Region:Global

Author(s):Shubham

Product Code:KRAA3197

Pages:99

Published On:August 2025

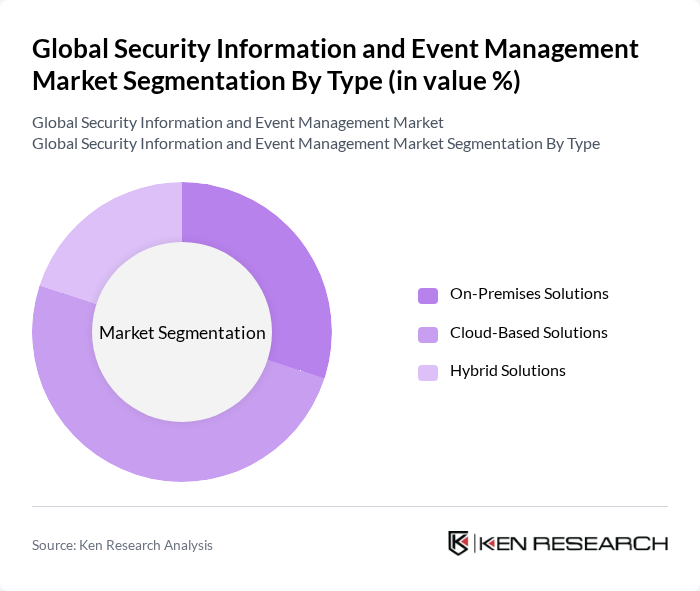

By Type:The market is segmented into On-Premises Solutions, Cloud-Based Solutions, and Hybrid Solutions. Cloud-Based Solutions are gaining traction due to their scalability, cost-effectiveness, and ease of deployment. Organizations are increasingly adopting cloud solutions to enhance their security posture, facilitate remote monitoring, and reduce the need for extensive on-premises infrastructure. The rise of hybrid IT environments and remote workforces has further accelerated demand for flexible, cloud-native SIEM platforms.

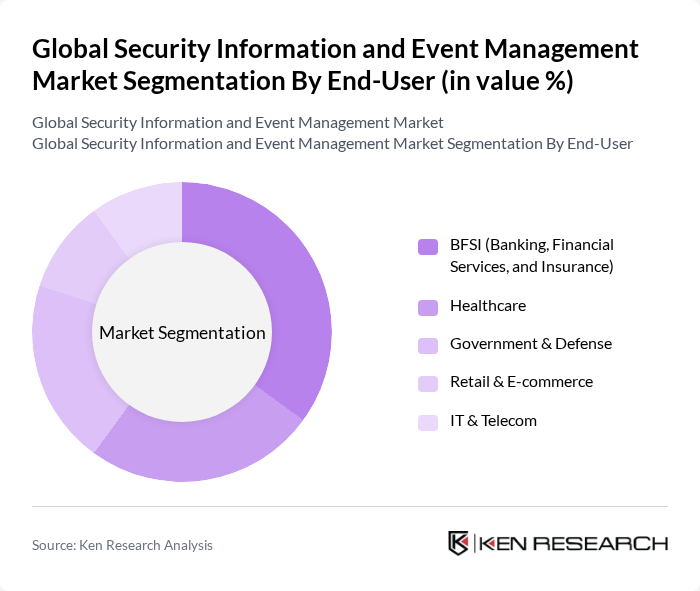

By End-User:The end-user segmentation includes BFSI (Banking, Financial Services, and Insurance), Healthcare, Government & Defense, Retail & E-commerce, and IT & Telecom. The BFSI sector leads the market due to the high volume of sensitive data, stringent regulatory requirements, and the need for robust security measures to counter increasingly sophisticated cyber threats. Healthcare and Government & Defense are also major adopters, driven by compliance mandates such as HIPAA and PCI-DSS, and the imperative to protect critical infrastructure and personal data.

The Global Security Information and Event Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Splunk Inc., Trellix (formerly McAfee Enterprise & FireEye), LogRhythm Inc., Sumo Logic Inc., RSA Security LLC, SolarWinds Corporation, Fortinet Inc., Rapid7 Inc., AT&T Cybersecurity, Check Point Software Technologies Ltd., Palo Alto Networks Inc., Micro Focus International plc, Trend Micro Incorporated, Exabeam Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SIEM market is poised for significant transformation, driven by advancements in artificial intelligence and machine learning technologies. As organizations increasingly adopt cloud-based solutions, the demand for scalable and flexible SIEM systems will rise. Furthermore, the growing emphasis on incident response capabilities will lead to enhanced automation and improved threat detection. These trends indicate a shift towards more proactive security measures, enabling organizations to better manage and mitigate cybersecurity risks in an evolving threat landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premises Solutions Cloud-Based Solutions Hybrid Solutions |

| By End-User | BFSI (Banking, Financial Services, and Insurance) Healthcare Government & Defense Retail & E-commerce IT & Telecom |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Component | Software Services (Professional & Managed) |

| By Sales Channel | Direct Sales Channel Partners/Distributors |

| By Industry Vertical | Telecommunications Energy and Utilities Manufacturing Education Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services SIEM Implementation | 100 | IT Security Managers, Risk Compliance Officers |

| Healthcare Sector Cybersecurity Strategies | 80 | Chief Information Security Officers, IT Directors |

| Retail Industry Security Solutions | 60 | IT Security Analysts, Operations Managers |

| Government Agency Cyber Defense | 50 | Cybersecurity Policy Makers, IT Managers |

| Manufacturing Sector Risk Management | 70 | IT Infrastructure Managers, Supply Chain Security Officers |

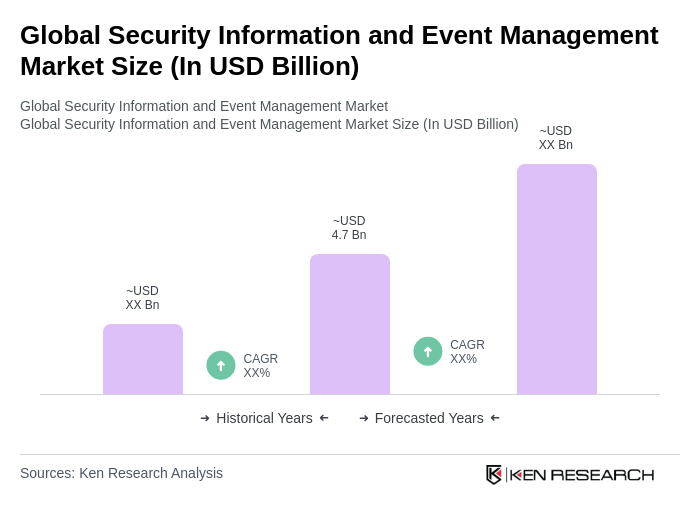

The Global Security Information and Event Management Market is valued at approximately USD 4.7 billion, driven by the increasing frequency of cyber threats, regulatory compliance mandates, and the need for real-time threat detection and analytics.