Region:Asia

Author(s):Rebecca

Product Code:KRAB0295

Pages:84

Published On:August 2025

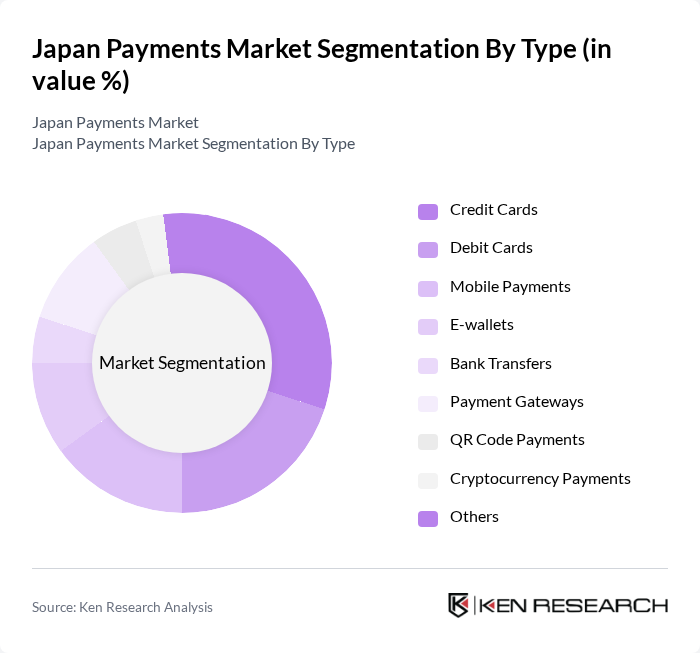

By Type:This segmentation includes various payment methods that consumers and businesses utilize for transactions. The subsegments are Credit Cards, Debit Cards, Mobile Payments, E-wallets, Bank Transfers, Payment Gateways, QR Code Payments, Cryptocurrency Payments, and Others. Each of these subsegments plays a crucial role in shaping the payment landscape in Japan, with credit cards and mobile payments seeing particularly strong growth due to consumer preference for convenience and security, and QR code payments expanding rapidly as a result of government incentives and merchant adoption .

By End-User:This segmentation categorizes the market based on the different sectors utilizing payment solutions. The subsegments include Retail, E-commerce, Hospitality, Transportation, Government, Financial Institutions, Utilities, and Others. Each sector has unique requirements and preferences for payment methods, influencing the overall market dynamics. Retail and e-commerce are the leading sectors, driven by high transaction volumes and the rapid digitalization of consumer payments. Hospitality and transportation are also witnessing increased adoption of contactless and digital payment methods, while government and utilities are gradually expanding digital payment acceptance .

The Japan Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rakuten Payment, Inc., PayPay Corporation, LINE Pay Corporation, GMO Payment Gateway, Inc., JCB Co., Ltd., Sumitomo Mitsui Trust Bank, Ltd., SoftBank Corp., NTT Data Corporation, SBI Holdings, Inc., Mitsubishi UFJ Financial Group, Inc., Seven Bank, Ltd., Aeon Credit Service Co., Ltd., Yahoo Japan Corporation, Mizuho Financial Group, Inc., Resona Holdings, Inc., Merpay, Inc., Japan Post Bank Co., Ltd., KDDI Corporation (au PAY), PayPal Japan, Amazon Pay Japan contribute to innovation, geographic expansion, and service delivery in this space.

The Japan payments market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security, while the rise of subscription-based models will cater to changing consumer behaviors. Additionally, the increasing focus on sustainability in payment solutions will likely shape future offerings, as businesses seek to align with environmentally conscious practices and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Credit Cards Debit Cards Mobile Payments E-wallets Bank Transfers Payment Gateways QR Code Payments Cryptocurrency Payments Others |

| By End-User | Retail E-commerce Hospitality Transportation Government Financial Institutions Utilities Others |

| By Payment Method | Online Payments In-Store Payments Recurring Payments Peer-to-Peer Payments Contactless Payments Others |

| By Transaction Size | Micro Transactions ( |

| By Industry Vertical | Financial Services Retail and E-commerce Telecommunications Healthcare Travel & Hospitality Utilities Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Entities |

| By Payment Frequency | One-Time Payments Recurring Payments Seasonal Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Payment Preferences | 120 | General Consumers, Tech-Savvy Users |

| Merchant Payment Acceptance | 90 | Small Business Owners, Retail Managers |

| Fintech Adoption Trends | 60 | Fintech Executives, Product Managers |

| Impact of COVID-19 on Payment Methods | 100 | Consumers, Health and Safety Officers |

| Regulatory Impact on Payment Systems | 50 | Compliance Officers, Legal Advisors |

The Japan Payments Market is valued at approximately USD 264 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions, e-commerce transactions, and consumer preferences for contactless and mobile payments.