Region:Middle East

Author(s):Dev

Product Code:KRAE0015

Pages:104

Published On:December 2025

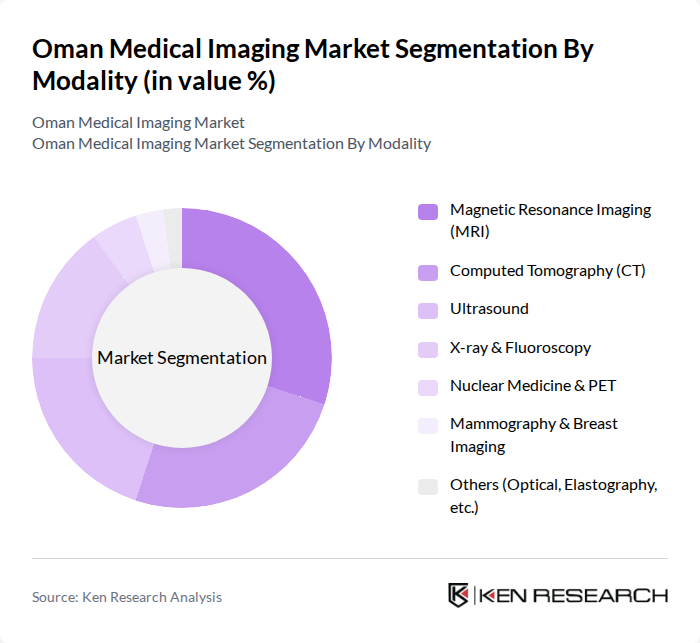

By Modality:The modalities in the medical imaging market include various technologies used for diagnostic purposes. The key modalities are Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound, X-ray & Fluoroscopy, Nuclear Medicine & PET, Mammography & Breast Imaging, and Others (Optical, Elastography, etc.). Each modality serves specific diagnostic needs and has unique advantages, influencing their adoption rates in healthcare facilities.

The Magnetic Resonance Imaging (MRI) segment is currently leading the market due to its non-invasive nature and ability to provide detailed images of soft tissues, making it essential for diagnosing various conditions, particularly in neurology and oncology. The increasing demand for early diagnosis and the growing prevalence of chronic diseases have further propelled the adoption of MRI technology in hospitals and diagnostic centers. Additionally, advancements in MRI technology, such as functional MRI and high-field MRI systems, are enhancing its application scope, thereby solidifying its market leadership.

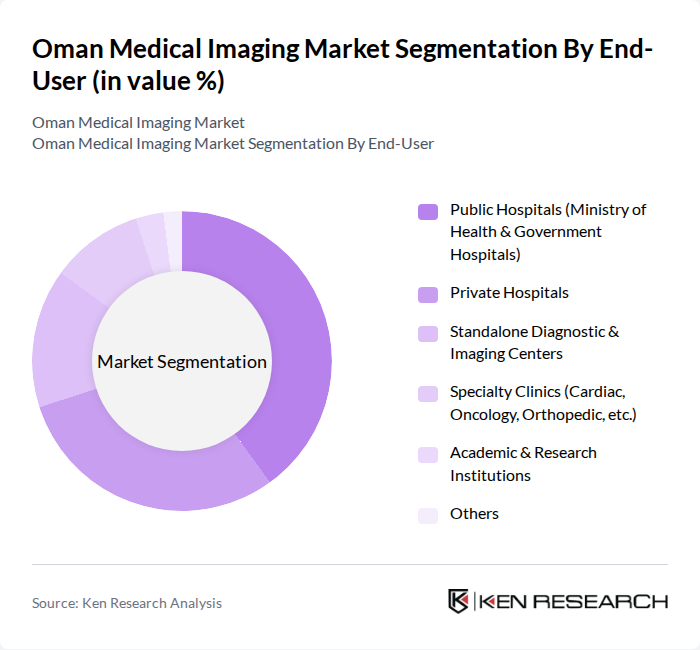

By End-User:The end-user segmentation includes various healthcare facilities that utilize medical imaging services. Key end-users are Public Hospitals (Ministry of Health & Government Hospitals), Private Hospitals, Standalone Diagnostic & Imaging Centers, Specialty Clinics (Cardiac, Oncology, Orthopedic, etc.), Academic & Research Institutions, and Others. Each end-user category has distinct requirements and influences the demand for different imaging modalities.

