Region:Middle East

Author(s):Shubham

Product Code:KRAC0699

Pages:85

Published On:August 2025

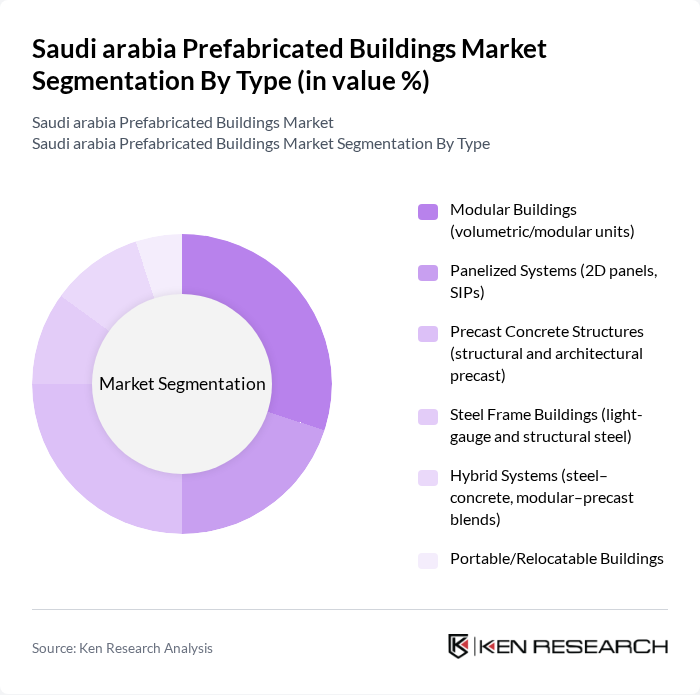

By Type:The prefabricated buildings market can be segmented into various types, including Modular Buildings, Panelized Systems, Precast Concrete Structures, Steel Frame Buildings, Hybrid Systems, and Portable/Relocatable Buildings. Each type serves different construction needs and preferences, with modular buildings gaining popularity for their speed and efficiency.

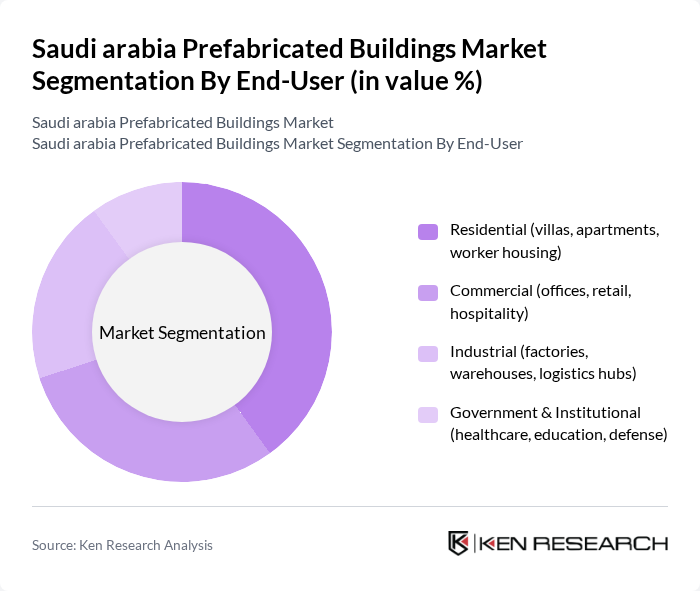

By End-User:The market can also be segmented by end-user categories, including Residential, Commercial, Industrial, and Government & Institutional. Each segment has unique requirements, with residential applications focusing on housing solutions and commercial applications targeting office and retail spaces.

