Region:Global

Author(s):Geetanshi

Product Code:KRAD4879

Pages:93

Published On:December 2025

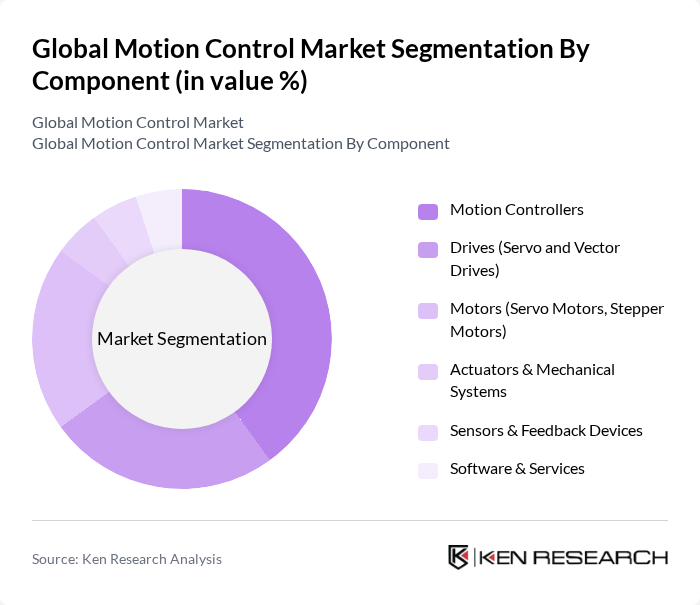

By Component:The motion control market is segmented into various components, including motion controllers, drives, motors, actuators, sensors, and software. Among these, motion controllers are leading the market in value contribution due to their critical role in managing and directing the operation of multi?axis motion systems and coordinating drives and motors. The increasing complexity of automation processes and the need for precise control in applications such as robotics, CNC machinery, semiconductor equipment, packaging, and material handling are driving the demand for advanced motion controllers and integrated controller?drive platforms. Additionally, the integration of software solutions with hardware components—such as PC?based control, digital twins, condition monitoring, and networked motion over industrial Ethernet—is enhancing the functionality, flexibility, and efficiency of motion control systems.

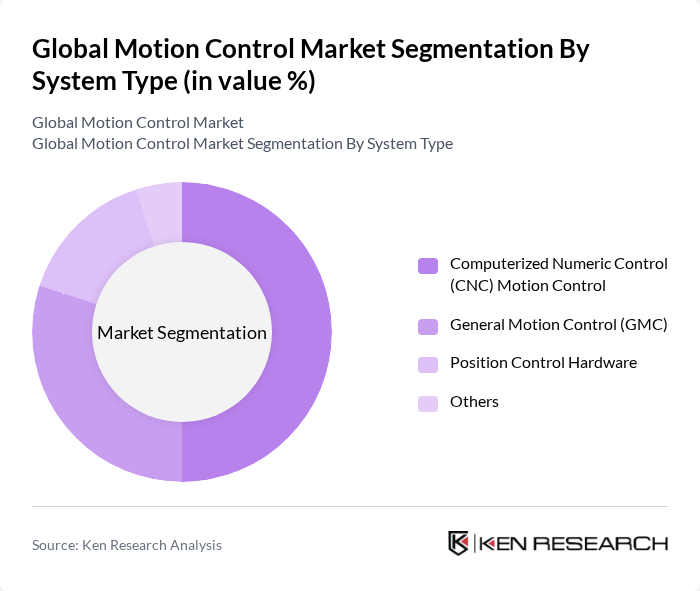

By System Type:The market is also segmented by system type, which includes Computerized Numeric Control (CNC) motion control, General Motion Control (GMC), and position control hardware. The CNC motion control segment is currently dominating high?precision discrete manufacturing applications due to its widespread use in machine tools, metal cutting and forming, and electronics manufacturing, where high precision, repeatability, and multi?axis coordination are essential. The growing trend of automation and digitalization in industries such as aerospace, automotive, electronics, and general machinery is further boosting the demand for CNC systems and advanced computer?numerical control platforms, as they offer enhanced productivity, reduced scrap, shorter changeover times, and lower operational costs.

The Global Motion Control Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Inc., Mitsubishi Electric Corporation, Schneider Electric SE, ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Bosch Rexroth AG, Parker Hannifin Corporation, Omron Corporation, National Instruments Corporation, Beckhoff Automation GmbH & Co. KG, KUKA AG, Delta Electronics, Inc., B&R Industrial Automation GmbH (A Member of ABB Group) contribute to innovation, geographic expansion, and service delivery in this space through broad motion portfolios, integrated control and drive platforms, and digital motion solutions.

The future of the motion control market is poised for significant transformation, driven by technological advancements and evolving industry needs. As industries increasingly adopt IoT-enabled systems, the demand for interconnected motion control solutions will rise. Furthermore, the focus on predictive maintenance will enhance operational efficiency, reducing downtime and maintenance costs. Companies that embrace these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Motion Controllers Drives (Servo and Vector Drives) Motors (Servo Motors, Stepper Motors) Actuators & Mechanical Systems Sensors & Feedback Devices Software & Services |

| By System Type | Computerized Numeric Control (CNC) Motion Control General Motion Control (GMC) Position Control Hardware Others |

| By Application | Metal Cutting Metal Forming Material Handling & Conveying Robotics & Automated Guided Vehicles Semiconductor & Electronics Machinery Packaging & Labelling Others |

| By End-Use Industry | Automotive Aerospace & Defense Semiconductor & Electronics Food & Beverages Pharmaceuticals & Life Sciences Metals & Machinery Manufacturing Medical Devices Logistics & Warehousing Others |

| By Technology | Analog Motion Control Digital Motion Control Networked / IoT-Enabled Motion Control Hybrid Motion Control |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Market Maturity | Emerging Markets Established Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robotics Integration | 120 | Robotics Engineers, Automation Specialists |

| CNC Machinery Applications | 90 | Manufacturing Managers, CNC Operators |

| Automotive Motion Control Systems | 80 | Automotive Engineers, Product Development Managers |

| Aerospace Motion Control Solutions | 70 | Aerospace Engineers, Systems Analysts |

| Industrial Automation Projects | 100 | Plant Managers, Process Engineers |

The Global Motion Control Market is valued at approximately USD 17 billion, driven by increasing automation, advancements in robotics, and the need for precision in manufacturing processes. This market is expected to grow significantly in the coming years.