Public Hospitals are the leading end-users in the medical imaging market, accounting for a significant share due to their extensive patient base and government funding. These hospitals are increasingly investing in advanced imaging technologies to improve diagnostic capabilities and patient care. The growing emphasis on public health initiatives and the need for comprehensive healthcare services further drive the demand for imaging services in public hospitals. Additionally, the collaboration between public hospitals and private entities for advanced imaging solutions is enhancing service delivery.

The Oman Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare (Koninklijke Philips N.V.), Canon Medical Systems Corporation, Fujifilm Healthcare Corporation, Shimadzu Corporation, Agfa HealthCare NV, Carestream Health Inc., Hologic Inc., Mindray Medical International Limited, Samsung Medison Co., Ltd., Esaote S.p.A., Neusoft Medical Systems Co., Ltd., United Imaging Healthcare Co., Ltd., Siemens Healthineers – Oman (Local Subsidiary & Channel Partners) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman medical imaging market is poised for significant transformation driven by technological advancements and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, the integration of artificial intelligence in imaging diagnostics is expected to improve efficiency and accuracy. Additionally, the expansion of telemedicine services will facilitate remote consultations, making imaging services more accessible. These trends indicate a promising future for the market, with a focus on patient-centered care and innovative solutions to meet healthcare demands.

| Segment | Sub-Segments |

|---|---|

| By Modality | Magnetic Resonance Imaging (MRI) Computed Tomography (CT) Ultrasound X-ray & Fluoroscopy Nuclear Medicine & PET Mammography & Breast Imaging Others (Optical, Elastography, etc.) |

| By End-User | Public Hospitals (Ministry of Health & Government Hospitals) Private Hospitals Standalone Diagnostic & Imaging Centers Specialty Clinics (Cardiac, Oncology, Orthopedic, etc.) Academic & Research Institutions Others |

| By Clinical Application | Oncology Cardiology & Vascular Imaging Neurology Musculoskeletal & Orthopedics Obstetrics & Gynecology Gastroenterology & Hepatology Others |

| By Technology | Digital Imaging (DR, CR, Digital Ultrasound, PACS) Analog / Conventional Imaging Hybrid Imaging (PET/CT, SPECT/CT, PET/MRI) AI-Enabled & Advanced Imaging Solutions |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah North & South Al Dakhiliyah Other Governorates (Al Sharqiyah, Al Dhahirah, Al Buraimi, Musandam) |

| By Ownership & Investment Source | Government-funded Facilities Private Domestic Investments Foreign Direct Investment & International Aid Public–Private Partnership (PPP) Projects Others |

| By Service Model | Equipment Sales Managed Equipment Services & Leasing Imaging Procedure Services Teleradiology & Remote Reporting Maintenance & After-Sales Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Clinic Imaging Services | 90 | Healthcare Administrators, Clinic Managers |

| Diagnostic Imaging Equipment Suppliers | 60 | Sales Representatives, Product Managers |

| Health Insurance Providers | 50 | Claims Analysts, Policy Underwriters |

| Research Institutions in Medical Imaging | 40 | Research Scientists, Academic Professors |

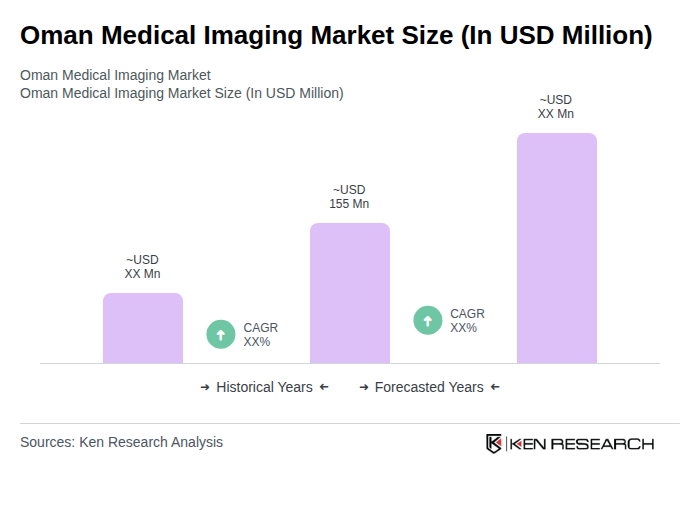

The Oman Medical Imaging Market is valued at approximately USD 155 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases, advancements in imaging technologies, and rising healthcare expenditure.