The Saudi arabia Prefabricated Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zamil Industrial Investment Co. (Zamil Steel Pre-Engineered Buildings), Saudi Building Systems Manufacturing Co. (SBS), Red Sea International Company, Alfanar Construction (Modular & Industrialized Building Systems), United Precast Concrete (Saudi Arabia), Al Rajhi Building Solutions (Al Rajhi Steel), AlKifah Precast (KIPCO) – Kifah Precast, Nesma & Partners Contracting Co. (Off-site/Modular Solutions), Saudi Aramco Community & Industrial Solutions (via contractors for modular camps), Al Latifia Trading & Contracting Co. (modular/industrialized building projects), Al Bawani Co. (industrialized/off-site construction programs), El Seif Engineering Contracting Co. (precast/modular integration), Saudi Preinsulated Panels (SPP) – Sandwich Panels, Al Shumaimri Industrial Company (portable buildings and cabins), Al Salem Johnson Controls (York) – modular MEP plantrooms contribute to innovation, geographic expansion, and service delivery in this space.

The future of the prefabricated buildings market in Saudi Arabia appears promising, driven by ongoing urbanization and government support for innovative construction methods. As the population continues to grow, the demand for affordable housing will likely increase, prompting further investment in prefabricated solutions. Additionally, the integration of smart technologies and sustainable practices will enhance the appeal of these buildings, positioning them as a key component of the nation’s infrastructure development strategy.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Buildings (volumetric/modular units) Panelized Systems (2D panels, SIPs) Precast Concrete Structures (structural and architectural precast) Steel Frame Buildings (light-gauge and structural steel) Hybrid Systems (steel–concrete, modular–precast blends) Portable/Relocatable Buildings |

| By End-User | Residential (villas, apartments, worker housing) Commercial (offices, retail, hospitality) Industrial (factories, warehouses, logistics hubs) Government & Institutional (healthcare, education, defense) |

| By Application | Temporary/Relocatable Structures (site offices, camps) Permanent Buildings (multi-storey, core facilities) Worker/Construction Camps and Accommodation Social Infrastructure (schools, clinics, community centers) |

| By Material | Wood/Timber Steel/Aluminum Concrete/Precast Composites & Insulated Panels (e.g., sandwich/SIP panels) |

| By Distribution Channel | Direct Sales (EPCs, government tenders) Distributors/Dealers Online/Config-to-Order Portals |

| By Price Range | Economy Mid-Range Premium |

| By Policy Support | Off-site Construction/Industrialized Building Initiatives Local Content (IKTVA) & Saudization Compliance Green Building/ESG Standards (SASO, Mostadam, LEED) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Prefabricated Buildings | 120 | Architects, Home Builders, Project Managers |

| Commercial Prefabricated Structures | 90 | Real Estate Developers, Construction Managers |

| Industrial Prefabricated Solutions | 80 | Facility Managers, Operations Directors |

| Government Projects Utilizing Prefabrication | 60 | Public Sector Officials, Urban Planners |

| Sustainable Building Practices in Prefabrication | 100 | Sustainability Consultants, Environmental Engineers |

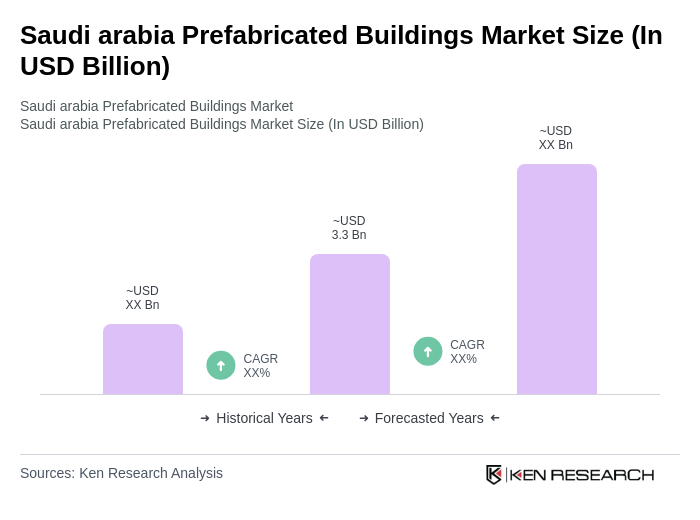

The Saudi Arabia Prefabricated Buildings Market is valued at approximately USD 3.3 billion, reflecting significant growth driven by urbanization, government initiatives, and the demand for sustainable building solutions.