Region:Central and South America

Author(s):Dev

Product Code:KRAC0353

Pages:85

Published On:August 2025

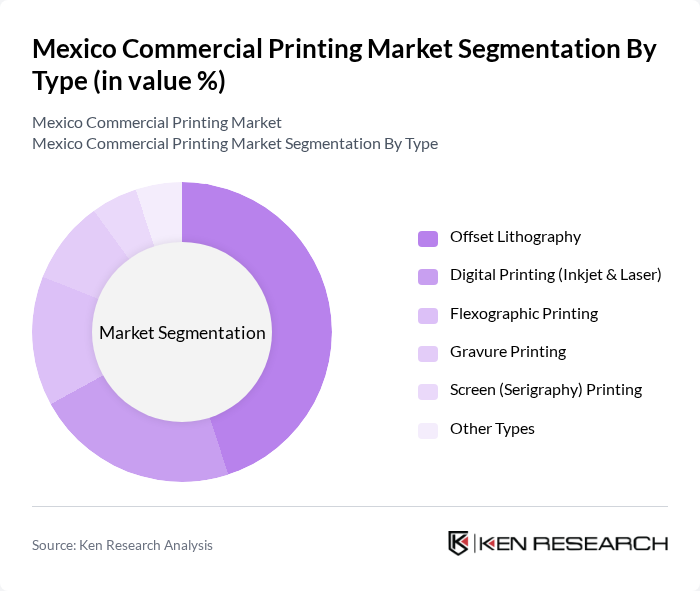

By Type:The commercial printing market can be segmented into Offset Lithography, Digital Printing (Inkjet & Laser), Flexographic Printing, Gravure Printing, Screen (Serigraphy) Printing, and Other Types. Among these, Offset Lithography is the most widely used method due to its efficiency in high-volume printing and superior print quality. Digital printing is gaining traction for short runs and customization, while Flexographic and Gravure printing are preferred for packaging applications .

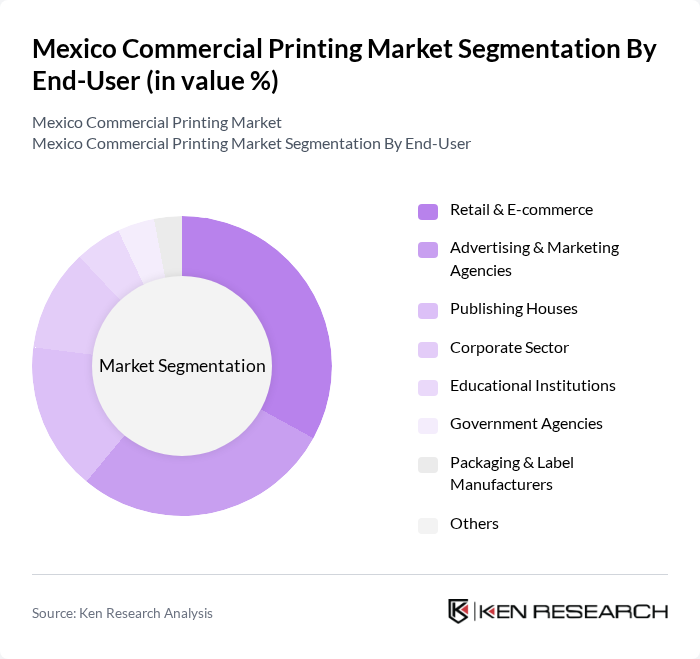

By End-User:The end-user segmentation includes Retail & E-commerce, Advertising & Marketing Agencies, Publishing Houses, Corporate Sector, Educational Institutions, Government Agencies, Packaging & Label Manufacturers, and Others. The Retail & E-commerce sector is the largest consumer of commercial printing services, driven by the need for promotional materials and packaging solutions. Advertising agencies also play a significant role, as they require high-quality printed materials for campaigns .

The Mexico Commercial Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Gondi, Grupo Sánchez, Grupo Formex, Fuerza Gráfica del Norte SAPI de CV, Dataprint México, Central Print México, Imprime TUS Ideas, Print LSC Communications México, Quad/Graphics México, Ink Throwers DE México SA, STICKER'S PACK SA de CV, Editorial Televisa, Grupo Expansión, Editorial Planeta México, Grupo Reforma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexican commercial printing market appears promising, driven by technological innovations and evolving consumer preferences. As businesses increasingly prioritize sustainability, the demand for eco-friendly printing solutions is expected to rise. Additionally, the integration of digital printing technologies will facilitate more efficient production processes, allowing companies to meet the growing demand for customized and on-demand printing services. These trends indicate a dynamic market landscape that will adapt to changing consumer needs and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Offset Lithography Digital Printing (Inkjet & Laser) Flexographic Printing Gravure Printing Screen (Serigraphy) Printing Other Types |

| By End-User | Retail & E-commerce Advertising & Marketing Agencies Publishing Houses Corporate Sector Educational Institutions Government Agencies Packaging & Label Manufacturers Others |

| By Application | Packaging (Flexible, Folding Cartons, Labels) Marketing Materials (Brochures, Flyers, Catalogs) Books and Magazines Stationery Promotional Items Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Distributors Trade Shows Others |

| By Material Used | Paper Plastic Metal Fabric Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing Others |

| By Customer Type | B2B B2C Government Contracts Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Services | 150 | Print Shop Owners, Operations Managers |

| Packaging Printing | 100 | Product Managers, Supply Chain Coordinators |

| Digital Printing Solutions | 80 | Marketing Directors, Graphic Designers |

| Offset Printing Techniques | 70 | Production Supervisors, Quality Control Managers |

| Specialty Printing Applications | 40 | Business Development Managers, R&D Specialists |

The Mexico Commercial Printing Market is valued at approximately USD 4.1 billion, reflecting a robust growth driven by increasing demand for printed materials across various sectors, including advertising, packaging, and publishing.