Region:Asia

Author(s):Dev

Product Code:KRAC2783

Pages:98

Published On:October 2025

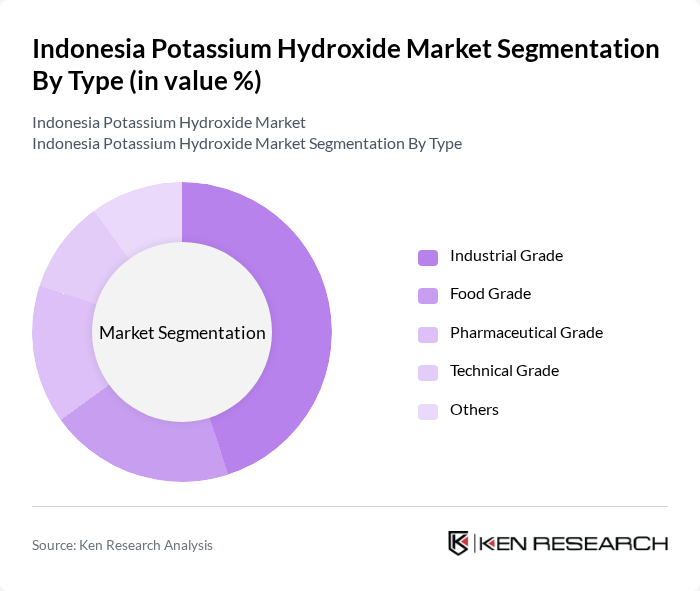

By Type:The market is segmented into Industrial Grade, Food Grade, Pharmaceutical Grade, Technical Grade, and Others. Each type serves distinct applications across industries. The Industrial Grade segment is dominant due to its extensive use in chemical manufacturing, fertilizers, and cleaning agents, reflecting the sector’s need for high-purity potassium hydroxide in large volumes .

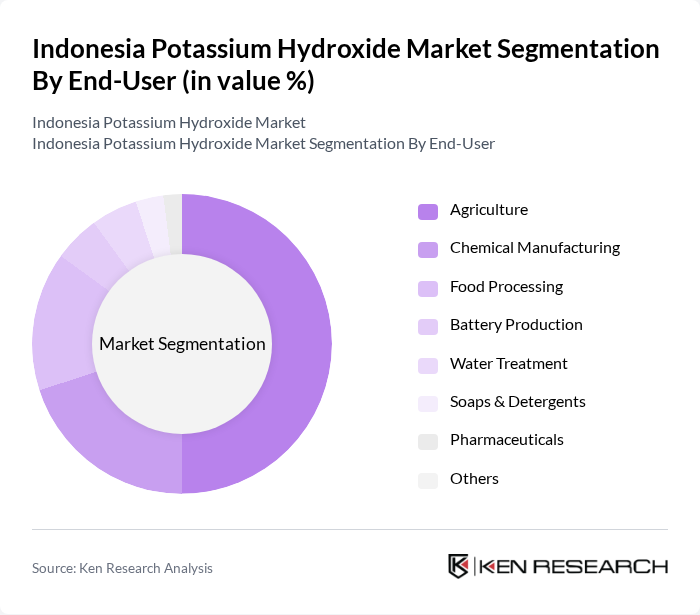

By End-User:The end-user segmentation includes Agriculture, Chemical Manufacturing, Food Processing, Battery Production, Water Treatment, Soaps & Detergents, Pharmaceuticals, and Others. The Agriculture segment leads the market, driven by the increasing need for fertilizers and soil amendments to enhance crop productivity and quality. Chemical manufacturing and food processing are also significant end-users, reflecting the broad industrial utility of potassium hydroxide .

The Indonesia Potassium Hydroxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Pupuk Indonesia, PT. Petrokimia Gresik, PT. Pupuk Kaltim, PT. Indorama Synthetics Tbk, PT. Chandra Asri Petrochemical Tbk, PT. Kimia Farma Tbk, PT. Asahimas Chemical, PT. Lautan Luas Tbk, PT. Sari Sarana Kimia, PT. Solvay Manyar, PT. Merck Chemicals Indonesia, PT. Unid Indonesia, PT. Dow Indonesia, PT. BASF Indonesia, PT. Olin Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the potassium hydroxide market in Indonesia appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers adopt greener production methods, the market is likely to see increased efficiency and reduced environmental impact. Additionally, the expansion of the agricultural sector and food processing industries will continue to fuel demand. With the government's support for sustainable practices, the market is poised for growth, creating opportunities for innovation and investment in new applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Food Grade Pharmaceutical Grade Technical Grade Others |

| By End-User | Agriculture Chemical Manufacturing Food Processing Battery Production Water Treatment Soaps & Detergents Pharmaceuticals Others |

| By Application | Fertilizers Cleaning Agents pH Control Water Treatment Biodiesel Production Textile Processing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Packaging Type | Bulk Packaging Drums Bags Intermediate Bulk Containers (IBC) Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua Others |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Use of Potassium Hydroxide | 120 | Agronomists, Farm Managers |

| Industrial Applications of Potassium Hydroxide | 100 | Production Managers, Chemical Engineers |

| Food Processing Sector Insights | 80 | Quality Control Managers, Food Technologists |

| Pharmaceutical Industry Usage | 70 | Regulatory Affairs Specialists, R&D Managers |

| Market Trends and Consumer Preferences | 110 | Market Analysts, Product Managers |

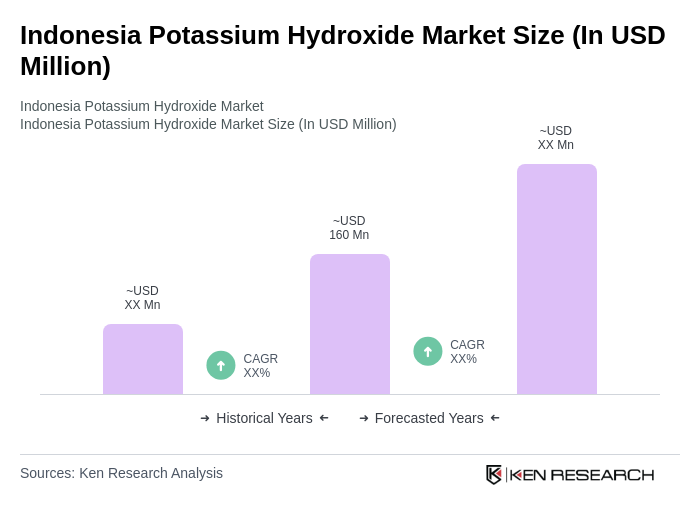

The Indonesia Potassium Hydroxide Market is valued at approximately USD 160 million, reflecting a five-year historical analysis. This growth is driven by increasing demand from agriculture, chemical manufacturing, and food processing sectors.