Region:Global

Author(s):Shubham

Product Code:KRAA2673

Pages:100

Published On:August 2025

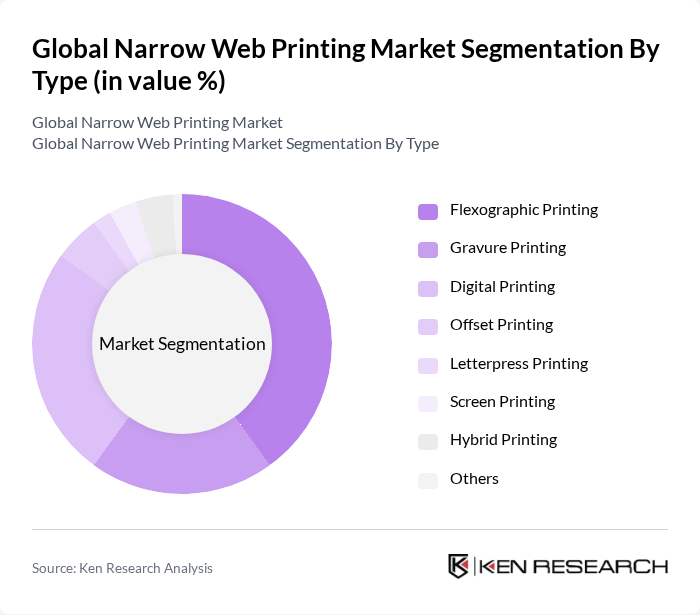

By Type:The narrow web printing market is segmented into various printing types, including Flexographic Printing, Gravure Printing, Digital Printing, Offset Printing, Letterpress Printing, Screen Printing, Hybrid Printing, and Others. Among these, Flexographic Printing is the most dominant segment due to its versatility and efficiency in high-volume production, particularly for labels and packaging. Digital Printing is also gaining traction, driven by the demand for customization and shorter print runs. The market is witnessing a trend towards hybrid printing solutions that combine the strengths of different printing technologies, such as integrating digital modules with flexographic presses for enhanced flexibility and print quality.

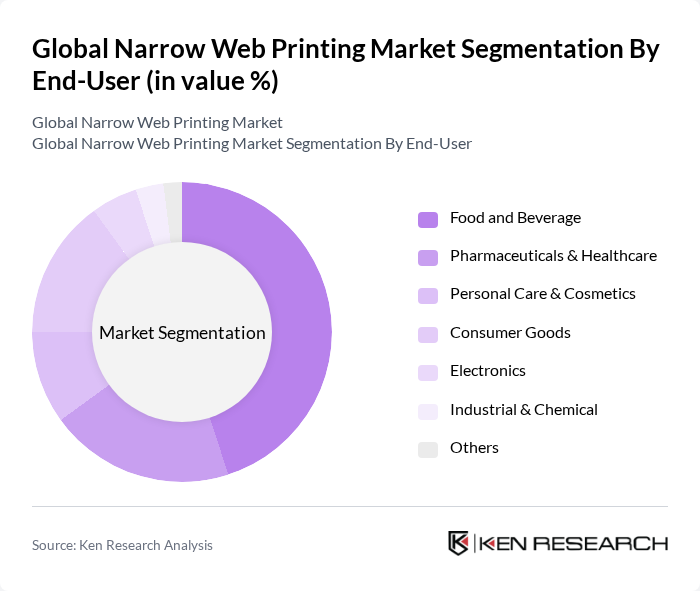

By End-User:The end-user segmentation of the narrow web printing market includes Food and Beverage, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Consumer Goods, Electronics, Industrial & Chemical, and Others. The Food and Beverage sector is the largest end-user, driven by the need for attractive packaging and labeling that enhances product visibility and compliance with regulatory standards. The Pharmaceuticals sector is also significant, as it requires high-quality printing for labels that ensure safety and traceability. The personal care and cosmetics sector is growing, propelled by premium packaging trends and the need for visually distinctive labels.

The Global Narrow Web Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avery Dennison Corporation, UPM Raflatac, CCL Industries Inc., Multi-Color Corporation, Sato Holdings Corporation, Domtar Corporation, WS Packaging Group, Inc., Label Technology, Inc., Fortis Solutions Group, Heidelberger Druckmaschinen AG, Mark Andy Inc., Bobst Group SA, Nilpeter A/S, Gallus Ferd. Rüesch AG (Gallus, a Heidelberg Company), Omet Srl contribute to innovation, geographic expansion, and service delivery in this space.

The future of the narrow web printing market appears promising, driven by the increasing emphasis on sustainability and technological innovation. As companies adopt eco-friendly practices and invest in advanced printing technologies, the market is expected to evolve significantly. Furthermore, the integration of automation and smart packaging solutions will enhance operational efficiency and customer engagement. These trends indicate a dynamic landscape where adaptability and innovation will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexographic Printing Gravure Printing Digital Printing Offset Printing Letterpress Printing Screen Printing Hybrid Printing Others |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Personal Care & Cosmetics Consumer Goods Electronics Industrial & Chemical Others |

| By Application | Labels (Pressure Sensitive, Glue-Applied, Shrink Sleeve, In-Mold, Wrap-Around, Thermal Transfer) Flexible Packaging Tags Shrink Sleeves Wrappers Folding Cartons Others |

| By Material | Paper Plastic Films (BOPP, PET, PE, PVC, Others) Foil/Metal Laminates Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Distributors Others |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Label Printing Sector | 120 | Production Managers, Marketing Directors |

| Packaging Industry | 90 | Supply Chain Managers, Product Development Leads |

| Textile Printing Applications | 60 | Textile Engineers, Brand Managers |

| Pharmaceutical Packaging | 50 | Regulatory Affairs Specialists, Quality Control Managers |

| Consumer Goods Printing | 70 | Brand Managers, Operations Directors |

The Global Narrow Web Printing Market is valued at approximately USD 76 billion, driven by increasing demand for packaging solutions, particularly in the food and beverage sector, and advancements in printing technologies.