Region:Global

Author(s):Dev

Product Code:KRAD0544

Pages:91

Published On:August 2025

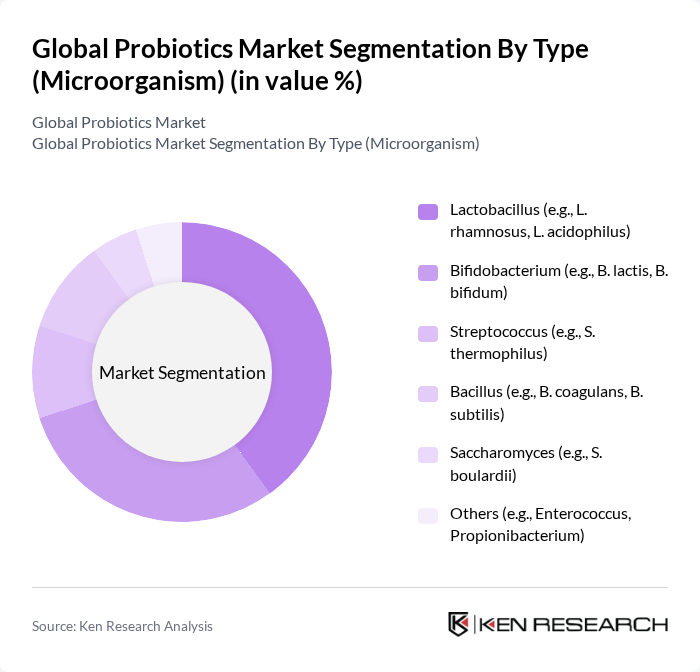

By Type (Microorganism):The probiotics market is segmented by microorganism type, which includes various strains that offer distinct health benefits. The leading sub-segment is Lactobacillus, known for its effectiveness in digestive health and immune support. Bifidobacterium follows closely, particularly popular in infant nutrition and gut health products. Other strains like Streptococcus and Bacillus are also gaining traction due to their unique properties and applications in both food and supplements.

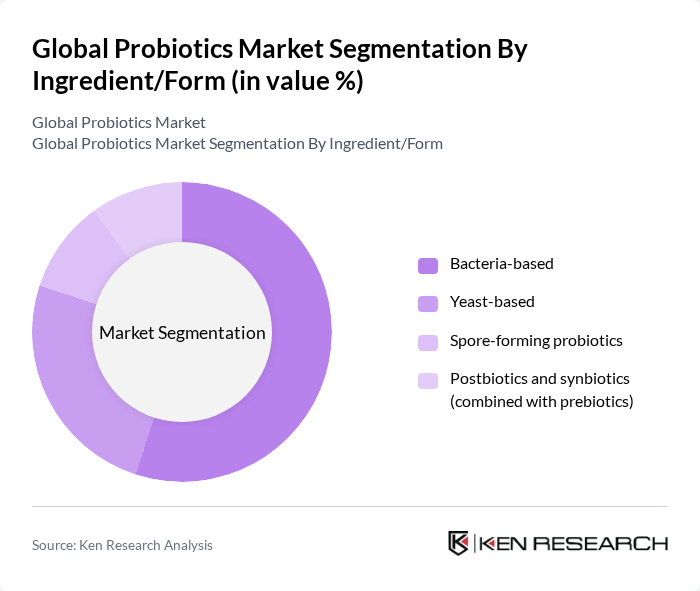

By Ingredient/Form:The probiotics market is also segmented by ingredient form, which includes bacteria-based, yeast-based, spore-forming probiotics, and postbiotics. Bacteria-based probiotics dominate the market due to their extensive research backing and established health benefits. Yeast-based probiotics are gaining popularity, particularly in digestive health products. The rise of postbiotics and synbiotics reflects a growing consumer interest in comprehensive gut health solutions that combine multiple beneficial components.

The Global Probiotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A., Nestlé S.A., Procter & Gamble Co. (Align), Yakult Honsha Co., Ltd., Chr. Hansen Holding A/S, International Flavors & Fragrances Inc. (IFF) — incl. DuPont Nutrition & Biosciences legacy, Probi AB, BioGaia AB, Lallemand Inc., Kerry Group plc, Archer Daniels Midland Company (ADM), Novozymes A/S (incl. Novonesis with Chr. Hansen where applicable), DSM-Firmenich, General Mills, Inc. (YoPlus, Yoplait probiotic lines), Lifeway Foods, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the probiotics market appears promising, driven by increasing consumer demand for health-oriented products and innovations in probiotic formulations. As awareness of gut health continues to rise, companies are likely to invest in research and development to create more effective and targeted probiotic solutions. Additionally, the integration of probiotics into various food and beverage categories will further enhance market growth, making it a dynamic sector to watch in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Microorganism) | Lactobacillus (e.g., L. rhamnosus, L. acidophilus) Bifidobacterium (e.g., B. lactis, B. bifidum) Streptococcus (e.g., S. thermophilus) Bacillus (e.g., B. coagulans, B. subtilis) Saccharomyces (e.g., S. boulardii) Others (e.g., Enterococcus, Propionibacterium) |

| By Ingredient/Form | Bacteria-based Yeast-based Spore-forming probiotics Postbiotics and synbiotics (combined with prebiotics) |

| By Application | Food & Beverages (e.g., yogurt, fermented drinks) Dietary Supplements Animal Feed/Companion Animal Health Pharmaceutical/OTC therapeutics Infant & Child Nutrition |

| By Health Benefit | Digestive/GI health Immune support Women’s health (urogenital, vaginal) Metabolic and weight management Skin and oral health Cognitive and mood support |

| By Formulation | Capsules & Tablets Powders & Sachets Liquids & Shots Gummies & Chewables Functional foods (spoonable/drinkable yogurt, kefir) |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies/Health Stores Online Retail/E-commerce Convenience Stores Specialty & Direct-to-Consumer |

| By End-User | Adults Children/Infants Elderly Pets/Livestock Clinical/Institutional |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-range Budget Subscription/D2C bundles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Probiotic Usage | 140 | Health-conscious Consumers, Fitness Enthusiasts |

| Retailer Perspectives on Probiotic Products | 100 | Store Managers, Category Buyers |

| Healthcare Professional Opinions | 80 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in Probiotic Supplements | 70 | Product Managers, Brand Strategists |

| Regulatory Insights on Probiotic Claims | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Global Probiotics Market is valued at approximately USD 100 billion, driven by increasing consumer awareness of gut health, demand for functional foods, and the expanding use of probiotics in dietary supplements and pharmaceuticals.