Region:Global

Author(s):Shubham

Product Code:KRAC2807

Pages:86

Published On:October 2025

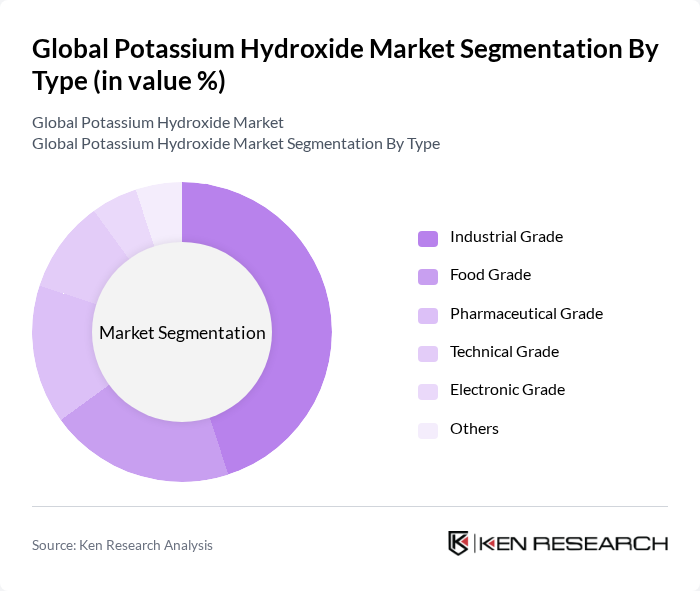

By Type:The potassium hydroxide market is segmented into various types, including Industrial Grade, Food Grade, Pharmaceutical Grade, Technical Grade, Electronic Grade, and Others. Among these, the Industrial Grade segment dominates the market due to its extensive use in chemical manufacturing and agriculture. The increasing demand for fertilizers and cleaning agents has led to a significant rise in the consumption of industrial-grade potassium hydroxide, making it a key player in the market.

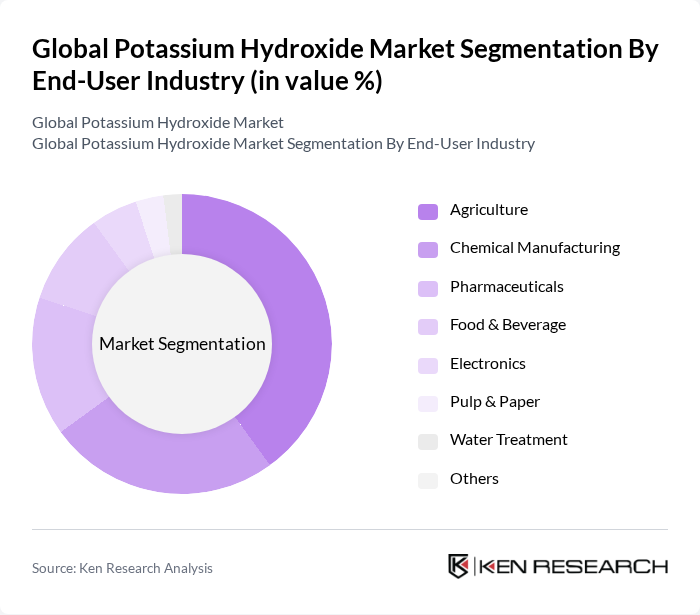

By End-User Industry:The end-user industries for potassium hydroxide include Agriculture, Chemical Manufacturing, Pharmaceuticals, Food & Beverage, Electronics, Pulp & Paper, Water Treatment, and Others. The Agriculture segment is the leading end-user, driven by the rising need for fertilizers and soil amendments. The increasing focus on sustainable farming practices and the need for high-yield crops have further propelled the demand for potassium hydroxide in this sector.

The Global Potassium Hydroxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olin Corporation (Olin Chlor Alkali Products & Vinyls), The Dow Chemical Company, BASF SE, Solvay S.A., Tata Chemicals Limited, K+S Aktiengesellschaft (K+S AG), Aditya Birla Chemicals, ICL Group Ltd., Nouryon Holding B.V., Chemtrade Logistics Inc., Gujarat Alkalies and Chemicals Limited, Univar Solutions Inc., Formosa Plastics Corporation, Merck KGaA, Mitsubishi Chemical Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the potassium hydroxide market appears promising, driven by increasing applications across various industries. The agricultural sector's demand for sustainable fertilizers and the chemical industry's growth will likely propel market expansion. Additionally, advancements in battery technology and renewable energy storage solutions are expected to create new opportunities. As companies invest in innovative production processes and sustainable practices, the market is poised for significant growth, aligning with global trends toward environmental responsibility and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Food Grade Pharmaceutical Grade Technical Grade Electronic Grade Others |

| By End-User Industry | Agriculture Chemical Manufacturing Pharmaceuticals Food & Beverage Electronics Pulp & Paper Water Treatment Others |

| By Application | Fertilizers Cleaning Agents & Detergents Electrolytes in Batteries Water Treatment Chemicals Biodiesel Production Food Processing Additives Pharmaceuticals Synthesis Pulp & Paper Processing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging Bagged Packaging Drum Packaging Others |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications | 100 | Agronomists, Farm Managers |

| Pharmaceutical Manufacturing | 80 | Production Supervisors, Quality Control Managers |

| Food Processing Industry | 70 | Food Technologists, Operations Managers |

| Industrial Cleaning Products | 50 | Product Development Managers, Marketing Directors |

| Electrolyte Solutions | 60 | Research Scientists, Chemical Engineers |

The Global Potassium Hydroxide Market is valued at approximately USD 3.4 billion, reflecting a significant growth trajectory driven by increasing demand across various sectors, including agriculture, food processing, and chemical manufacturing.