Global Network Traffic Analysis Market Overview

- The Global Network Traffic Analysis Market is valued at USD 4.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for robust cybersecurity measures, the surge in data traffic due to digital transformation, and the need for real-time analytics to enhance operational efficiency. Organizations are investing in advanced network traffic analysis tools to monitor, manage, and secure their networks effectively. The proliferation of connected devices, expansion of cloud services, and heightened risk of sophisticated cyber threats such as ransomware and advanced persistent threats further accelerate market adoption .

- Key players in this market include the United States, China, and Germany. The United States dominates due to its advanced technological infrastructure, high adoption of cloud services, and significant investments in cybersecurity. China follows closely, driven by its vast internet user base, rapid digitalization, and government-led initiatives to strengthen network security. Germany leads in Europe with its strong industrial base and stringent data protection regulations, especially in sectors such as manufacturing and automotive .

- In 2023, the European Union implemented the Digital Services Act, issued by the European Parliament and Council, which mandates stricter regulations on data privacy and security for online platforms. This regulation requires digital service providers to implement robust measures for user protection, transparency, and accountability, thereby driving the demand for network traffic analysis solutions that ensure compliance with these new operational standards .

Global Network Traffic Analysis Market Segmentation

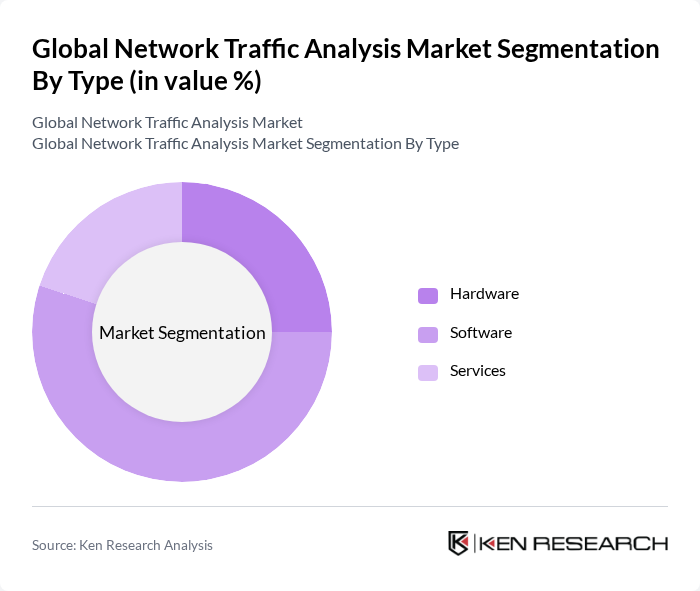

By Type:

The market is segmented into Hardware, Software, and Services. Among these, the Software sub-segment is dominating the market due to the increasing need for advanced analytics and real-time monitoring capabilities. Organizations are increasingly adopting software solutions that provide comprehensive insights into network performance and security threats. The demand for cloud-based software solutions is also rising, as they offer scalability, flexibility, and seamless integration with existing IT infrastructure, making them attractive to businesses of all sizes. The growing sophistication of cyber threats and the need for continuous monitoring further reinforce the dominance of software in this segment .

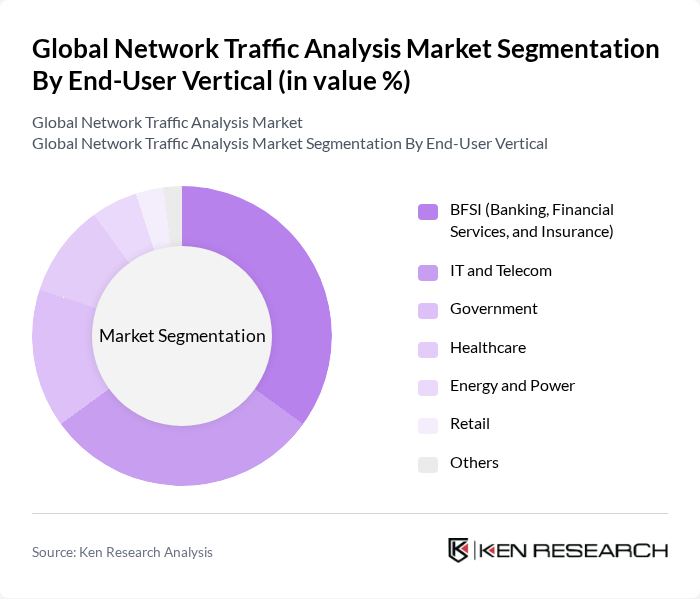

By End-User Vertical:

