Region:Global

Author(s):Dev

Product Code:KRAB0600

Pages:99

Published On:August 2025

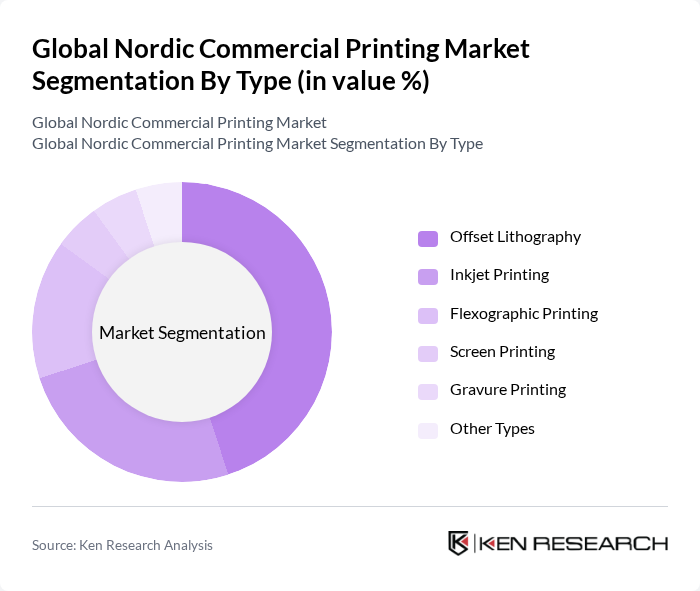

By Type:The market is segmented into Offset Lithography, Inkjet Printing, Flexographic Printing, Screen Printing, Gravure Printing, and Other Types. Offset Lithography remains the most widely used technology due to its efficiency in high-volume printing and superior print quality. Inkjet Printing is rapidly gaining market share for its versatility and ability to produce high-quality images on diverse substrates, especially for shorter runs and personalized products. Flexographic Printing is preferred for packaging applications owing to its speed, cost-effectiveness, and suitability for various packaging materials.

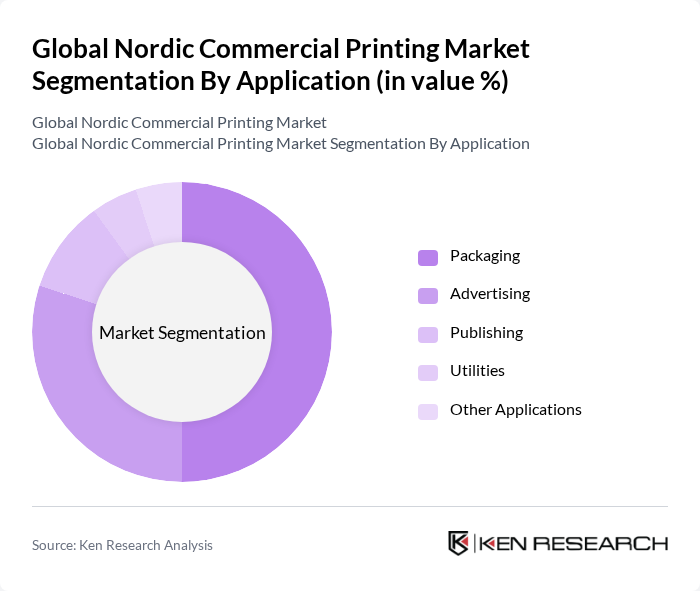

By Application:Commercial printing applications include Packaging, Advertising, Publishing, Utilities, and Other Applications. Packaging is the leading segment, supported by the robust e-commerce sector and the demand for visually appealing, sustainable packaging solutions. Advertising remains a significant application, as businesses continue to invest in printed materials for marketing campaigns. The publishing sector is important, though it faces ongoing challenges from digital media and shifting consumer preferences.

The Global Nordic Commercial Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aller Tryk A/S, Alma Manu Oy, Bold Printing Group AB, Botnia Print Oy Ab, ScandBook Holding AB, Ålgård Offset AS, Gota Media AB, amedia trykk og distribusjon, Printall AS, Stibo Complete A/S, Sörmlands Grafiska AB, Tryckeri AB Alingsås Offset, Elanders AB, V-TAB AB, Print Group Nordic AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nordic commercial printing market appears promising, driven by ongoing technological advancements and a strong shift towards sustainability. As companies increasingly adopt digital printing technologies, operational efficiencies are expected to improve, allowing for greater customization and faster turnaround times. Additionally, the rise of e-commerce will continue to fuel demand for innovative packaging solutions. The market is likely to see further consolidation as firms seek to enhance their competitive edge through strategic partnerships and investments in sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Offset Lithography Inkjet Printing Flexographic Printing Screen Printing Gravure Printing Other Types |

| By Application | Packaging Advertising Publishing Utilities Other Applications |

| By End-User | Retail Food & Beverage Industry Corporate Sector Advertising Agencies Publishing Houses Others |

| By Geography | Sweden Norway Finland Denmark Rest of Nordic Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Services | 120 | Print Operations Managers, Business Development Executives |

| Packaging Printing Solutions | 90 | Product Managers, Packaging Engineers |

| Digital Printing Technologies | 60 | Technology Officers, R&D Managers |

| Publishing and Media Printing | 50 | Editorial Directors, Print Production Coordinators |

| Environmental Sustainability Practices | 40 | Sustainability Managers, Compliance Officers |

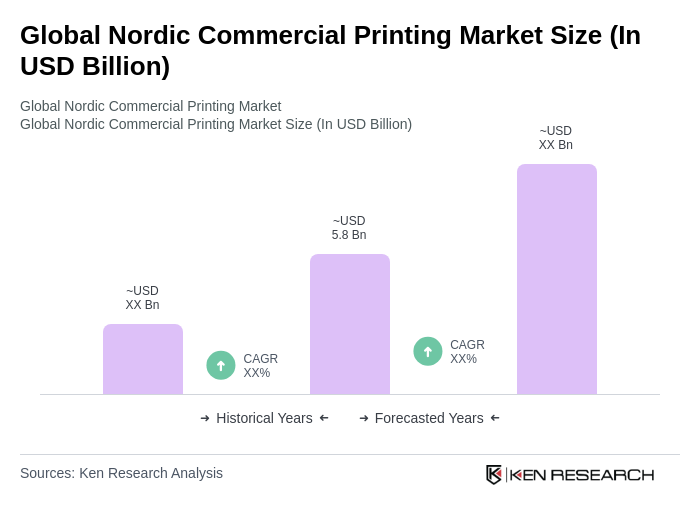

The Global Nordic Commercial Printing Market is valued at approximately USD 5.8 billion, driven by the increasing demand for high-quality printed materials across various sectors, including packaging, advertising, and publishing.