Region:Asia

Author(s):Rebecca

Product Code:KRAA1336

Pages:84

Published On:August 2025

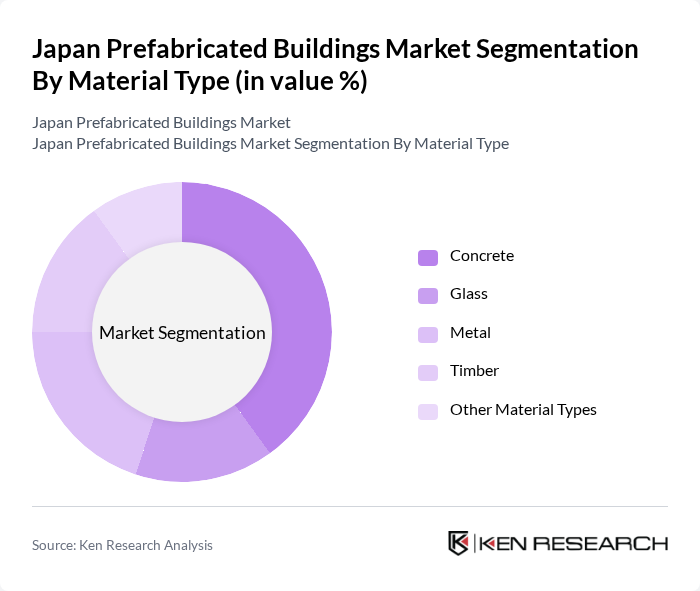

By Material Type:The market is segmented based on the materials used in prefabricated buildings, which include Concrete, Glass, Metal, Timber, and Other Material Types. Each material type has unique properties that cater to different construction needs and preferences. Concrete remains the dominant material due to its durability and versatility, while timber is gaining traction driven by sustainability trends.

The Concrete segment is the leading material type in the market, primarily due to its durability, strength, and versatility in various construction applications. Concrete prefabricated buildings are widely used in both residential and commercial sectors, as they can be easily molded into different shapes and sizes. The increasing focus on sustainable construction practices has also led to innovations in concrete technology, further enhancing its appeal among builders and developers.

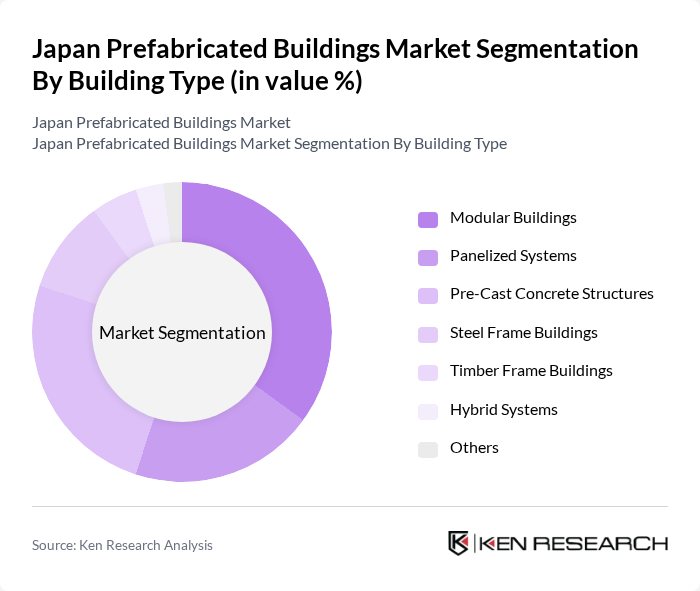

By Building Type:The market is also segmented by building types, which include Modular Buildings, Panelized Systems, Pre-Cast Concrete Structures, Steel Frame Buildings, Timber Frame Buildings, Hybrid Systems, and Others. Each building type serves different purposes and caters to various consumer needs. Modular buildings are preferred for their rapid assembly and flexibility, especially in urban areas with limited space.

Modular Buildings are the dominant building type in the market, favored for their quick assembly and flexibility in design. They are particularly popular in urban areas where space is limited, allowing for efficient use of land. The trend towards sustainable living and the need for affordable housing solutions have further propelled the demand for modular buildings, making them a preferred choice for both residential and commercial projects.

The Japan Prefabricated Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sekisui House, Ltd., Daiwa House Industry Co., Ltd., Asahi Kasei Corporation, Panasonic Homes Co., Ltd., Misawa Homes Co., Ltd., Obayashi Corporation, Shimizu Corporation, Taisei Corporation, Sumitomo Forestry Co., Ltd., Mitsui Home Co., Ltd., Marubeni Corporation, Sato Kogyo Co., Ltd., Konoike Construction Co., Ltd., Yachiyo Industry Co., Ltd., ORIENTHOUSE Co., Ltd., Zenitaka Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan prefabricated buildings market appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As cities expand, the need for efficient housing solutions will intensify, pushing the adoption of prefabricated structures. Additionally, advancements in technology will likely enhance production efficiency and customization options, making these buildings more appealing to consumers. The integration of smart technologies will further revolutionize the market, aligning with global trends toward intelligent living spaces.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Concrete Glass Metal Timber Other Material Types |

| By Building Type | Modular Buildings Panelized Systems Pre-Cast Concrete Structures Steel Frame Buildings Timber Frame Buildings Hybrid Systems Others |

| By Application | Residential Commercial Industrial Infrastructure & Institutional |

| By Purpose | Temporary Structures Permanent Structures Disaster Relief Housing Educational Facilities |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low-End Mid-Range High-End |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Prefabricated Housing | 90 | Architects, Home Builders, Real Estate Developers |

| Commercial Prefabricated Structures | 60 | Project Managers, Construction Firms, Facility Managers |

| Industrial Prefabricated Solutions | 50 | Manufacturing Executives, Supply Chain Managers |

| Government Infrastructure Projects | 40 | Public Sector Officials, Urban Planners, Policy Makers |

| Innovative Prefabrication Technologies | 40 | R&D Managers, Technology Developers, Industry Analysts |

The Japan Prefabricated Buildings Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by urbanization, demand for efficient construction methods, and sustainable building solutions.