The market is segmented into BFSI, IT and Telecom, Government, Healthcare, Energy and Power, Retail, and Others. The BFSI sector is leading the market due to stringent regulatory requirements and the need for robust security measures to protect sensitive financial data. Financial institutions are increasingly investing in network traffic analysis solutions to detect fraud, ensure compliance, and enhance customer trust. The IT and Telecom sector follows closely, driven by the need for efficient network management, performance optimization, and the adoption of 5G and cloud-native environments. Healthcare and government sectors are also witnessing increased adoption due to rising cyber threats and regulatory mandates for data protection .

Global Network Traffic Analysis Market Competitive Landscape

The Global Network Traffic Analysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., IBM Corporation, NetScout Systems, Inc., SolarWinds Corporation, Juniper Networks, Inc., VMware, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Splunk Inc., Akamai Technologies, Inc., F5, Inc., Extreme Networks, Inc., Barracuda Networks, Inc., Arista Networks, Inc., Zscaler, Inc., Palo Alto Networks, Inc., Gigamon Inc., Darktrace plc, Keysight Technologies, Inc., Viavi Solutions Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Network Traffic Analysis Market Industry Analysis

Growth Drivers

- Increasing Data Traffic:The global data traffic is projected to reach 175 zettabytes in future, driven by the proliferation of digital content and online services. This surge in data consumption is primarily fueled by video streaming, cloud computing, and social media platforms, which collectively account for over 82% of global internet traffic. As organizations adapt to this growing demand, investments in network traffic analysis tools are expected to rise significantly, enhancing operational efficiency and user experience.

- Demand for Network Security:Cybersecurity threats are escalating, with global cybercrime costs projected to hit $10.5 trillion annually in future. This alarming trend is prompting businesses to prioritize network security, leading to increased investments in traffic analysis solutions. In future, organizations are expected to allocate approximately $150 billion to cybersecurity measures, including advanced network monitoring tools, to safeguard sensitive data and maintain compliance with regulatory standards, thereby driving market growth.

- Adoption of IoT Devices:The number of connected IoT devices is anticipated to exceed 30 billion in future, creating a massive influx of data traffic. This rapid adoption necessitates robust network traffic analysis to manage and optimize device performance effectively. As industries such as healthcare, manufacturing, and smart cities increasingly rely on IoT solutions, the demand for comprehensive traffic analysis tools will grow, enabling organizations to harness the full potential of their IoT ecosystems.

Market Challenges

- Data Privacy Concerns:With the implementation of stringent regulations like GDPR, organizations face significant challenges in ensuring data privacy and compliance. In future, nearly 60% of businesses report concerns regarding data handling practices, which can lead to hefty fines and reputational damage. This heightened scrutiny complicates the deployment of network traffic analysis tools, as companies must balance effective monitoring with stringent privacy requirements, potentially stalling market growth.

- High Implementation Costs:The initial investment required for advanced network traffic analysis solutions can be substantial, often exceeding $500,000 for mid-sized enterprises. This financial barrier can deter organizations from adopting necessary technologies, particularly in economically challenging environments. As companies grapple with budget constraints, the reluctance to invest in sophisticated analysis tools may hinder the overall growth of the network traffic analysis market in the near term.

Global Network Traffic Analysis Market Future Outlook

The future of the network traffic analysis market appears promising, driven by technological advancements and increasing data demands. As organizations continue to embrace AI and machine learning, the integration of these technologies into traffic analysis tools will enhance predictive capabilities and operational efficiency. Furthermore, the expansion of 5G networks is expected to facilitate faster data transmission, creating new opportunities for real-time analytics and improved network management, ultimately shaping the market landscape in the coming years.

Market Opportunities

- Growth in Cloud Computing:The global cloud computing market is projected to reach $1.6 trillion in future, creating significant opportunities for network traffic analysis solutions. As businesses migrate to cloud environments, the need for effective monitoring and management of cloud-based traffic will increase, driving demand for advanced analytics tools that ensure optimal performance and security.

- Expansion of 5G Networks:With 5G networks expected to cover 40% of the global population in future, the demand for network traffic analysis will surge. This technology will enable faster data transfer and lower latency, necessitating sophisticated analysis tools to manage the increased traffic volume effectively. Companies that capitalize on this trend will be well-positioned to enhance their network performance and user experience.