Region:Global

Author(s):Rebecca

Product Code:KRAA2904

Pages:86

Published On:August 2025

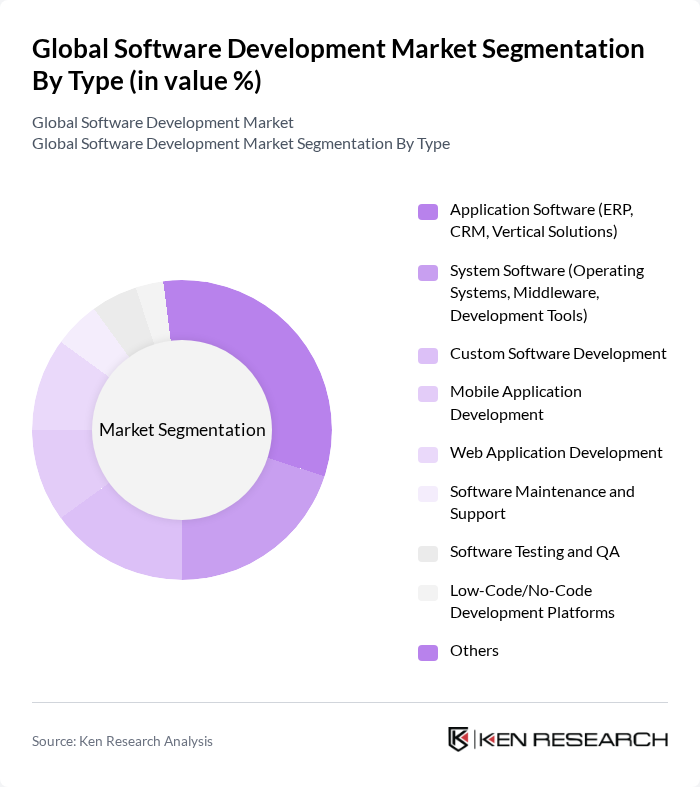

By Type:The software development market is segmented into various types, including Application Software, System Software, Custom Software Development, Mobile Application Development, Web Application Development, Software Maintenance and Support, Software Testing and QA, Low-Code/No-Code Development Platforms, and Others. Among these, Application Software is currently the leading segment, driven by the increasing demand for enterprise resource planning (ERP), customer relationship management (CRM), and vertical-specific solutions. Businesses are increasingly adopting these applications to streamline operations, improve customer engagement, and support digital transformation initiatives. The adoption of AI-driven applications and automation tools is also accelerating growth in this segment .

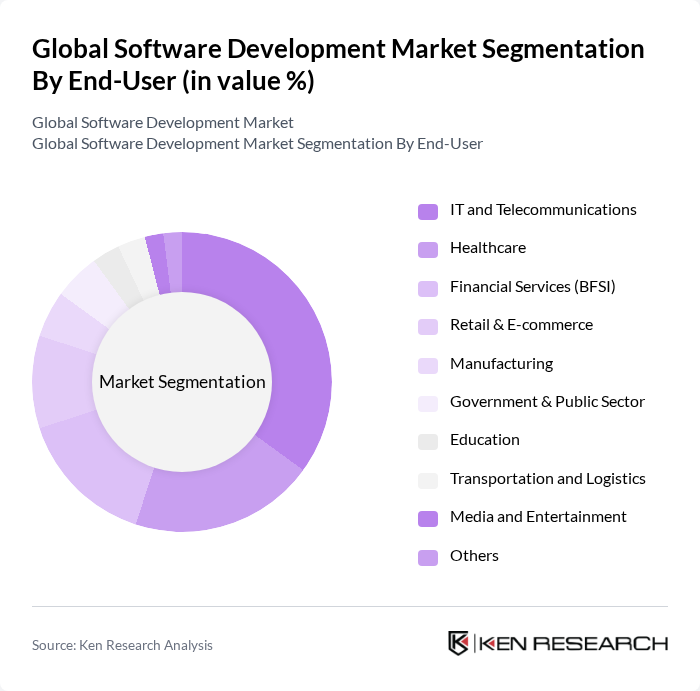

By End-User:The end-user segmentation includes IT and Telecommunications, Healthcare, Financial Services (BFSI), Retail & E-commerce, Manufacturing, Government & Public Sector, Education, Transportation and Logistics, Media and Entertainment, and Others. The IT and Telecommunications sector is the dominant end-user, as it requires continuous software development to support infrastructure, enhance communication services, and innovate new technologies. The rapid evolution of digital services, increased adoption of cloud-based platforms, and the integration of AI and automation drive significant investments in software solutions for this sector. Healthcare and BFSI are also experiencing robust growth due to digital health initiatives and the need for secure, compliant financial platforms .

The Global Software Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Oracle Corporation, IBM Corporation, SAP SE, Salesforce, Inc., Alphabet Inc. (Google), Adobe Inc., Infosys Limited, Accenture Plc, Tata Consultancy Services Limited, Capgemini SE, Wipro Limited, Cognizant Technology Solutions Corporation, HCL Technologies Limited, DXC Technology Company, EPAM Systems, Inc., ServiceNow, Inc., OpenAI, L.P., ThoughtWorks Holding, Inc., Globant S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the software development market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt low-code/no-code platforms, development cycles will accelerate, enabling rapid deployment of applications. Additionally, the integration of artificial intelligence and machine learning will enhance software capabilities, providing personalized user experiences. Companies that embrace these trends will likely gain a competitive edge, positioning themselves for success in an ever-evolving digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Software (ERP, CRM, Vertical Solutions) System Software (Operating Systems, Middleware, Development Tools) Custom Software Development Mobile Application Development Web Application Development Software Maintenance and Support Software Testing and QA Low-Code/No-Code Development Platforms Others |

| By End-User | IT and Telecommunications Healthcare Financial Services (BFSI) Retail & E-commerce Manufacturing Government & Public Sector Education Transportation and Logistics Media and Entertainment Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Service Model | Managed Services Professional Services Consulting Services |

| By Pricing Model | Fixed Price Time and Material Subscription-Based |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Software Development | 100 | CTOs, Software Architects |

| Mobile Application Development | 80 | Product Managers, Mobile Developers |

| Cloud-Based Solutions | 60 | Cloud Engineers, IT Managers |

| Agile Development Practices | 50 | Scrum Masters, Project Managers |

| Software Quality Assurance | 40 | QA Engineers, Test Managers |

The Global Software Development Market is valued at approximately USD 730 billion, driven by the increasing demand for digital transformation, advancements in cloud computing, and the need for customized software solutions across various industries.