Japan Probiotics Market Overview

- The Japan Probiotics Market is valued at USD 4.0 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness of gut health, the rising demand for functional foods, and the growing trend of preventive healthcare. The market has seen a significant uptick in the adoption of probiotics in various food and beverage products, as well as dietary supplements, reflecting a shift towards healthier lifestyles .

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Probiotics Market due to their high population density, advanced healthcare infrastructure, and a strong consumer base that is increasingly health-conscious. These urban centers are also home to numerous food and beverage manufacturers, which contribute to the market's growth by innovating and launching new probiotic products tailored to local preferences .

- In recent years, the Japanese government has strengthened regulations to enhance the safety and efficacy of probiotic products. This includes stricter guidelines for labeling and health claims associated with probiotics, ensuring that consumers receive accurate information about the benefits and potential risks of these products. The regulation aims to foster consumer trust and promote the responsible marketing of probiotics in the health and wellness sector .

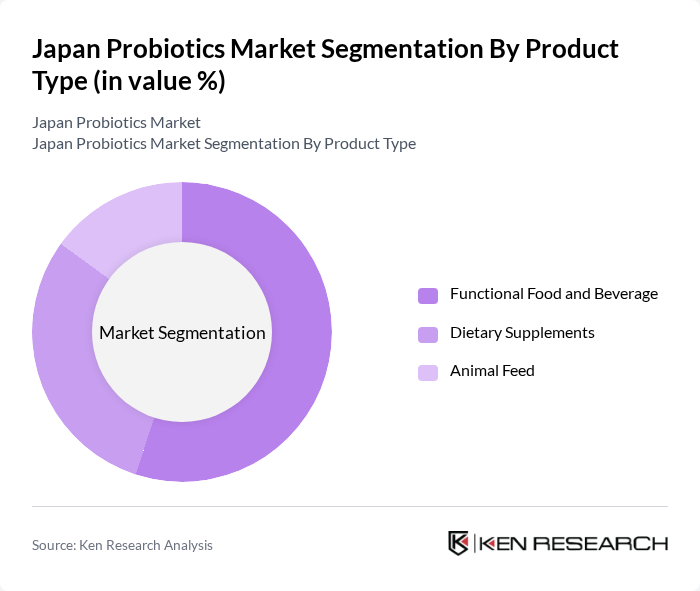

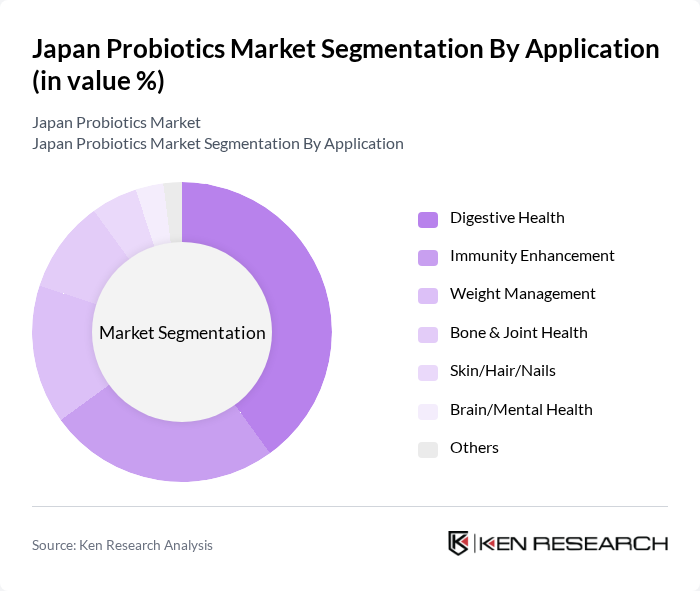

Japan Probiotics Market Segmentation

By Product Type:The product type segmentation includes Functional Food and Beverage, Dietary Supplements, and Animal Feed. Among these, Functional Food and Beverage is the leading sub-segment, driven by the increasing incorporation of probiotics in everyday food items such as yogurt, drinks, and snacks. The growing trend of health-conscious eating habits has led consumers to seek out functional foods that offer additional health benefits, thus propelling this segment's growth .

