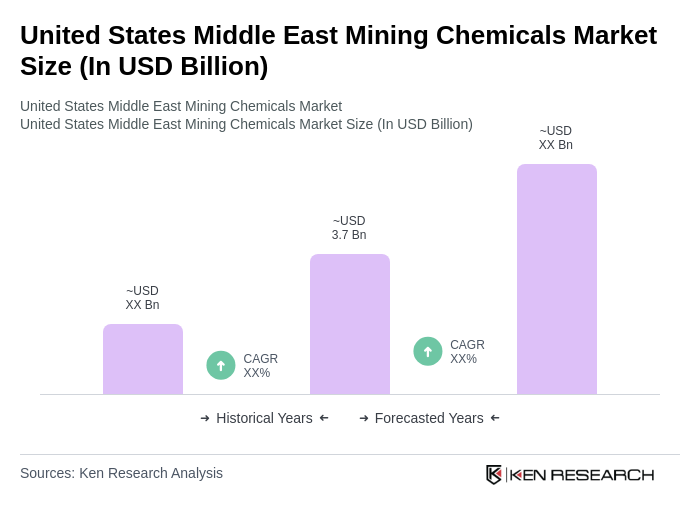

The United States Middle East Mining Chemicals Market is valued at approximately USD 3.7 billion, reflecting a robust growth trajectory driven by increased demand for mining chemicals in mineral processing and the expansion of mining activities in the region.