Region:Middle East

Author(s):Shubham

Product Code:KRAA8555

Pages:82

Published On:November 2025

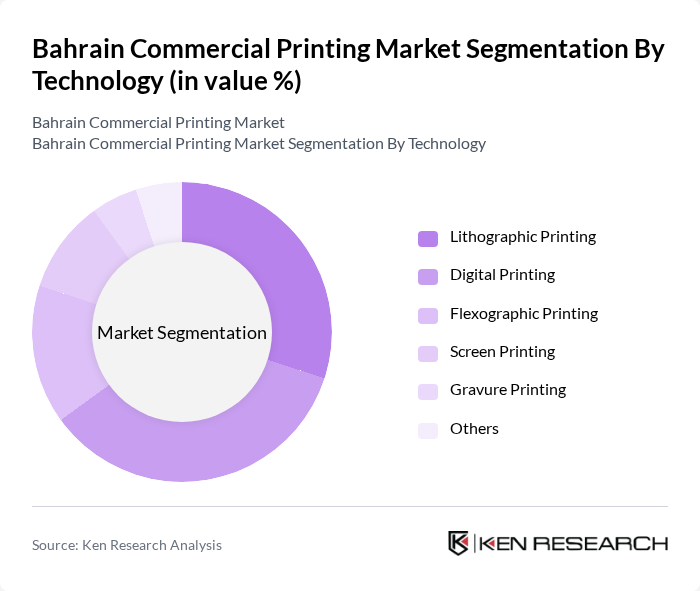

By Technology:The technology segment of the commercial printing market encompasses lithographic, digital, flexographic, screen, gravure printing, and other methods. Each technology addresses distinct customer requirements: lithographic printing is preferred for high-volume jobs, digital printing excels in short-run and customized projects, flexographic is dominant in packaging, while screen and gravure serve specialized applications. Digital printing continues to gain market share due to its flexibility, cost-effectiveness, and ability to deliver rapid, high-quality results tailored to client specifications.

Thedigital printingsegment currently leads the market, favored for its ability to deliver high-quality, rapid, and cost-effective prints. Businesses increasingly prefer digital printing for short-run, personalized, and variable data jobs, aligning with the growing demand for customization in marketing and packaging. The technology’s minimal setup time and adaptability to diverse substrates further reinforce its dominant market position.

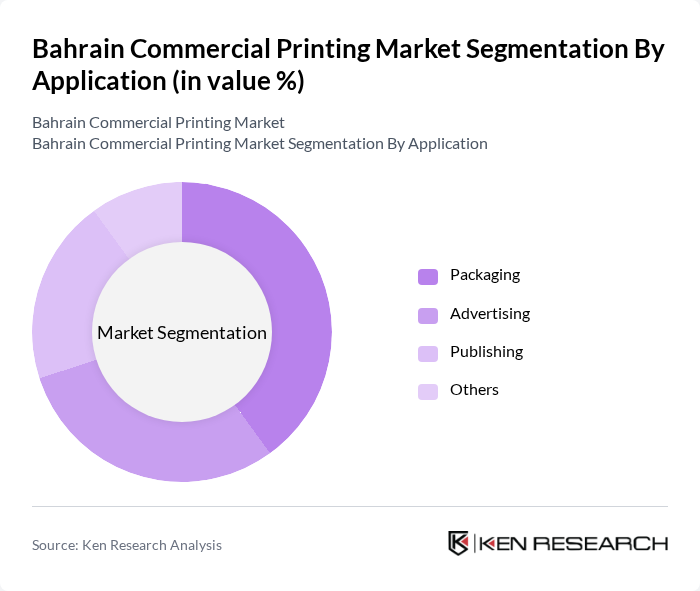

By Application:The application segment includes packaging, advertising, publishing, and other uses. Packaging remains the largest application, driven by robust growth in retail, e-commerce, and consumer goods sectors. Advertising and publishing also contribute significantly, with demand for promotional materials and branded content rising across industries. The surge in online retail and consumer engagement has intensified the need for innovative packaging designs and high-impact advertising collateral.

Packagingis the leading application in the Bahrain commercial printing market, propelled by the expanding retail and e-commerce sectors. Businesses are investing in branded, sustainable packaging to enhance product presentation and consumer experience, with innovative designs and eco-friendly materials gaining prominence. This trend is expected to sustain packaging’s dominant market share as companies prioritize differentiation and environmental responsibility.

The Bahrain Commercial Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Printing Press, Al-Hekma Printing Press, Bahrain Printing & Publishing Company, Al-Moayyed Printing Press, Al-Fateh Printing Press, Al-Mansoori Printing Press, Al-Salam Printing Press, Al-Bahrain Printing Press, Al-Mahroos Printing Press, Al-Muhriz Printing Press, Al-Mahmood Printing Press, Al-Qudsi Printing Press, Al-Sayed Printing Press, Al-Muhtadi Printing Press, Al-Mansoor Printing Press contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain commercial printing market appears promising, driven by technological innovations and a shift towards sustainable practices. As businesses increasingly adopt eco-friendly printing solutions, the demand for sustainable materials and processes is expected to rise. Additionally, the integration of automation and digital technologies will enhance operational efficiency, allowing companies to meet the growing demand for customized and on-demand printing services. This evolution will likely reshape the competitive landscape, presenting new opportunities for growth and expansion.

| Segment | Sub-Segments |

|---|---|

| By Technology | Lithographic Printing Digital Printing Flexographic Printing Screen Printing Gravure Printing Others |

| By Application | Packaging Advertising Publishing Others |

| By Product Category | Brochures and Flyers Business Cards Packaging Materials Labels and Stickers Books and Magazines Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Distributors Others |

| By Geographic Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Customer Type | B2B B2C Government Contracts Non-Profit Organizations Others |

| By Service Type | Pre-Press Services Printing Services Post-Press Services Design Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Firms | 100 | Business Owners, Operations Managers |

| Graphic Design Agencies | 60 | Creative Directors, Project Managers |

| Advertising Agencies | 50 | Account Managers, Media Buyers |

| Packaging Solutions Providers | 40 | Product Managers, Supply Chain Coordinators |

| End-Users of Printing Services | 70 | Marketing Managers, Procurement Officers |

The Bahrain Commercial Printing Market is valued at approximately USD 160 million, reflecting a comprehensive analysis of historical data and regional trends within the GCC market. This valuation underscores the sector's growth driven by demand for printed materials in various industries.