Region:Global

Author(s):Rebecca

Product Code:KRAC8626

Pages:94

Published On:November 2025

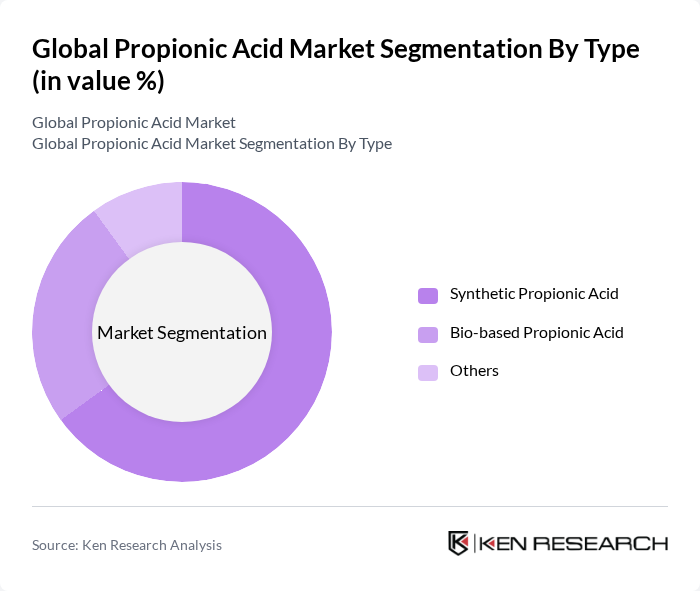

By Type:The market is segmented into three main types: Synthetic Propionic Acid, Bio-based Propionic Acid, and Others. Synthetic Propionic Acid is the most widely used due to its cost-effectiveness and established production processes. Bio-based Propionic Acid is gaining traction as consumers and industries shift towards sustainable and eco-friendly products. The "Others" category includes various niche products that cater to specific applications .

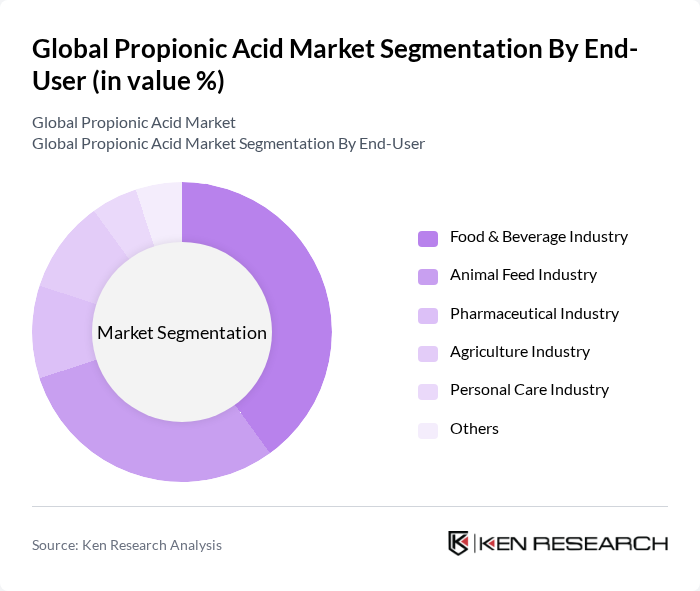

By End-User:The end-user segments include the Food & Beverage Industry, Animal Feed Industry, Pharmaceutical Industry, Agriculture Industry, Personal Care Industry, and Others. The Food & Beverage Industry is the largest consumer of propionic acid, utilizing it primarily as a preservative. The Animal Feed Industry follows closely, where propionic acid is used to enhance feed quality and shelf life. Other industries are also adopting propionic acid for various applications, contributing to market growth .

The Global Propionic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Eastman Chemical Company, Perstorp Holding AB, Dow Inc., Daicel Corporation, Macco Organiques Inc., LUXI Group Co., Ltd., OQ Chemicals GmbH, Otto Chemie Pvt. Ltd., KEMIN Industries, Inc., Impextraco N.V., Perstorp Holding AB, Niacet Corporation (A Kerry Group Company), Celanese Corporation, Sabo S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the propionic acid market appears promising, driven by the increasing focus on sustainable production methods and the rising demand for natural preservatives. As consumers become more health-conscious, the shift towards bio-based and environmentally friendly products is expected to gain momentum. Additionally, technological advancements in manufacturing processes will likely enhance efficiency and reduce costs, further supporting market growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Propionic Acid Bio-based Propionic Acid Others |

| By End-User | Food & Beverage Industry Animal Feed Industry Pharmaceutical Industry Agriculture Industry Personal Care Industry Others |

| By Application | Food Preservatives Animal Feed Additives Herbicides Plasticizers Sodium & Calcium Salts Cellulose Acetate Propionate Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Production Method | Oxo Process (Hydroformylation) Reppe Process Fermentation By-product Process Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 45 | Food Technologists, Quality Assurance Managers |

| Pharmaceutical Sector Usage | 38 | Formulation Scientists, Regulatory Affairs Specialists |

| Agricultural Chemicals | 42 | Agronomists, Product Development Managers |

| Industrial Applications | 35 | Production Managers, Chemical Engineers |

| Market Trends and Innovations | 40 | Market Analysts, R&D Directors |

The Global Propionic Acid Market is valued at approximately USD 1.8 billion, driven by increasing demand in food preservation, animal feed, and agricultural applications. This growth reflects a significant expansion in packaged food and animal feed industries.