Global Refractive Surgery Devices Market Overview

- The Global Refractive Surgery Devices Market is valued at USD 220 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of refractive errors, advancements in laser-based correction technologies, and rising consumer awareness regarding vision correction options. The market has seen a surge in demand for innovative devices that enhance surgical outcomes and patient satisfaction. Technological integration, such as femtosecond and excimer lasers, has improved procedural accuracy, while supportive reimbursement frameworks and expanding access to advanced eye care infrastructure have further accelerated global adoption , , .

- Key players in this market are concentrated in regions such as North America, Europe, and Asia-Pacific. The dominance of these regions can be attributed to the presence of advanced healthcare infrastructure, high disposable incomes, and a growing population seeking corrective eye surgeries. Countries like the United States, Germany, and Japan lead the market due to their technological advancements and established healthcare systems. Notably, North America holds a significant share, with the United States accounting for over a quarter of global revenues in recent years , .

- In 2023, the U.S. Food and Drug Administration (FDA) implemented updated regulatory requirements for refractive surgery devices under the Medical Device User Fee Amendments (MDUFA V, 2022) issued by the U.S. Food and Drug Administration. These regulations require manufacturers to conduct more rigorous clinical trials and enhanced post-market surveillance, including mandatory adverse event reporting and periodic safety updates, to ensure that devices meet the highest safety standards and foster consumer confidence in refractive surgical procedures , .

