Region:Global

Author(s):Rebecca

Product Code:KRAA2942

Pages:83

Published On:August 2025

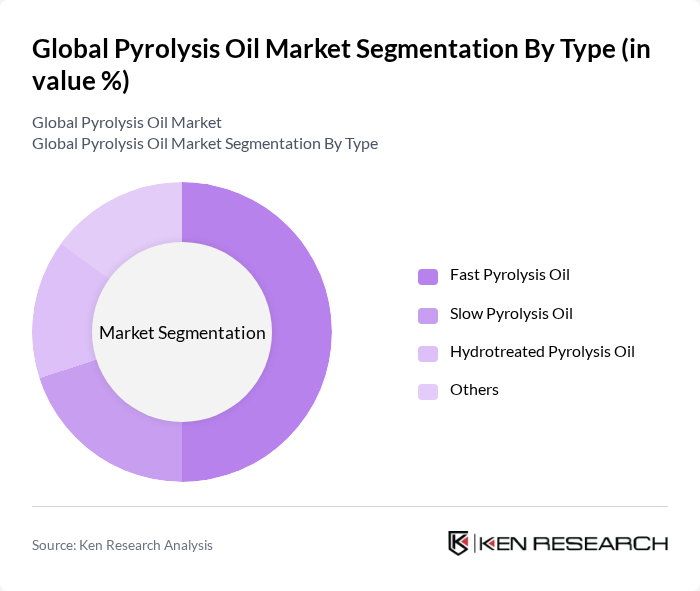

By Type:The market is segmented into Fast Pyrolysis Oil, Slow Pyrolysis Oil, Hydrotreated Pyrolysis Oil, and Others.Fast Pyrolysis Oilremains the dominant sub-segment, accounting for the largest market share due to its higher yield and efficiency in converting biomass into liquid fuel. The increasing focus on renewable energy sources, stricter environmental regulations, and the need for cleaner fuels are driving demand for fast pyrolysis oil, making it the preferred choice among manufacturers.

By Feedstock:The feedstock segment includes Biomass, Plastic Waste, Rubber/Tires, and Others.Biomassis the leading sub-segment, primarily due to its abundance and the growing emphasis on sustainable energy solutions. The increasing availability of agricultural residues and forestry waste, alongside rising plastic waste volumes, is propelling the use of biomass and plastics as primary feedstocks for pyrolysis oil production.

The Global Pyrolysis Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bioenergy Technologies Inc., Pyrolyx AG, Agilyx Corporation, Greenfield Global Inc., RES Polyflow (now Brightmark), Klean Industries Inc., TCG Digital (formerly TCC Group), A2A S.p.A., Biofuels International Ltd., Enerkem Inc., Veolia Environnement S.A., TotalEnergies SE, Shell Global Solutions, SUEZ Recycling and Recovery, Covanta Holding Corporation, Plastic Energy Ltd., Neste Oyj, Quantafuel ASA, Alterra Energy, ReOil Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pyrolysis oil market appears promising, driven by increasing global emphasis on sustainability and circular economy practices. As governments implement stricter regulations on waste management and emissions, the demand for pyrolysis oil is expected to rise. Furthermore, advancements in technology will likely enhance production efficiency, making pyrolysis a more attractive option for energy generation. The integration of pyrolysis oil into existing energy systems could also facilitate its acceptance and growth in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Fast Pyrolysis Oil Slow Pyrolysis Oil Hydrotreated Pyrolysis Oil Others |

| By Feedstock | Biomass Plastic Waste Rubber/Tires Others |

| By Application | Chemical Feedstock Fuel Production Power Generation Others |

| By End-User | Transportation Industrial Heating Utilities & Power Plants Petrochemical Industry Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Netherlands, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Rest of World (South America, Middle East & Africa) |

| By Method of Upgrading | Hydrotreatment Distillation Steam Reforming Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pyrolysis Oil Producers | 60 | Plant Managers, Production Supervisors |

| End-Users in Energy Sector | 50 | Energy Analysts, Procurement Managers |

| Research Institutions | 40 | Research Scientists, Policy Advisors |

| Equipment Manufacturers | 45 | Sales Engineers, Product Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The Global Pyrolysis Oil Market is valued at approximately USD 1.8 billion, driven by increasing demand for renewable fuels, rising plastic waste, and advancements in pyrolysis technology that enhance production efficiency and scalability.