Region:Global

Author(s):Dev

Product Code:KRAC8661

Pages:88

Published On:November 2025

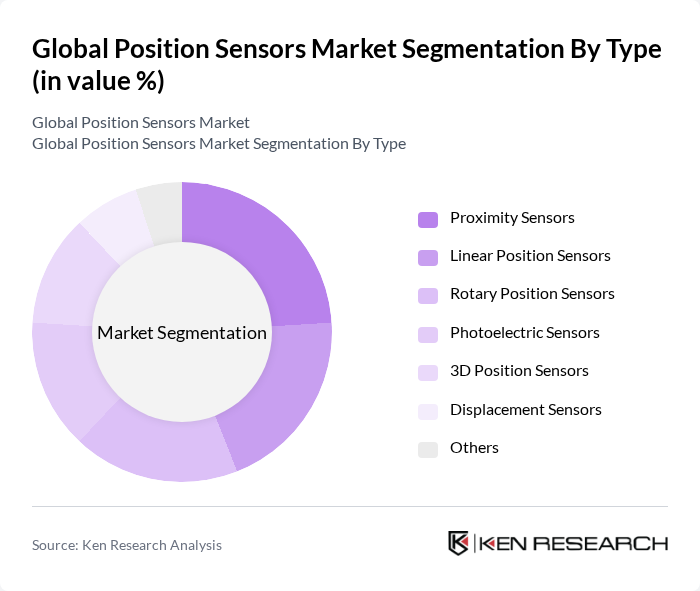

By Type:The market is segmented into Linear Position Sensors, Rotary Position Sensors, Proximity Sensors, Photoelectric Sensors, 3D Position Sensors, Displacement Sensors, and Others.Proximity Sensorscurrently hold the largest share, driven by their widespread use in automation, consumer electronics, and industrial applications. Linear Position Sensors are also gaining traction due to their critical role in robotics and process automation, while Rotary Position Sensors remain significant in automotive and aerospace systems .

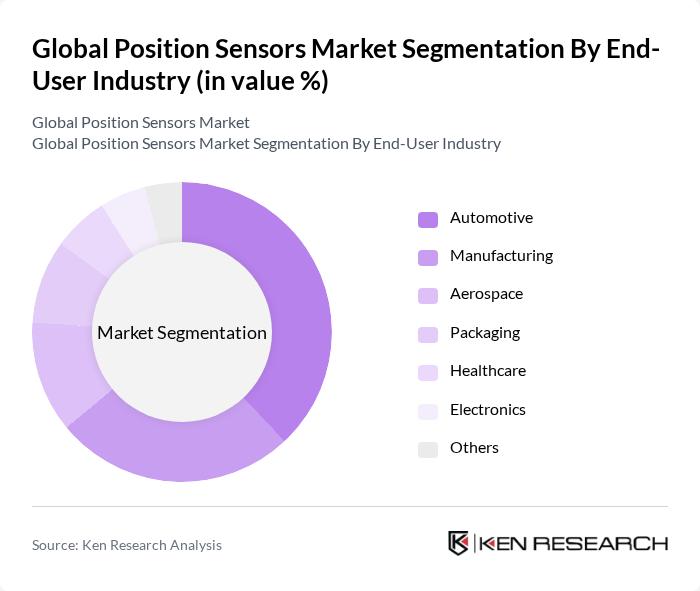

By End-User Industry:The position sensors market is segmented by end-user industries, including Automotive, Manufacturing, Aerospace, Packaging, Healthcare, Electronics, and Others.Automotiveremains the largest consumer, propelled by the integration of ADAS, electric vehicles, and stringent safety regulations. Manufacturing is also a significant segment, reflecting ongoing automation and smart factory initiatives. Aerospace, packaging, and healthcare sectors are experiencing steady adoption due to the need for precision and reliability in operations .

The Global Position Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Bosch Sensortec GmbH, TE Connectivity Ltd., Analog Devices, Inc., Renishaw plc, Omron Corporation, Microchip Technology Inc., Infineon Technologies AG, Vishay Intertechnology, Inc., NXP Semiconductors N.V., SICK AG, Endress+Hauser AG, Kistler Group, Balluff GmbH, STMicroelectronics N.V., Panasonic Corporation, Sensata Technologies, Inc., IFM Electronic GmbH, and Banner Engineering Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the position sensors market appears promising, driven by ongoing technological advancements and increasing automation across various sectors. As industries continue to embrace digital transformation, the demand for precise and reliable position sensing solutions is expected to rise. Furthermore, the integration of artificial intelligence and machine learning into sensor technologies will enhance their capabilities, leading to more efficient operations. Companies that invest in innovative sensor solutions will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Position Sensors Rotary Position Sensors Proximity Sensors Photoelectric Sensors D Position Sensors Displacement Sensors Others |

| By End-User Industry | Automotive Manufacturing Aerospace Packaging Healthcare Electronics Others |

| By Application | Machine Tools Robotics Motion Systems Material Handling Test Equipment Automotive Safety Systems Industrial Machinery Medical Devices Others |

| By Technology | Capacitive Sensors Inductive Sensors Magnetic Sensors Optical Sensors Ultrasonic Sensors Others |

| By Region | Asia-Pacific Europe North America Latin America Middle East & Africa |

| By Connectivity | Wired Sensors Wireless Sensors |

| By Output Type | Digital Output Analog Output |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Position Sensors | 100 | Automotive Engineers, Product Development Managers |

| Aerospace Applications | 80 | Aerospace Engineers, Quality Assurance Managers |

| Industrial Automation | 110 | Factory Managers, Automation Specialists |

| Consumer Electronics | 60 | Product Managers, R&D Engineers |

| Healthcare Equipment | 50 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global Position Sensors Market is valued at approximately USD 6.5 billion, driven by increasing automation demands across various industries, advancements in sensor technology, and the growing adoption of electric and autonomous vehicles.