Region:Global

Author(s):Rebecca

Product Code:KRAA2418

Pages:97

Published On:August 2025

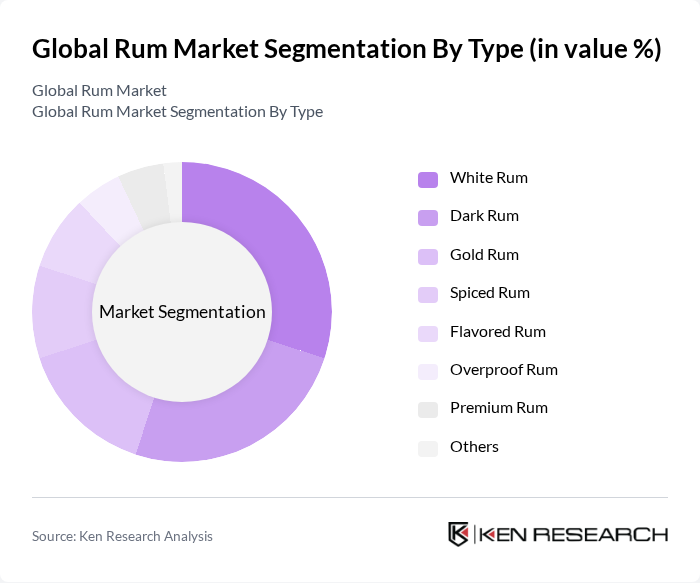

By Type:The rum market is segmented into various types, including White Rum, Dark Rum, Gold Rum, Spiced Rum, Flavored Rum, Overproof Rum, Premium Rum, and Others. Each type caters to distinct consumer preferences and occasions. White Rum is widely used in cocktails due to its light flavor, while Dark Rum is favored for sipping and premium mixes. Gold and Spiced Rums appeal to consumers seeking richer taste profiles and versatility in mixology. Flavored and Overproof Rums are increasingly popular in innovative cocktail recipes and among adventurous consumers .

By End-User:The rum market is also segmented by end-users, which include Retail Consumers, Bars and Restaurants, Nightclubs, and Online Retailers. Retail Consumers represent the largest segment, purchasing rum for personal consumption. Bars and Restaurants contribute significantly to sales through cocktail offerings and premium rum experiences. Nightclubs and Online Retailers are gaining importance as distribution channels, with online platforms driving growth due to convenience and expanded product availability .

The Global Rum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc (Captain Morgan, Ron Zacapa), Bacardi Limited (Bacardi, Cazadores), Pernod Ricard S.A. (Havana Club, Malibu), Brown-Forman Corporation (El Jimador, Herradura, but also owns Diplomático as of 2023), William Grant & Sons Ltd. (Sailor Jerry, O.V.D.), Rémy Cointreau S.A. (Mount Gay Rum), Mount Gay Distilleries Ltd., Ron Diplomático (Destilerías Unidas S.A.), St. Lucia Distillers Group of Companies, The Kraken Rum Company (Proximo Spirits), Sailor Jerry Spiced Rum (William Grant & Sons Ltd.), Compañía Licorera de Nicaragua S.A. (Flor de Caña), Demerara Distillers Limited (El Dorado Rum), Pusser's Rum Ltd., Rhum Clément (Groupe Bernard Hayot) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rum market appears promising, driven by evolving consumer preferences and innovative product offerings. As the trend towards premiumization continues, brands that focus on quality and unique flavor profiles are likely to thrive. Additionally, the rise of craft distilleries is expected to enhance market diversity, catering to niche consumer segments. With the increasing integration of sustainability practices in production, the rum industry is poised to attract environmentally conscious consumers, further expanding its market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | White Rum Dark Rum Gold Rum Spiced Rum Flavored Rum Overproof Rum Premium Rum Others |

| By End-User | Retail Consumers Bars and Restaurants Nightclubs Online Retailers |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores E-commerce Platforms Duty-Free Shops |

| By Packaging Type | Glass Bottles Plastic Bottles Cans |

| By Price Range | Economy Mid-Range Premium Super Premium |

| By Occasion | Celebrations Casual Gatherings Special Events |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rum Production Insights | 100 | Distillery Owners, Production Managers |

| Retail Market Dynamics | 60 | Retail Managers, Beverage Buyers |

| Consumer Preferences Survey | 120 | Rum Enthusiasts, General Consumers |

| Distribution Channel Analysis | 50 | Distributors, Logistics Managers |

| Market Trend Evaluation | 70 | Industry Analysts, Market Researchers |

The global rum market is valued at approximately USD 20 billion, driven by the increasing popularity of rum-based cocktails, premium and craft spirits, and expanding online sales channels. This growth reflects a diverse consumer base that appreciates rum's versatility and evolving flavor profiles.