Region:Global

Author(s):Rebecca

Product Code:KRAA2462

Pages:97

Published On:August 2025

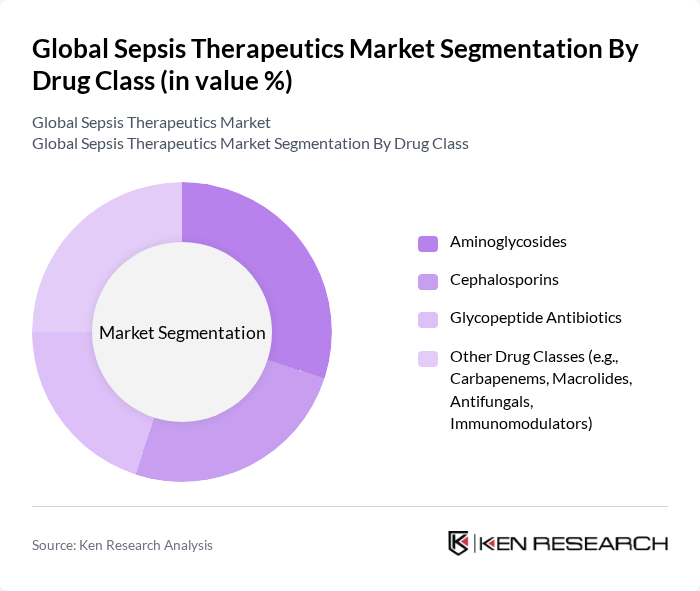

By Drug Class:The market is segmented into various drug classes, including Aminoglycosides, Cephalosporins, Glycopeptide Antibiotics, and Other Drug Classes such as Carbapenems, Macrolides, Antifungals, and Immunomodulators. Among these, Aminoglycosides and Cephalosporins are leading due to their broad-spectrum efficacy against a variety of pathogens. The increasing resistance to antibiotics is driving the demand for newer classes of drugs, particularly in the "Other Drug Classes" category. The market is also witnessing a surge in research on immunomodulators and adjunctive therapies to address multidrug-resistant infections and improve survival rates .

By Route of Administration:The market is categorized into Intravenous and Oral routes of administration. The Intravenous route is dominating the market due to its rapid onset of action, which is critical in sepsis management. The preference for intravenous administration in hospital settings is driven by the need for immediate therapeutic effects, especially in severe cases of sepsis. Oral therapies are mainly reserved for step-down treatment or less severe cases .

The Global Sepsis Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, GSK plc, Amgen Inc., Novartis AG, Roche Holding AG, Sanofi S.A., AbbVie Inc., Astellas Pharma Inc., Baxter International Inc., Eli Lilly and Company, Biotest AG, Shionogi & Co., Ltd., CSL Behring contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sepsis therapeutics market in the None region appears promising, driven by ongoing advancements in technology and increased government support. As diagnostic tools become more sophisticated, early detection will improve, leading to better patient outcomes. Additionally, the focus on personalized medicine and tailored treatment plans is expected to gain traction, enhancing the efficacy of therapies. Collaborative efforts among stakeholders will further accelerate innovation and research, ultimately transforming the sepsis management landscape.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Aminoglycosides Cephalosporins Glycopeptide Antibiotics Other Drug Classes (e.g., Carbapenems, Macrolides, Antifungals, Immunomodulators) |

| By Route of Administration | Intravenous Oral |

| By End-User | Hospitals Clinics Home Healthcare Long-term Care Facilities |

| By Patient Type | Adult Patients Pediatric Patients |

| By Severity of Sepsis | Severe Sepsis Septic Shock |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Sepsis Management | 100 | Intensivists, Emergency Medicine Physicians |

| Pharmaceutical Procurement | 60 | Pharmacy Directors, Procurement Managers |

| Clinical Research on Sepsis | 50 | Clinical Researchers, Clinical Trial Coordinators |

| Infectious Disease Specialists | 70 | Infectious Disease Physicians, KOLs |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

The Global Sepsis Therapeutics Market is valued at approximately USD 3.9 billion, driven by the increasing incidence of sepsis, advancements in diagnostic technologies, and heightened awareness of sepsis management protocols among healthcare professionals.