Region:Global

Author(s):Geetanshi

Product Code:KRAC3705

Pages:89

Published On:October 2025

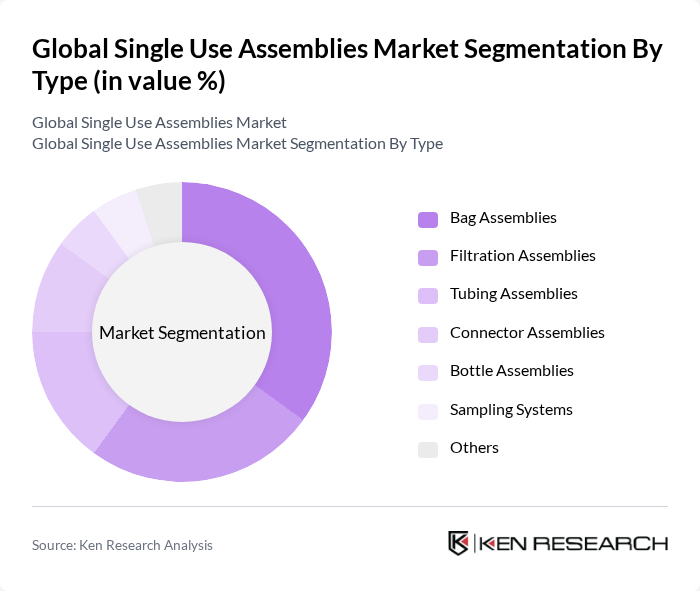

By Type:The market is segmented into various types, including Bag Assemblies, Filtration Assemblies, Tubing Assemblies, Connector Assemblies, Bottle Assemblies, Sampling Systems, and Others. Among these, Filtration Assemblies are currently dominating the market due to their critical role in bioprocessing applications, particularly in downstream purification and sterile filtration processes. The increasing adoption of single-use technologies in the pharmaceutical industry has led to a surge in demand for these assemblies, as they offer significant advantages in terms of flexibility, reduced risk of contamination, and lower operational costs. Cell Culture and Mixing applications are emerging as the fastest-growing segment, driven by the expansion of bioreactor capacities and the rising production of monoclonal antibodies and cell therapies.

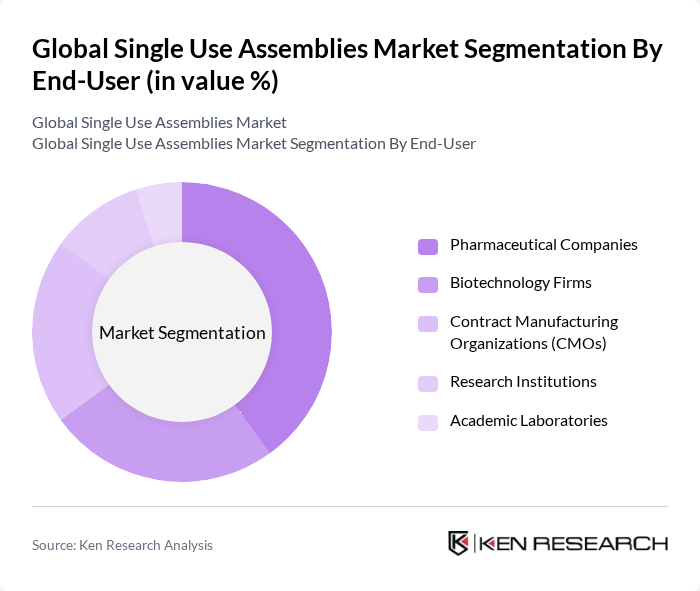

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Contract Manufacturing Organizations (CMOs), Research Institutions, and Academic Laboratories. Pharmaceutical Companies are the leading end-users in the market, driven by the increasing demand for biopharmaceuticals and the need for efficient production processes. The trend towards outsourcing manufacturing to CMOs is also contributing to the growth of this segment, as these organizations seek to leverage single-use technologies for enhanced productivity and reduced costs. The expansion of contract manufacturing organizations has been particularly significant, as they require flexible, scalable systems that can accommodate multiple client projects with rapid changeover capabilities, making single-use assemblies an essential component of their operational infrastructure.

The Global Single Use Assemblies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Danaher Corporation, Avantor, Inc., Saint-Gobain Life Sciences, Pall Corporation, Corning Incorporated, Eppendorf AG, Lonza Group AG, Entegris, Inc., 3M Company, Bio-Rad Laboratories, Inc., West Pharmaceutical Services, Inc., Kuhner AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the single-use assemblies market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt digital technologies, such as IoT and AI, operational efficiencies are expected to improve significantly. Furthermore, the shift towards personalized medicine will likely create new opportunities for single-use systems, enabling tailored production processes that meet specific patient needs while maintaining high safety standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Bag Assemblies Filtration Assemblies Tubing Assemblies Connector Assemblies Bottle Assemblies Sampling Systems Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Contract Manufacturing Organizations (CMOs) Research Institutions Academic Laboratories |

| By Application | Upstream Processing Downstream Processing Drug Development Vaccine Production Cell Culture & Mixing Fill-Finish Applications Storage & Sampling Others |

| By Component | Single Use Bioreactors Single Use Mixing Systems Single Use Filtration Systems Single Use Connectors & Tubing Single Use Sensors Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Diagnostic Equipment Supply Chain | 80 | Supply Chain Managers, Procurement Officers |

| Medical Device Development | 70 | R&D Managers, Regulatory Affairs Specialists |

| Pharmaceutical Packaging Solutions | 90 | Packaging Engineers, Product Development Managers |

| Healthcare Facility Operations | 40 | Facility Managers, Infection Control Officers |

The Global Single Use Assemblies Market is valued at approximately USD 13.5 billion. This growth is driven by the increasing demand for biopharmaceuticals, advancements in single-use technologies, and the need for cost-effective manufacturing solutions.