Region:Global

Author(s):Dev

Product Code:KRAD3241

Pages:94

Published On:November 2025

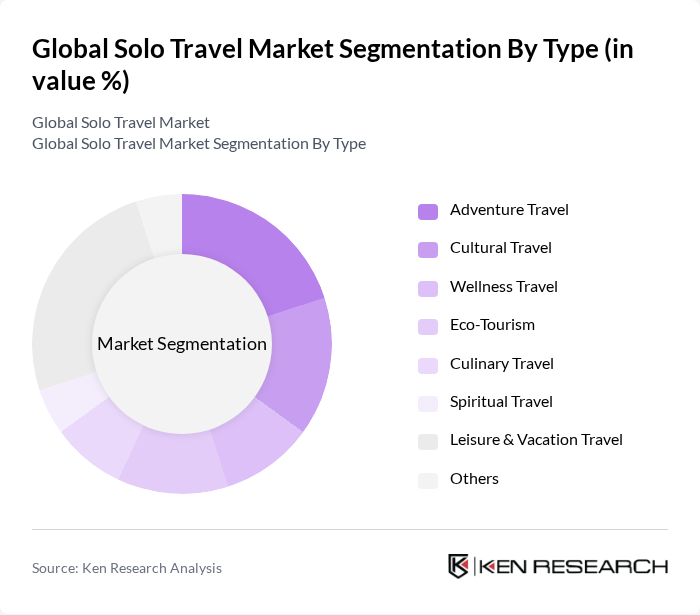

By Type:The market is segmented into various types of travel experiences that cater to solo travelers. The primary subsegments include Adventure Travel, Cultural Travel, Wellness Travel, Eco-Tourism, Culinary Travel, Spiritual Travel, Leisure & Vacation Travel, and Others. Each of these subsegments appeals to different interests and preferences among solo travelers, contributing to the overall growth of the market. Adventure and leisure travel remain the most popular, with strong growth in wellness and eco-tourism driven by rising health consciousness and sustainability trends.

TheLeisure & Vacation Travelsubsegment is currently dominating the market, driven by the increasing number of individuals seeking relaxation and personal time away from their daily routines. This trend is particularly prevalent among millennials and Gen Z travelers, who prioritize experiences that allow them to unwind and explore new destinations at their own pace. The rise of social media has also played a significant role in promoting leisure travel, as individuals share their experiences and inspire others to embark on similar journeys.

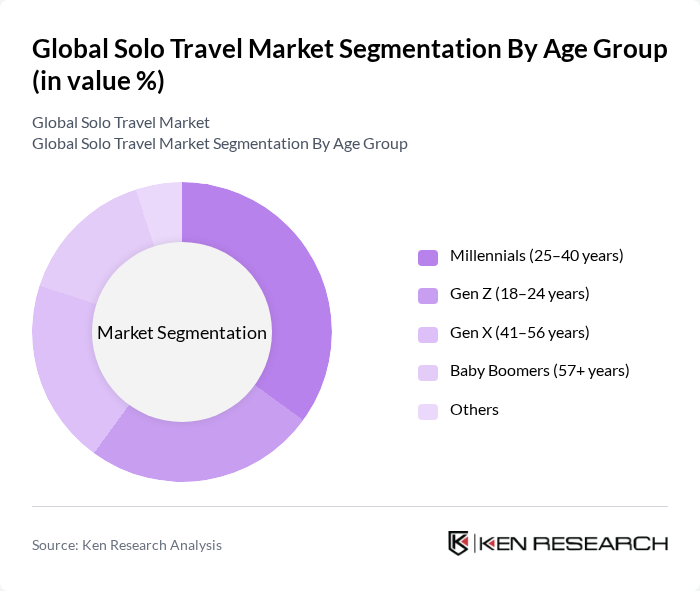

By Age Group:The market is segmented by age groups, including Millennials (25–40 years), Gen Z (18–24 years), Gen X (41–56 years), Baby Boomers (57+ years), and Others. Each age group exhibits distinct travel preferences and behaviors, influencing the types of travel experiences they seek. Millennials and Gen Z are the most active segments, driven by a desire for self-discovery, adventure, and digital connectivity.

Millennialsare the leading age group in the solo travel market, driven by their desire for unique experiences and personal growth. This demographic is more inclined to travel solo as they seek to explore new cultures, engage in adventure activities, and connect with like-minded individuals. The influence of social media and travel blogs has further encouraged this trend, as millennials often share their travel stories and seek inspiration from others, making them a significant force in shaping the market.

The Global Solo Travel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intrepid Travel, G Adventures, Solo Traveler World, Contiki, Hostelworld Group, Airbnb, Inc., Expedia Group, Booking Holdings Inc. (Booking.com, Kayak, Agoda), Trip.com Group, Viator (a Tripadvisor company), Lonely Planet, Skyscanner Ltd., Tripadvisor, Inc., Trafalgar, Travel Leaders Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solo travel market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly prioritize unique experiences, the demand for personalized itineraries and sustainable travel options is expected to rise. Additionally, the integration of technology, such as mobile apps and virtual reality, will enhance travel planning and experiences. This dynamic landscape presents opportunities for travel companies to innovate and cater to the growing segment of solo travelers seeking adventure and self-discovery.

| Segment | Sub-Segments |

|---|---|

| By Type | Adventure Travel Cultural Travel Wellness Travel Eco-Tourism Culinary Travel Spiritual Travel Leisure & Vacation Travel Others |

| By Age Group | Millennials (25–40 years) Gen Z (18–24 years) Gen X (41–56 years) Baby Boomers (57+ years) Others |

| By Gender | Female Male Non-binary Others |

| By Travel Duration | Short-term (1–3 days) Medium-term (4–7 days) Long-term (8+ days) Others |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Booking (Brand Websites/Apps) Travel Agents (Offline/Concierge) Social Media Platforms Others |

| By Accommodation Type | Hostels Hotels Vacation Rentals (e.g., Airbnb, Vrbo) Boutique Guesthouses Others |

| By Activity Type | Sightseeing & City Tours Adventure Sports & Outdoor Activities Cultural Experiences & Workshops Wellness & Retreats Food & Culinary Experiences Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solo Travel Enthusiasts | 120 | Frequent Solo Travelers, Travel Bloggers |

| Travel Agency Clients | 85 | Solo Travel Package Customers, Travel Advisors |

| Adventure Travel Participants | 75 | Outdoor Enthusiasts, Adventure Tour Operators |

| Cultural Experience Seekers | 65 | Solo Travelers Interested in Cultural Tours, Tour Guides |

| Digital Nomads | 75 | Remote Workers, Co-working Space Users |

The Global Solo Travel Market is valued at approximately USD 480 billion, reflecting a significant growth trend driven by personalized travel experiences, digital platforms, and the increasing acceptance of solo travel as a leisure option.