Global Organic Pigments Market Overview

- The Global Organic Pigments Market is valued at USD 6.5 billion, based on a five?year historical analysis. This expansion is primarily driven by the rising demand for eco-friendly and sustainable products across industries such as paints, coatings, plastics, textiles, and printing inks. The market benefits from a shift toward environmentally responsible alternatives, with organic pigments favored for their vibrant colors, superior brightness, and lower environmental impact compared to inorganic pigments. Advancements in pigment dispersion and nanotechnology have further enhanced product performance, increasing resistance to heat, chemicals, and light exposure.

- Key market leaders include the United States, Germany, and China, each maintaining dominance through robust manufacturing bases, advanced technological capabilities, and well-established supply chains. These regions are home to major chemical companies and continue to drive innovation and production efficiency in organic pigments.

- In 2023, the European Union reinforced stringent regulations on hazardous substances in pigments under the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) Regulation (EC) No 1907/2006, issued by the European Parliament and Council. REACH mandates comprehensive registration, evaluation, and authorization of chemicals used in pigment production, requiring manufacturers to provide safety data and comply with substance restrictions to protect human health and the environment. This regulatory framework continues to promote the adoption of safer, organic alternatives in the market.

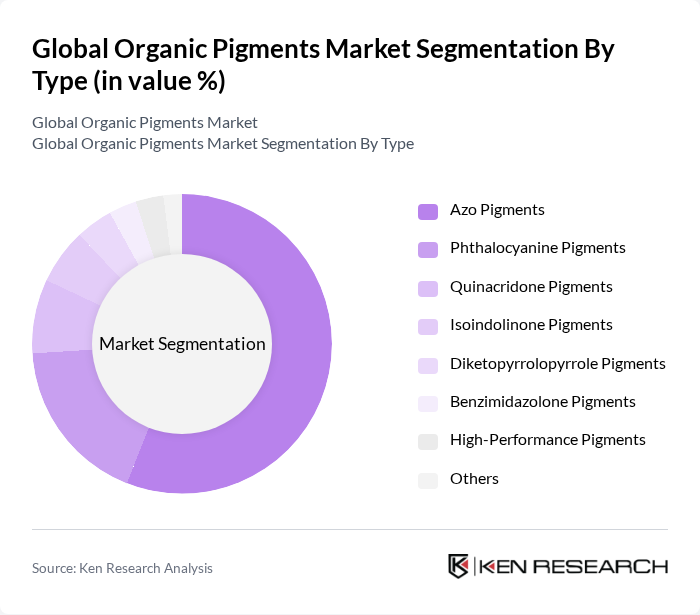

Global Organic Pigments Market Segmentation

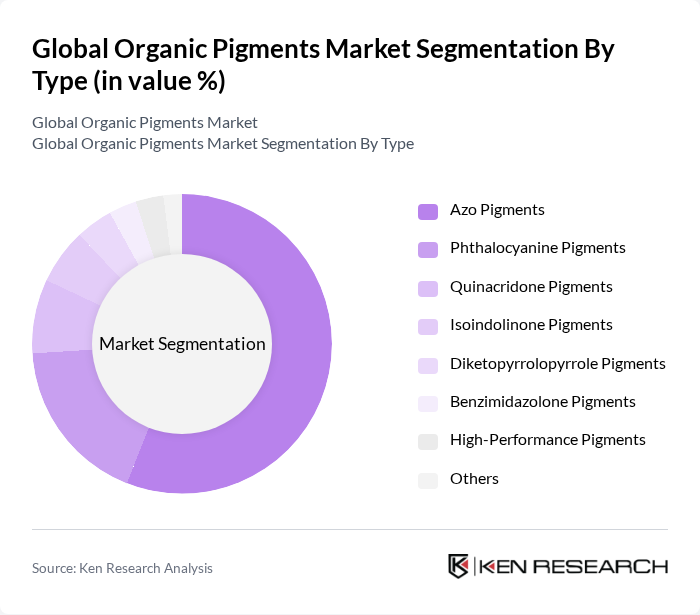

By Type:The organic pigments market is segmented into Azo Pigments, Phthalocyanine Pigments, Quinacridone Pigments, Isoindolinone Pigments, Diketopyrrolopyrrole Pigments, Benzimidazolone Pigments, High-Performance Pigments, and Others. Among these,Azo Pigmentshold the largest market share, attributed to their versatility, cost-effectiveness, and strong color performance. Azo pigments are extensively used in printing inks, coatings, plastics, and textiles due to their adaptability in both solvent- and water-based systems.

