Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0005

Pages:82

Published On:July 2025

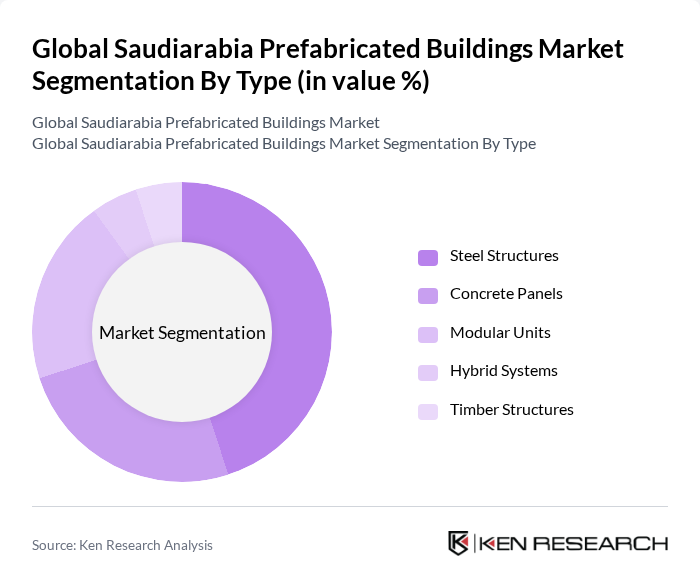

By Type:In the prefabricated buildings market, the dominant sub-segment isSteel Structures, which is favored for its durability, strength, and versatility. Steel structures are increasingly used in commercial and industrial applications due to their ability to withstand harsh environmental conditions and their quick assembly time. The trend towards sustainable construction practices has also led to a rise in the use of recycled steel, further enhancing its appeal among builders and developers .

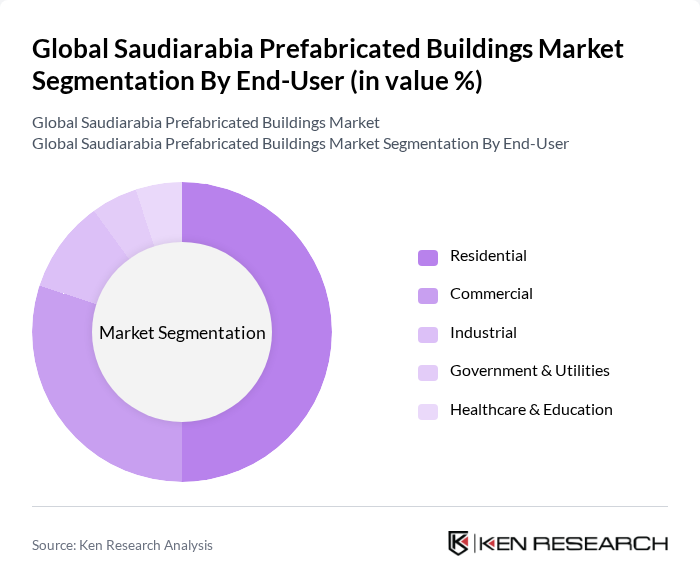

By End-User:TheResidentialsegment is the leading sub-segment in the prefabricated buildings market, driven by the increasing demand for affordable housing solutions. With a growing population and urban migration, there is a significant push for quick and efficient housing options. Prefabricated residential units offer a cost-effective solution that meets the needs of first-time homebuyers and low-income families, making them a popular choice among developers and government housing initiatives .

The Global Saudiarabia Prefabricated Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Building Systems Manufacturing Co., Red Sea International Company, Zamil Industrial Investment Co., Al-Fouzan Trading & General Construction Co., Al-Babtain Group, Al-Muhaidib Group, Al-Arrab Contracting Company, Al-Jazira Factory for Steel Products, Al-Khodari & Sons, Al-Tamimi Group, Al-Watania for Industries, Eastern Province Cement Company, Saudi Readymix Concrete Company, Saudi Steel Pipe Company, United Precast Concrete Co. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the prefabricated buildings market in Saudi Arabia appears promising, driven by ongoing government support and a shift towards innovative construction methods. As urbanization accelerates, the demand for quick, cost-effective housing solutions will likely increase. Furthermore, advancements in technology, such as 3D printing and smart building integration, will enhance the efficiency and appeal of prefabricated structures, making them a preferred choice for developers and consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Steel Structures Concrete Panels Modular Units Hybrid Systems Timber Structures |

| By End-User | Residential Commercial Industrial Government & Utilities Healthcare & Education |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Residential Buildings Commercial Buildings Industrial Facilities Temporary Structures Social Infrastructure (Schools, Hospitals) |

| By Material Used | Steel Wood Concrete Glass Composite Materials |

| By Construction Method | Modular Construction Panelized Construction Pre-Cast Construction D Volumetric Construction |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Prefabricated Buildings | 100 | Architects, Home Builders, Project Managers |

| Commercial Prefabricated Structures | 80 | Construction Managers, Real Estate Developers |

| Industrial Prefabricated Facilities | 60 | Facility Managers, Operations Directors |

| Modular Building Solutions | 50 | Product Designers, Engineering Consultants |

| Prefabricated Building Materials Suppliers | 40 | Supply Chain Managers, Procurement Officers |

The Global Saudi Arabia Prefabricated Buildings Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by urbanization, government initiatives for sustainable construction, and the demand for cost-effective building solutions.