Region:Global

Author(s):Shubham

Product Code:KRAD6659

Pages:100

Published On:December 2025

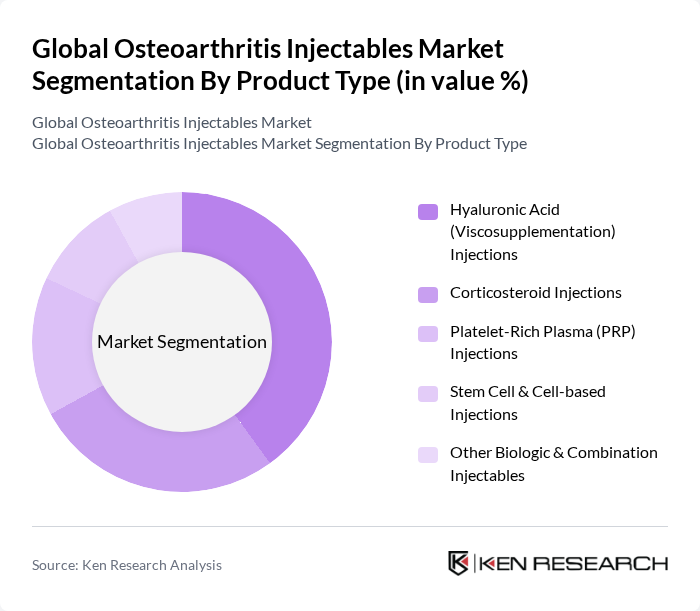

By Product Type:The product type segmentation includes various injectables used for treating osteoarthritis. The subsegments are Hyaluronic Acid (Viscosupplementation) Injections, Corticosteroid Injections, Platelet-Rich Plasma (PRP) Injections, Stem Cell & Cell-based Injections, and Other Biologic & Combination Injectables. Among these, Hyaluronic Acid injections are leading the market due to their effectiveness in providing joint lubrication and pain relief, high prescription rates, and continued adoption as a minimally invasive option for delaying surgery in knee osteoarthritis.

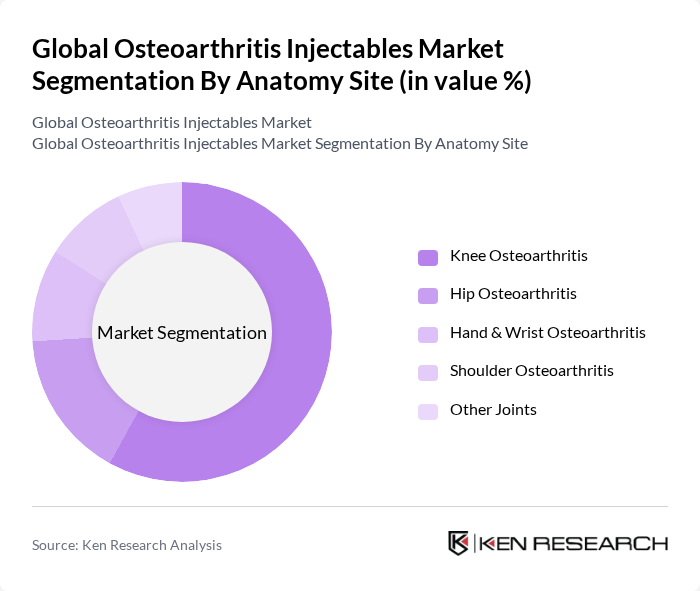

By Anatomy Site:The anatomy site segmentation includes various joints affected by osteoarthritis. The subsegments are Knee Osteoarthritis, Hip Osteoarthritis, Hand & Wrist Osteoarthritis, Shoulder Osteoarthritis, and Other Joints. Knee osteoarthritis is the most prevalent, accounting for a significant portion of the market due to the high incidence of knee joint issues among the aging population, the impact of obesity and sports injuries, and the strong clinical adoption of intra?articular injectables as a non?surgical management option.

The Global Osteoarthritis Injectables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi S.A., Anika Therapeutics, Inc., Bioventus LLC, Zimmer Biomet Holdings, Inc., Ferring Pharmaceuticals A/S, Teva Pharmaceutical Industries Ltd., Seikagaku Corporation, Chugai Pharmaceutical Co., Ltd., OrthogenRx, Inc., Flexion Therapeutics, Inc. (a Pacira BioSciences company), Smith & Nephew plc, Johnson & Johnson (DePuy Synthes), AbbVie Inc., Regeneron Pharmaceuticals, Inc., Arthrex, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the osteoarthritis injectables market appears promising, driven by ongoing research and development efforts aimed at creating more effective therapies. As the healthcare landscape evolves, the integration of personalized medicine and telehealth solutions is expected to enhance patient engagement and treatment adherence. Additionally, the growing emphasis on minimally invasive procedures will likely lead to increased adoption of injectables, providing patients with safer and more effective options for managing osteoarthritis symptoms.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hyaluronic Acid (Viscosupplementation) Injections Corticosteroid Injections Platelet-Rich Plasma (PRP) Injections Stem Cell & Cell-based Injections Other Biologic & Combination Injectables |

| By Anatomy Site | Knee Osteoarthritis Hip Osteoarthritis Hand & Wrist Osteoarthritis Shoulder Osteoarthritis Other Joints |

| By End-User | Hospitals Orthopedic & Rheumatology Clinics Ambulatory Surgical Centers Other Healthcare Settings |

| By Route of Administration | Intra-articular Injections Other Parenteral Routes |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age Group (Adults, Seniors) Gender (Male, Female) Others |

| By Treatment Regimen | Single-injection Regimens Multiple-injection Regimens |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 50 | Surgeons specializing in joint replacement and osteoarthritis |

| Rheumatologists | 40 | Doctors focusing on autoimmune and inflammatory joint diseases |

| Pharmaceutical Sales Representatives | 30 | Sales professionals from companies producing injectable therapies |

| Healthcare Administrators | 40 | Decision-makers in hospitals and clinics regarding treatment protocols |

| Patients with Osteoarthritis | 45 | Individuals currently receiving treatment for osteoarthritis |

The Global Osteoarthritis Injectables Market is valued at approximately USD 7.4 billion, driven by factors such as the increasing prevalence of osteoarthritis, an aging population, and advancements in injectable therapies that enhance pain relief and joint function.