Region:Global

Author(s):Shubham

Product Code:KRAA3198

Pages:82

Published On:August 2025

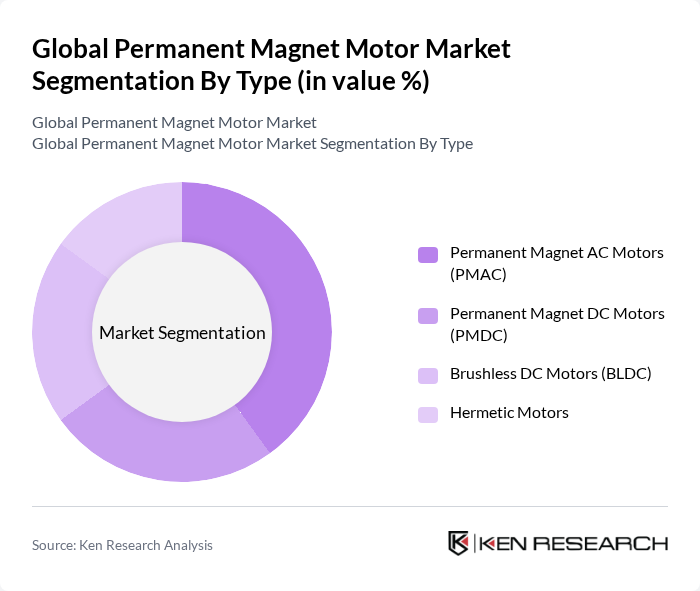

By Type:The market is segmented into four main types: Permanent Magnet AC Motors (PMAC), Permanent Magnet DC Motors (PMDC), Brushless DC Motors (BLDC), and Hermetic Motors. PMAC motors are gaining significant traction due to their high efficiency, superior torque characteristics, and suitability for electric vehicles and industrial automation. PMDC motors remain important in consumer electronics and small appliances, while BLDC motors are preferred for their compactness, reliability, and maintenance-free operation in robotics, HVAC, and automotive applications. Hermetic motors are primarily used in refrigeration and air conditioning systems, where sealed environments are required .

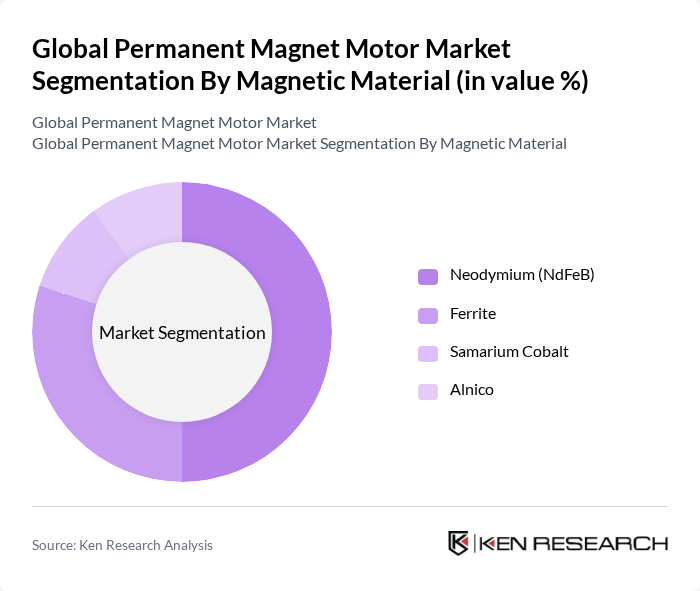

By Magnetic Material:The market is categorized into Neodymium (NdFeB), Ferrite, Samarium Cobalt, and Alnico magnets. Neodymium magnets dominate the market due to their high magnetic strength and critical role in high-performance applications, including electric vehicles, wind turbines, and industrial automation. Ferrite magnets are widely used in cost-sensitive applications such as consumer electronics and household appliances. Samarium Cobalt and Alnico serve specialized segments requiring high-temperature stability and corrosion resistance, such as aerospace, defense, and high-precision instruments .

The Global Permanent Magnet Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Nidec Corporation, Schneider Electric SE, Mitsubishi Electric Corporation, General Electric Company, Rockwell Automation, Inc., Bosch Rexroth AG, Emerson Electric Co., Danfoss A/S, Yaskawa Electric Corporation, Regal Rexnord Corporation, Parker Hannifin Corporation, Johnson Electric Holdings Limited, Maxon Motor AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the permanent magnet motor market appears promising, driven by ongoing technological advancements and increasing regulatory support for energy-efficient solutions. As industries continue to prioritize sustainability, the integration of smart technologies and IoT applications is expected to enhance motor performance and efficiency. Furthermore, the growing emphasis on electric vehicles will likely accelerate the adoption of permanent magnet motors, positioning them as a critical component in the transition towards greener transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Magnet AC Motors (PMAC) Permanent Magnet DC Motors (PMDC) Brushless DC Motors (BLDC) Hermetic Motors |

| By Magnetic Material | Neodymium (NdFeB) Ferrite Samarium Cobalt Alnico |

| By Power Rating | Up to 25 kW –100 kW –300 kW kW & Above |

| By End-User | Automotive Industrial Commercial Residential Aerospace Healthcare |

| By Application | Electric Vehicles Industrial Automation Consumer Electronics Robotics HVAC Systems Renewable Energy Systems |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Permanent Magnet Motors | 120 | Automotive Engineers, Product Development Managers |

| Industrial Applications of Permanent Magnet Motors | 100 | Operations Managers, Plant Engineers |

| Renewable Energy Sector Motors | 80 | Energy Analysts, Project Managers |

| Consumer Electronics Motor Applications | 60 | Product Managers, R&D Engineers |

| Research and Development in Motor Technologies | 50 | Research Scientists, Technical Directors |

The Global Permanent Magnet Motor Market is valued at approximately USD 47.9 billion, driven by the increasing demand for energy-efficient motors across various sectors, including automotive, industrial automation, and renewable energy.