Region:Global

Author(s):Geetanshi

Product Code:KRAA2758

Pages:94

Published On:August 2025

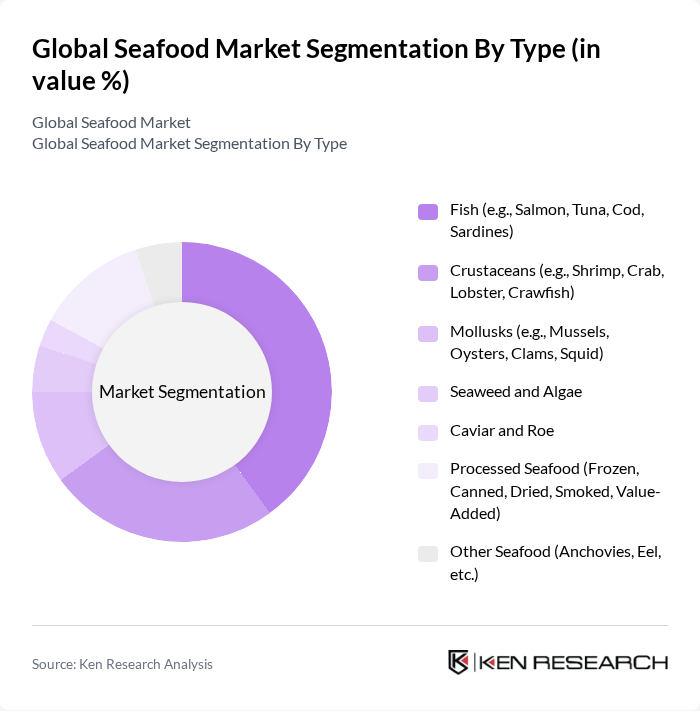

By Type:The seafood market is segmented into various types, including fish, crustaceans, mollusks, seaweed and algae, caviar and roe, processed seafood, and other seafood. Fish, particularly species like salmon and tuna, dominate the market due to their high demand, nutritional value, and versatility in global cuisines. Crustaceans, such as shrimp and crab, also hold a significant share, driven by their popularity in culinary applications and increasing aquaculture production. Processed seafood—including frozen, canned, dried, smoked, and value-added products—is gaining traction as consumers seek convenience and ready-to-eat options, supported by advancements in cold chain logistics and packaging technologies.

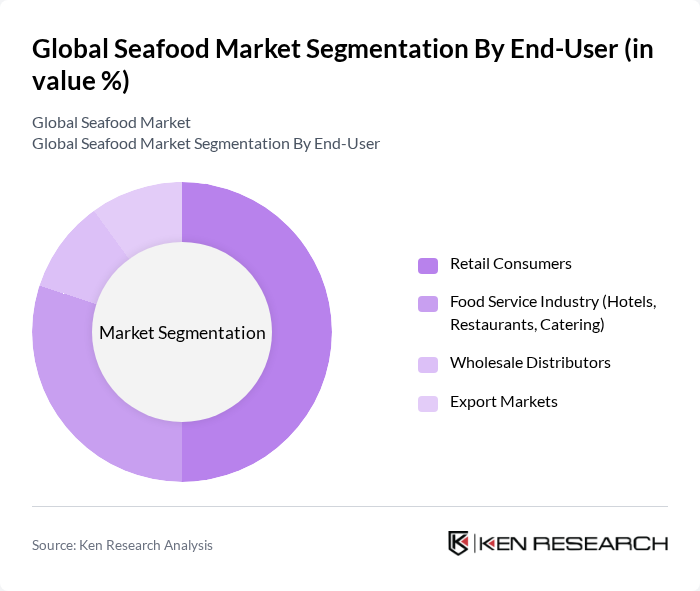

By End-User:The seafood market is segmented by end-user into retail consumers, the food service industry, wholesale distributors, and export markets. Retail consumers represent the largest segment, driven by increasing health consciousness, the popularity of seafood in home cooking, and the expansion of supermarket and online retail channels. The food service industry—including hotels, restaurants, and catering services—plays a crucial role, as seafood is a staple in many global cuisines and fine dining establishments. Export markets are significant for countries with abundant seafood resources, contributing to global trade and supporting the growth of wholesale distributors who manage large-scale supply chains.

The Global Seafood Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mowi ASA, Thai Union Group PCL, Nippon Suisan Kaisha, Ltd. (Nissui), Dongwon Industries Co., Ltd., Trident Seafoods Corporation, Bumble Bee Foods, LLC, Clearwater Seafoods Incorporated, High Liner Foods Incorporated, Pacific Seafood Group, Maruha Nichiro Corporation, Austevoll Seafood ASA, Aker BioMarine ASA, Seaboard Corporation, Ocean Beauty Seafoods, LLC, American Seafoods Company, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the seafood market is poised for transformation, driven by technological advancements and evolving consumer preferences. As aquaculture continues to expand, innovations in breeding and feed technology will enhance production efficiency. Additionally, the rise of plant-based seafood alternatives is expected to capture a significant market share, appealing to health-conscious and environmentally aware consumers. The focus on sustainability will further shape industry practices, leading to increased investments in responsible sourcing and traceability initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Fish (e.g., Salmon, Tuna, Cod, Sardines) Crustaceans (e.g., Shrimp, Crab, Lobster, Crawfish) Mollusks (e.g., Mussels, Oysters, Clams, Squid) Seaweed and Algae Caviar and Roe Processed Seafood (Frozen, Canned, Dried, Smoked, Value-Added) Other Seafood (Anchovies, Eel, etc.) |

| By End-User | Retail Consumers Food Service Industry (Hotels, Restaurants, Catering) Wholesale Distributors Export Markets |

| By Sales Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail/E-Commerce Specialty Seafood Stores Direct Sales |

| By Distribution Mode | Direct Distribution Indirect Distribution Cold Chain Logistics |

| By Price Range | Premium Seafood Mid-Range Seafood Budget Seafood |

| By Product Origin | Wild-Caught Seafood Farmed (Aquaculture) Seafood |

| By Certification Type | Organic Certification Sustainability Certification (e.g., MSC, ASC) Quality Assurance Certification |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wild Catch Fisheries | 100 | Fishery Managers, Vessel Owners |

| Aquaculture Operations | 60 | Aquaculture Farm Managers, Feed Suppliers |

| Seafood Processing Industry | 75 | Processing Plant Supervisors, Quality Control Managers |

| Seafood Distribution Networks | 55 | Distributors, Logistics Coordinators |

| Retail Seafood Sales | 65 | Retail Managers, Seafood Department Heads |

The Global Seafood Market is valued at approximately USD 370 billion, reflecting a significant growth driven by increasing consumer demand for healthy protein sources and the expansion of aquaculture practices.