Region:Global

Author(s):Rebecca

Product Code:KRAA2862

Pages:85

Published On:August 2025

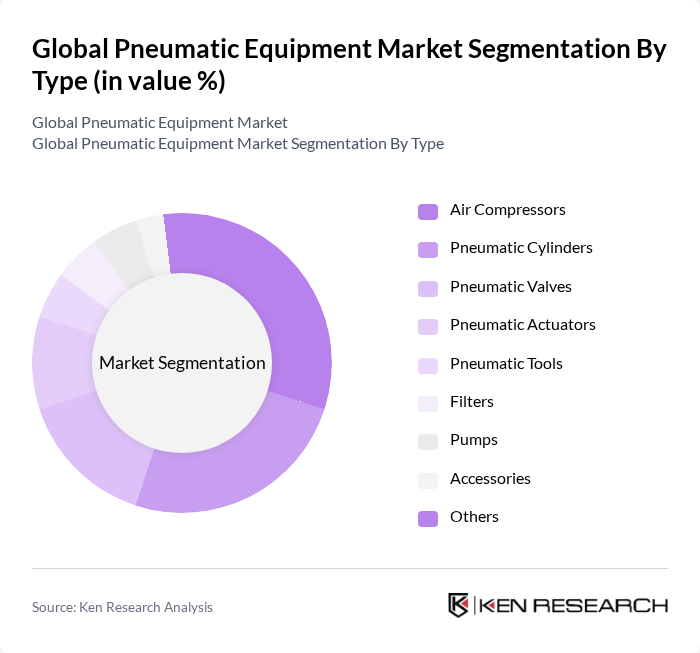

By Type:The pneumatic equipment market is segmented into air compressors, pneumatic cylinders, pneumatic valves, pneumatic actuators, pneumatic tools, filters, pumps, accessories, and others.Air compressorsandpneumatic cylindersare the most significant subsegments, driven by their widespread use in manufacturing automation, material handling, and assembly line operations. Air compressors are in high demand due to their versatility in powering various pneumatic tools and systems, while pneumatic cylinders are essential for precise linear motion and control in automated processes.

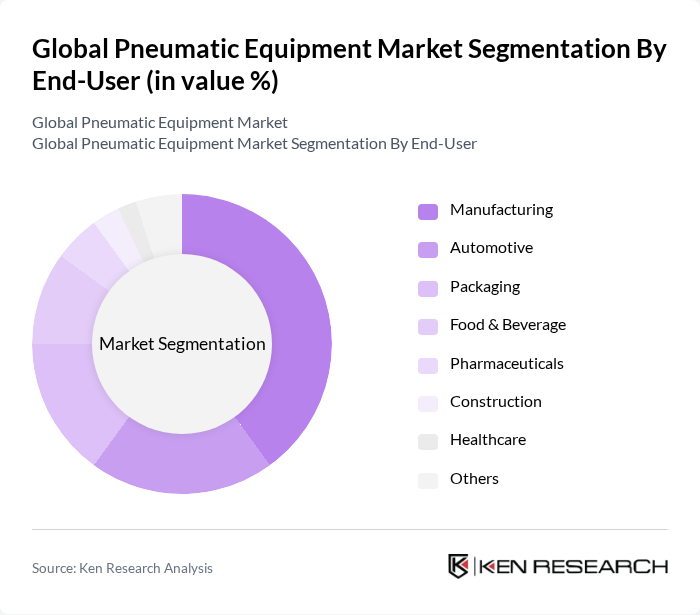

By End-User:The end-user segmentation of the pneumatic equipment market includes manufacturing, automotive, packaging, food & beverage, pharmaceuticals, construction, healthcare, and others. Themanufacturing sectoris the largest consumer of pneumatic equipment, driven by the need for automation, efficiency, and precision in production processes. The automotive industry also significantly contributes to the market, utilizing pneumatic systems for assembly lines, material handling, and quality control. Packaging, food & beverage, and pharmaceuticals are notable segments due to stringent hygiene and safety standards that favor pneumatic solutions.

The Global Pneumatic Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as SMC Corporation, Festo AG & Co. KG, Parker Hannifin Corporation, Bosch Rexroth AG, Emerson Electric Co., Bimba Manufacturing Company, Aignep S.p.A., Norgren Ltd. (IMI Precision Engineering), ARO Fluid Management (Ingersoll Rand), Pneumax S.p.A., Camozzi Automation S.p.A., AirTAC International Group, Atlas Copco AB, AVENTICS GmbH (Emerson), Boge Kompressoren GmbH & Co. KG, Sullair, LLC, Ingersoll Rand Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the pneumatic equipment market appears promising, driven by ongoing technological advancements and increasing industrial automation. As industries continue to prioritize efficiency and sustainability, the integration of smart technologies and IoT in pneumatic systems is expected to gain traction. Furthermore, the growing emphasis on energy-efficient solutions will likely lead to innovations that enhance performance while reducing environmental impact, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Compressors Pneumatic Cylinders Pneumatic Valves Pneumatic Actuators Pneumatic Tools Filters Pumps Accessories Others |

| By End-User | Manufacturing Automotive Packaging Food & Beverage Pharmaceuticals Construction Healthcare Others |

| By Application | Material Handling Assembly Lines Packaging Robotics Painting Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Netherlands, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Taiwan, New Zealand, Rest of Asia-Pacific) Latin America Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of MEA) Others |

| By Price Range | Low Medium High |

| By Technology | Conventional Pneumatics Smart Pneumatics Hybrid Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Pneumatic Systems | 120 | Production Managers, Maintenance Supervisors |

| Aerospace Pneumatic Equipment Usage | 60 | Engineering Managers, Quality Assurance Leads |

| Construction Industry Pneumatic Tools | 50 | Site Managers, Equipment Operators |

| Healthcare Pneumatic Device Applications | 40 | Biomedical Engineers, Procurement Specialists |

| Automotive Pneumatic Systems Integration | 70 | R&D Engineers, Supply Chain Managers |

The Global Pneumatic Equipment Market is valued at approximately USD 31 billion, reflecting a robust growth trajectory driven by increasing automation demands across various industries, including manufacturing, automotive, and packaging.