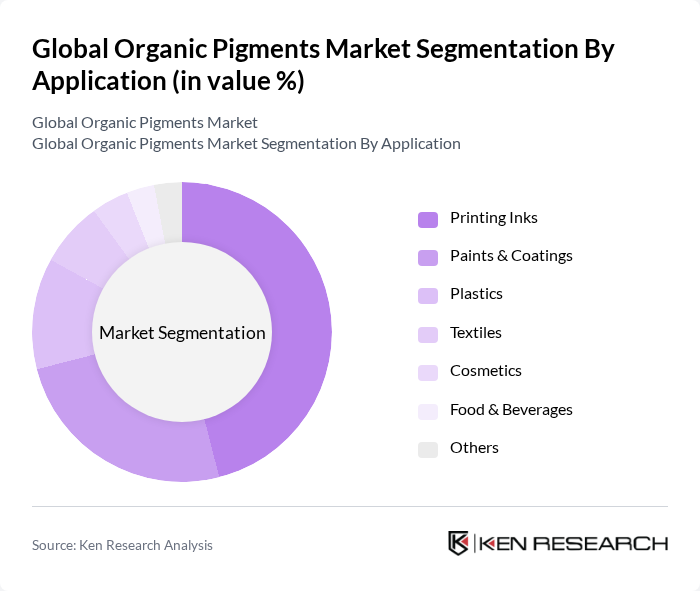

By Application:The organic pigments market is segmented by application into Printing Inks, Paints & Coatings, Plastics, Textiles, Cosmetics, Food & Beverages, and Others.Printing Inksrepresent the largest application segment, driven by the demand for high-quality, durable, and environmentally friendly inks in packaging and publishing. Paints & Coatings also account for a significant share, supported by growth in construction and automotive industries and increasing regulatory pressure for sustainable products.

Global Organic Pigments Market Competitive Landscape

The Global Organic Pigments Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, DIC Corporation, Sun Chemical Corporation, Toyo Ink SC Holdings Co., Ltd., Heubach Group, Sudarshan Chemical Industries Ltd., Huntsman Corporation, Kronos Worldwide, Inc., Shepherd Color Company, ECKART Effect Pigments GmbH, Merck KGaA, Ferro Corporation, Cabot Corporation, Lanxess AG, Chromaflo Technologies Corp., Toyal America, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Organic Pigments Market Industry Analysis

Growth Drivers

- Increasing Demand for Eco-Friendly Products:The global market for eco-friendly products is projected to reach $150 billion in future, driven by consumer preferences for sustainable options. This trend is particularly evident in the organic pigments sector, where demand is surging due to heightened awareness of environmental issues. For instance, the organic pigments segment is expected to grow significantly as manufacturers respond to consumer demand for non-toxic, biodegradable alternatives, aligning with the broader shift towards sustainability in various industries.

- Expansion of End-User Industries:The automotive and construction industries are anticipated to grow by approximately 4.5% and 3.8% in future, creating a robust demand for organic pigments. As these sectors increasingly adopt eco-friendly materials, the need for organic pigments in coatings and finishes will rise. The automotive coatings market alone is projected to reach $25 billion in future, with organic pigments playing a crucial role in meeting regulatory standards and consumer preferences for sustainable products.

- Technological Advancements in Pigment Production:Innovations in production technologies are enhancing the efficiency and quality of organic pigments. For example, advancements in bio-based synthesis methods are reducing production costs by approximately 20% while improving pigment performance. This technological evolution is expected to drive market growth, as manufacturers can produce high-quality organic pigments at competitive prices, thus attracting more customers from various industries seeking sustainable solutions.

Market Challenges

- Fluctuating Raw Material Prices:The organic pigments market faces significant challenges due to the volatility of raw material prices, which can fluctuate by as much as 30% annually. This instability affects production costs and profit margins for manufacturers. For instance, the price of natural colorants has seen sharp increases, impacting the overall pricing strategy for organic pigments and potentially leading to reduced competitiveness against inorganic alternatives.

- Stringent Environmental Regulations:Compliance with environmental regulations, such as the REACH regulations in Europe, imposes additional costs on manufacturers. The cost of compliance can reach up to $1 million for small to medium enterprises, creating barriers to entry and operational challenges. These regulations, while essential for sustainability, can hinder the growth of the organic pigments market by limiting the number of players who can afford to meet these stringent requirements.

Global Organic Pigments Market Future Outlook

The future of the organic pigments market appears promising, driven by increasing consumer awareness and regulatory support for sustainable practices. As industries continue to prioritize eco-friendly materials, the demand for organic pigments is expected to rise. Additionally, innovations in production technologies will likely enhance the quality and reduce costs, making organic pigments more accessible. The market is poised for growth, particularly in sectors like automotive coatings and packaging, where sustainability is becoming a key differentiator.

Market Opportunities

- Growth in the Automotive Coatings Sector:The automotive coatings market is projected to reach $25 billion in future, presenting a significant opportunity for organic pigments. As manufacturers seek to comply with environmental regulations, the shift towards organic pigments in automotive applications will likely accelerate, driven by consumer demand for sustainable vehicles.

- Increasing Use in the Packaging Industry:The global sustainable packaging market is expected to grow to $500 billion in future, creating opportunities for organic pigments. As brands prioritize eco-friendly packaging solutions, the demand for organic pigments in inks and coatings will rise, aligning with consumer preferences for sustainable products and practices.