Region:Global

Author(s):Geetanshi

Product Code:KRAA1299

Pages:84

Published On:August 2025

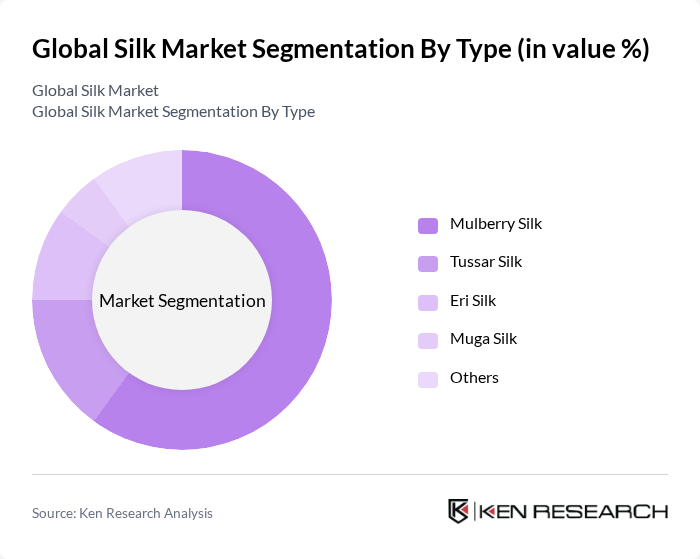

By Type:The silk market can be segmented into various types, including Mulberry Silk, Tussar Silk, Eri Silk, Muga Silk, and Others. Among these, Mulberry Silk is the most dominant due to its widespread cultivation and high demand in the textile industry. Tussar and Eri silks are gaining traction due to their unique texture, natural color, and eco-friendly appeal, while Muga Silk remains a niche product with cultural and regional significance, especially in Northeast India .

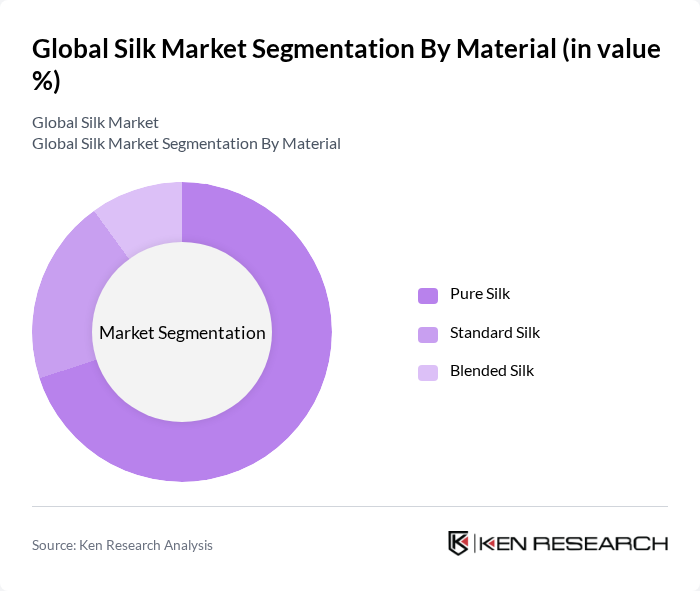

By Material:The silk market is also categorized by material types, including Pure Silk, Standard Silk, and Blended Silk. Pure Silk is the most sought-after material due to its luxurious feel, strength, and hypoallergenic properties, making it a favorite among consumers for premium apparel and home textiles. Standard Silk is popular for its affordability and accessibility, while Blended Silk is gaining popularity for its versatility, cost-effectiveness, and suitability for a wider range of applications, including upholstery and technical textiles .

The Global Silk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jiangsu Sutong Cocoon & Silk Co., Ltd., Zhejiang Cathaya International Co., Ltd., Wensli Group Co., Ltd., Anhui Silk Co., Ltd., Shengkun Silk Manufacturing Co., Ltd., Sichuan Nanchong Liuhe (Group) Co., Ltd., Thai Silk Co., Ltd., Bombyx Holdings International, Kanchipuram Silk Sarees Pvt. Ltd., Griva Silk Industries, Silktex Ltd., Atlas Silk Mill, Xinhe Silk Group Co., Ltd., Surya Silk Mills, Manipur Sericulture Development Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the silk market in None appears promising, driven by increasing consumer interest in luxury and sustainable textiles. As the fashion industry continues to embrace eco-friendly practices, silk's natural properties will likely position it favorably. Additionally, technological advancements in production methods are expected to enhance efficiency and reduce costs, making silk more accessible. The integration of digital platforms for marketing and sales will further expand silk's reach, catering to a broader audience seeking quality and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Mulberry Silk Tussar Silk Eri Silk Muga Silk Others |

| By Material | Pure Silk Standard Silk Blended Silk |

| By Production Process | Cocoon Production Reeling Throwing Weaving Dyeing Others |

| By End-User | Textile Cosmetics Medical Others |

| By Application | Apparel Upholstery Bedding Industrial Uses |

| By Region | Asia-Pacific North America Europe Latin America |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Premium Mid-Range Budget |

| By Policy Support | Subsidies for Silk Farmers Tax Incentives for Silk Exporters Research Grants for Silk Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Silk Producers | 100 | Farmers, Cooperative Leaders |

| Textile Manufacturers | 70 | Production Managers, Sourcing Directors |

| Fashion Designers | 50 | Creative Directors, Product Developers |

| Retail Buyers | 60 | Merchandise Managers, Category Buyers |

| Industry Experts | 40 | Market Analysts, Trade Association Representatives |

The Global Silk Market is valued at approximately USD 16 billion, driven by increasing demand for luxury textiles and sustainable fashion. This market has shown significant growth due to rising consumer interest in high-quality, eco-friendly silk products.