Region:Global

Author(s):Dev

Product Code:KRAA3048

Pages:98

Published On:August 2025

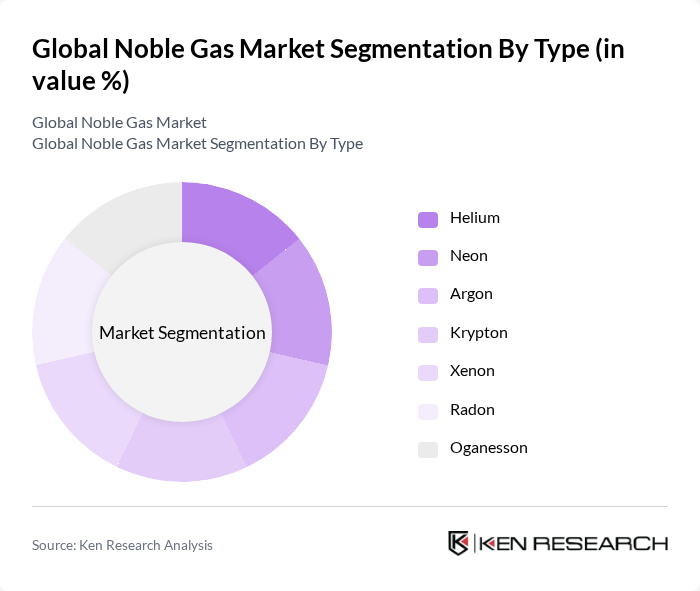

By Type:The noble gas market is segmented into Helium, Neon, Argon, Krypton, Xenon, and Radon. Among these,Argonis the most widely used noble gas, primarily due to its extensive applications in welding, metal fabrication, and as a shielding gas in industrial processes.Heliumfollows, with strong demand in cryogenics, medical imaging, and as a lifting gas. The unique inertness and low reactivity of noble gases drive their essential role in high-purity and specialty applications across industries.

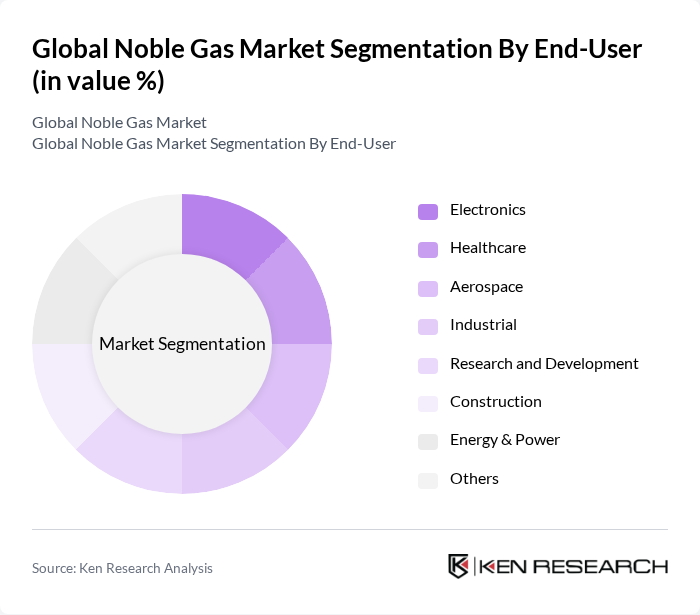

By End-User:The noble gas market is segmented by end-user industries, including Electronics, Healthcare, Aerospace, Industrial, Research and Development, Construction, Energy & Power, and Others. TheElectronicssector is the leading end-user, driven by the growing demand for semiconductors, flat-panel displays, and specialty lighting.Healthcareis a significant segment, with noble gases used in medical imaging, anesthesia, and respiratory treatments. Technological advancements and the need for ultra-high-purity gases continue to propel growth in these sectors.

The Global Noble Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Praxair Technology, Inc. (now part of Linde plc), Messer Group GmbH, Air Liquide S.A., Matheson Tri-Gas, Inc., Iwatani Corporation, Gulf Cryo, BOC Group Limited (subsidiary of Linde plc), Taiyo Nippon Sanso Corporation, Universal Industrial Gases, Inc., MESA Specialty Gases & Equipment, Airgas, Inc. (an Air Liquide company), BASF SE, AGA Gas AB (part of Linde plc) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the noble gas market appears promising, driven by technological advancements and increasing applications across various sectors. Innovations in gas extraction technologies are expected to enhance supply efficiency, while the growing emphasis on clean energy solutions will likely boost demand for noble gases in sustainable applications. Additionally, emerging markets are anticipated to present new opportunities, as industrialization and urbanization continue to rise, further expanding the market landscape for noble gases.

| Segment | Sub-Segments |

|---|---|

| By Type | Helium Neon Argon Krypton Xenon Radon Oganesson |

| By End-User | Electronics Healthcare Aerospace Industrial Research and Development Construction Energy & Power Others |

| By Application | Lighting Welding Refrigeration Insulation Medical Imaging Metal Melting Cryogenics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America United States Canada Mexico Europe United Kingdom Germany France Italy Spain Russia Benelux Nordics Rest of Europe Asia-Pacific China India Japan South Korea ASEAN Oceania Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East & Africa Turkey Israel GCC North Africa South Africa Rest of Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing Others |

| By Product Form | Gaseous Liquid Solid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Gas Applications | 100 | Healthcare Administrators, Medical Equipment Suppliers |

| Industrial Gas Usage | 80 | Manufacturing Managers, Process Engineers |

| Aerospace Applications | 60 | Aerospace Engineers, Procurement Specialists |

| Research and Development | 50 | Lab Managers, Research Scientists |

| Electronics Manufacturing | 70 | Production Supervisors, Quality Control Managers |

The Global Noble Gas Market is valued at approximately USD 2.9 billion, driven by increasing demand in sectors such as electronics, healthcare, and aerospace, along with the need for high-purity gases in various industrial applications.