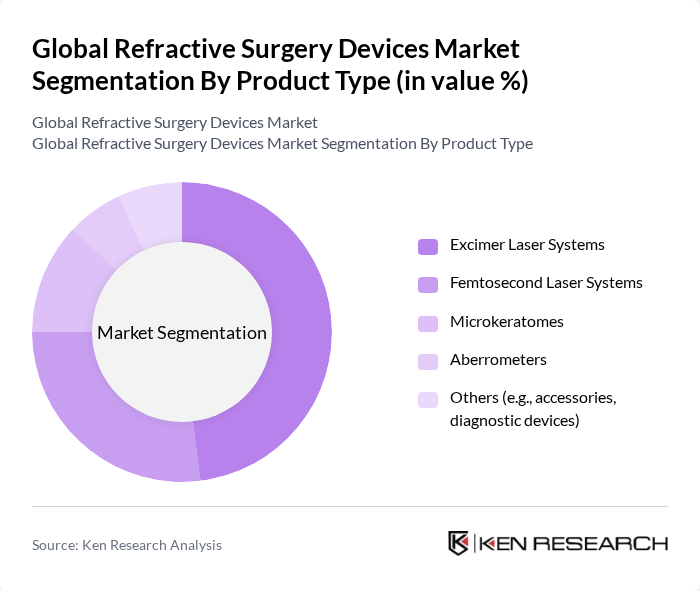

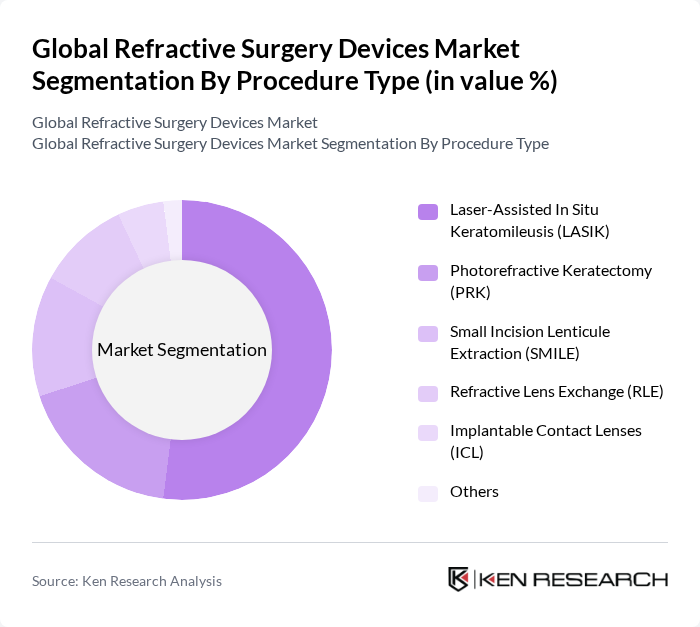

Global Refractive Surgery Devices Market Segmentation

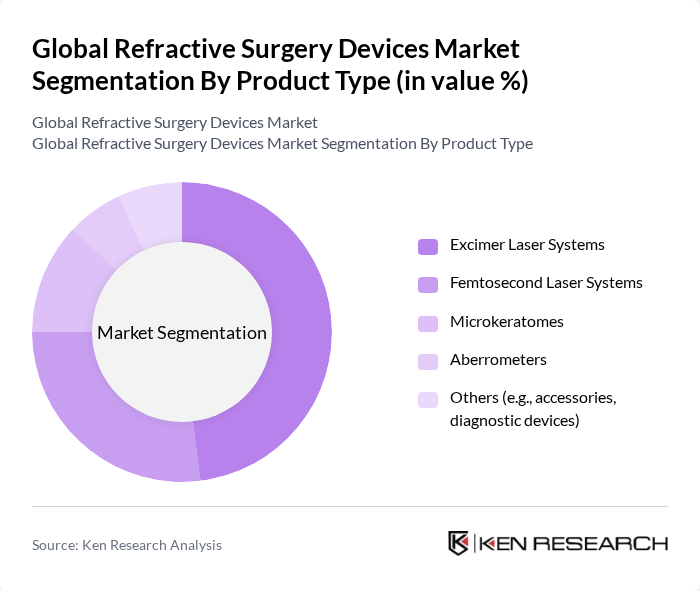

By Product Type:The product type segmentation includes various devices used in refractive surgeries. The leading subsegments are Excimer Laser Systems, Femtosecond Laser Systems, Microkeratomes, Aberrometers, and Others (e.g., accessories, diagnostic devices). Among these, Excimer Laser Systems dominate the market due to their precision and effectiveness in correcting refractive errors, making them the preferred choice for both surgeons and patients. Lasers as a category (including excimer and femtosecond) account for nearly half of the global market share , .

By Procedure Type:The procedure type segmentation encompasses various surgical techniques employed in refractive surgeries. The key subsegments include Laser-Assisted In Situ Keratomileusis (LASIK), Photorefractive Keratectomy (PRK), Small Incision Lenticule Extraction (SMILE), Refractive Lens Exchange (RLE), Implantable Contact Lenses (ICL), and Others. LASIK remains the most popular procedure due to its quick recovery time and high success rates, making it the leading choice among patients seeking vision correction. LASIK and related laser procedures collectively account for the majority of refractive surgeries performed globally , .

Global Refractive Surgery Devices Market Competitive Landscape

The Global Refractive Surgery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb (Bausch Health Companies Inc.), Ziemer Ophthalmic Systems AG, Carl Zeiss Meditec AG, Abbott Medical Optics (now part of Johnson & Johnson Vision), Nidek Co., Ltd., Rayner Intraocular Lenses Limited, Santen Pharmaceutical Co., Ltd., STAAR Surgical Company, HOYA Corporation, SCHWIND eye-tech-solutions GmbH & Co. KG, LENSAR, Inc., Lumenis Ltd., iVIS Technologies S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

Global Refractive Surgery Devices Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Refractive Errors:The global prevalence of refractive errors is estimated to affect approximately2.2 billion peopleaccording to the World Health Organization. This rising number is driven by factors such as aging populations and increased screen time, leading to a higher demand for corrective procedures. As more individuals seek solutions for vision correction, the market for refractive surgery devices is expected to expand significantly, providing opportunities for growth in this sector.

- Advancements in Surgical Technology:Technological innovations in refractive surgery, such as femtosecond lasers and wavefront-guided LASIK, have improved surgical outcomes and reduced recovery times. In future, the global investment in medical technology is projected to reachUSD 500 billion, with a significant portion allocated to ophthalmic devices. These advancements not only enhance the precision of surgeries but also increase patient satisfaction, driving further adoption of refractive surgery devices in the market.

- Rising Demand for Minimally Invasive Procedures:The shift towards minimally invasive surgical techniques is evident, with outpatient procedures expected to account for over70%of all surgeries in future. This trend is fueled by patient preferences for quicker recovery and less postoperative pain. As refractive surgery aligns with these preferences, the demand for devices that facilitate such procedures is anticipated to grow, further propelling the market forward in the coming years.

Market Challenges

- High Cost of Refractive Surgery Devices:The average cost of refractive surgery devices can range fromUSD 50,000 to USD 200,000, depending on the technology and equipment used. This high initial investment can deter smaller clinics from adopting advanced technologies, limiting market penetration. Additionally, patients may be reluctant to undergo procedures due to the out-of-pocket expenses associated with these devices, posing a significant challenge to market growth.

- Stringent Regulatory Requirements:Regulatory bodies such as the FDA and CE mark impose rigorous approval processes for new refractive surgery devices. In future, the average time for device approval is expected to exceed12 months, which can delay market entry for innovative products. These stringent regulations can hinder the speed at which new technologies are introduced, impacting the overall growth of the refractive surgery devices market.

Global Refractive Surgery Devices Market Future Outlook

The future of the refractive surgery devices market appears promising, driven by ongoing technological advancements and increasing patient awareness. As personalized surgical solutions become more prevalent, the integration of digital technologies will enhance surgical precision and outcomes. Furthermore, the trend towards outpatient surgeries is expected to continue, making procedures more accessible. These developments will likely foster a more competitive landscape, encouraging innovation and collaboration among industry players to meet evolving patient needs.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities. With a combined population ofover 4 billion, these regions are witnessing rising disposable incomes and increasing healthcare access, which can drive demand for refractive surgery devices. In future, the market in these regions is expected to grow substantially, offering lucrative prospects for manufacturers.

- Development of Innovative Surgical Techniques:The continuous evolution of surgical techniques, such as SMILE (Small Incision Lenticule Extraction), is creating new avenues for market growth. These innovations not only improve patient outcomes but also attract a broader patient base. As research and development investments increase, the introduction of novel techniques will likely enhance the competitive landscape, providing opportunities for companies to differentiate their offerings.