Region:Global

Author(s):Geetanshi

Product Code:KRAD4885

Pages:95

Published On:December 2025

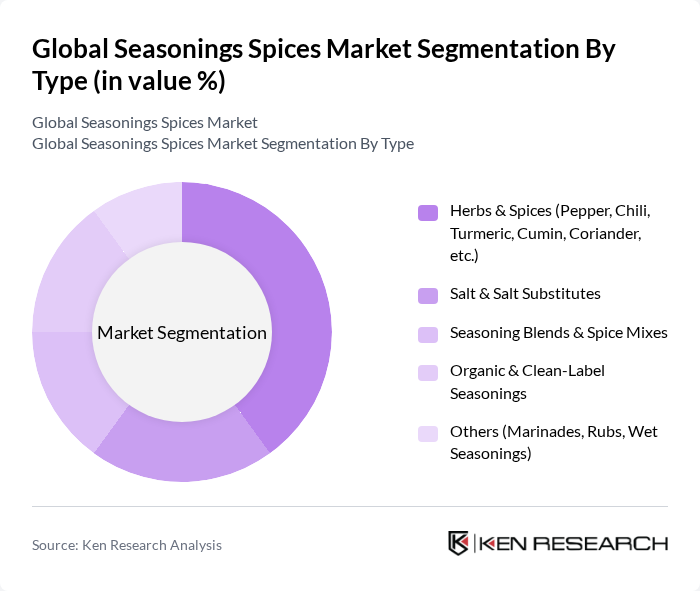

By Type:The market is segmented into various types, including herbs and spices, salt and salt substitutes, seasoning blends and spice mixes, organic and clean-label seasonings, and others such as marinades, rubs, and wet seasonings. Among these, herbs and spices, particularly pepper, chili, turmeric, cumin, and coriander, dominate the market due to their essential role in enhancing flavor and aroma in culinary applications. The growing trend of health-conscious consumers is also driving the demand for organic and clean-label seasonings, which are perceived as healthier alternatives and are increasingly positioned around functional benefits such as anti-inflammatory and antioxidant properties.

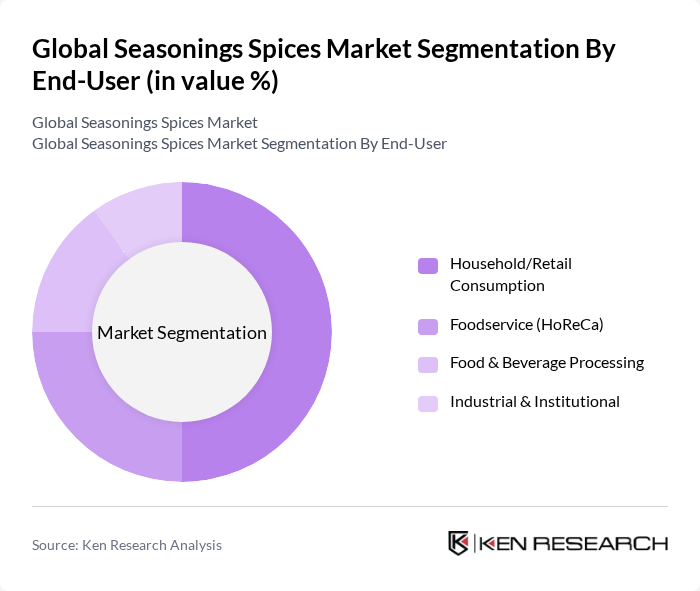

By End-User:The market is categorized into household/retail consumption, foodservice (HoReCa), food and beverage processing, and industrial and institutional users. Household consumption is the leading segment, driven by the increasing trend of home cooking, growth in retail packaged spices, and the growing interest in culinary experimentation among consumers. The foodservice sector is also significant, as restaurants and catering services seek to enhance their offerings with diverse flavors and high-quality seasonings, while food and beverage processors increasingly incorporate spice blends to improve the taste and health profile of convenience and ready-to-eat products.

The Global Seasonings Spices Market is characterized by a dynamic mix of regional and international players. Leading participants such as McCormick & Company, Incorporated, Ajinomoto Co., Inc., Kerry Group plc, Olam International Limited (ofi – Olam Food Ingredients), Associated British Foods plc (ABF Ingredients, AB World Foods), B&G Foods, Inc. (Spice Islands, Tone's, Weber), EVEREST Food Products Pvt. Ltd., DS Group (Catch Spices), MDH Spices (Mahashian Di Hatti Pvt. Ltd.), ITC Limited (Aashirvaad Spices), Tata Consumer Products Limited (Tata Sampann Spices), Sensient Technologies Corporation, Moguntia Food Group, Dohler GmbH, VKL Seasoning Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the seasonings and spices market appears promising, driven by evolving consumer preferences and innovative product offerings. As the trend towards plant-based diets continues, the demand for spices that enhance flavor without artificial additives is expected to rise. Additionally, the growth of online culinary education and subscription services will likely foster a deeper appreciation for diverse spices, encouraging consumers to experiment with new flavors and cooking techniques, thus expanding market reach and engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbs & Spices (Pepper, Chili, Turmeric, Cumin, Coriander, etc.) Salt & Salt Substitutes Seasoning Blends & Spice Mixes Organic & Clean-Label Seasonings Others (Marinades, Rubs, Wet Seasonings) |

| By End-User | Household/Retail Consumption Foodservice (HoReCa) Food & Beverage Processing Industrial & Institutional |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Meat, Poultry & Seafood Snacks, Convenience Foods & RTE Meals Bakery, Confectionery & Desserts Sauces, Dressings & Marinades Others (Beverages, Functional & Medicinal Uses) |

| By Packaging Type | Bulk & Industrial Packaging Retail Rigid Packaging (Jars, Tins, Glass) Retail Flexible Packaging (Pouches, Sachets) Eco-friendly & Recyclable Packaging |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience & Grocery Stores Specialty & Gourmet Stores Online/E-commerce Foodservice Distributors & B2B Channels |

| By Price Range | Economy Mid-range Premium & Gourmet Private Label/Store Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Spice Sales | 120 | Retail Managers, Category Buyers |

| Food Service Industry | 90 | Restaurant Owners, Executive Chefs |

| Online Spice Retailers | 60 | E-commerce Managers, Digital Marketing Specialists |

| Export Market Insights | 50 | Export Managers, Trade Analysts |

| Consumer Preferences | 100 | Home Cooks, Culinary Enthusiasts |

The Global Seasonings Spices Market is valued at approximately USD 22 billion, reflecting a significant growth trend driven by consumer preferences for diverse and flavorful cuisines, as well as the rising popularity of home cooking and gourmet food preparation.