By Application:The application segmentation includes Digestive Health, Immunity Enhancement, Weight Management, Bone & Joint Health, Skin/Hair/Nails, Brain/Mental Health, and Others. Digestive Health is the dominant application area, as consumers increasingly recognize the importance of gut health in overall well-being. The rising prevalence of digestive disorders and the growing awareness of the benefits of probiotics in maintaining gut flora balance have significantly contributed to the growth of this segment .

Japan Probiotics Market Competitive Landscape

The Japan Probiotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yakult Honsha Co., Ltd., Asahi Group Holdings, Ltd., Meiji Holdings Co., Ltd., Morinaga Milk Industry Co., Ltd., Calpis Co., Ltd. (Asahi Group), Kewpie Corporation, Danone S.A., Nestlé S.A., Probi AB, Biofermin Pharmaceutical Co., Ltd., Bifodan A/S, DuPont de Nemours, Inc., Chr. Hansen Holding A/S, Morishita Jintan Co., Ltd., Mitsubishi Chemical Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Japan Probiotics Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Japanese population is increasingly prioritizing health, with 80% of adults actively seeking products that enhance well-being. This trend is supported by a report from the Ministry of Health, Labor and Welfare, indicating that health-related expenditures have risen to ¥44 trillion ($320 billion). As consumers become more informed about gut health, the demand for probiotics, which are linked to improved digestive health, is expected to surge, driving market growth significantly.

- Rising Demand for Functional Foods:The functional food market in Japan is projected to reach ¥2.5 trillion ($18 billion), with probiotics playing a crucial role. According to the Japan Food Safety Commission, 60% of consumers are now incorporating functional foods into their diets, driven by a desire for preventive health measures. This shift is fostering a robust demand for probiotic products, as they are increasingly recognized for their health benefits, including immune support and digestive health.

- Growth in the Aging Population:Japan's aging population, projected to reach 36 million seniors, is a significant driver for the probiotics market. The World Bank reports that 29% of the population will be over 65, leading to increased health concerns such as digestive issues and weakened immunity. Probiotics are increasingly viewed as a solution to these age-related health challenges, prompting higher consumption rates among older adults, thus expanding the market.

Market Challenges

- High Competition:The Japanese probiotics market is characterized by intense competition, with over 200 brands vying for consumer attention. According to an industry report, the top five companies hold only 35% of the market share, indicating a fragmented landscape. This high level of competition can lead to price wars and reduced profit margins, making it challenging for new entrants to establish a foothold in the market.

- Regulatory Compliance Costs:Navigating Japan's stringent regulatory environment poses significant challenges for probiotics manufacturers. Compliance with food safety standards and health claims regulations can incur costs exceeding ¥100 million ($700,000) for new product launches. The Japan Food Safety Commission emphasizes the importance of rigorous testing and documentation, which can deter smaller companies from entering the market, limiting innovation and diversity in product offerings.

Japan Probiotics Market Future Outlook

The future of the Japan probiotics market appears promising, driven by increasing health consciousness and a growing aging population. Innovations in product formulations, such as plant-based probiotics, are expected to attract health-focused consumers. Additionally, the rise of e-commerce platforms will facilitate broader access to probiotic products, enhancing consumer convenience. As collaborations with health professionals become more common, the credibility and acceptance of probiotics are likely to improve, further propelling market growth in future.

Market Opportunities

- Innovations in Product Formulation:There is a significant opportunity for companies to develop innovative probiotic products tailored to specific health needs. For instance, probiotics targeting gut health and immune support can attract health-conscious consumers. The Japan Health and Nutrition Food Association reports that 45% of consumers are interested in personalized nutrition solutions, indicating a strong market potential for customized probiotic offerings.

- Expansion into Emerging Markets:Japanese probiotic companies have the opportunity to expand into emerging markets in Southeast Asia, where demand for health products is rising. The Asian Development Bank projects a robust growth rate in health and wellness sectors in these regions. By leveraging their expertise, Japanese firms can tap into this growing market, enhancing their global footprint and driving revenue growth.