Region:Global

Author(s):Shubham

Product Code:KRAD5427

Pages:92

Published On:December 2025

By Function:The market is segmented by function into various categories, including fillers & diluents, binders, disintegrants, coating agents, lubricants & glidants, flavoring & sweetening agents, preservatives & antioxidants, and others. Among these, fillers & diluents are the most widely used due to their essential role in enhancing the volume, flow properties, and stability of nutraceutical formulations, and global functional analyses consistently show fillers and diluents holding the largest share among excipient functionalities. The increasing demand for dietary supplements and functional foods, particularly in convenient formats such as tablets, capsules, gummies, and powders, drives the need for effective fillers that support dose uniformity, compressibility, and overall product integrity and consumer satisfaction.

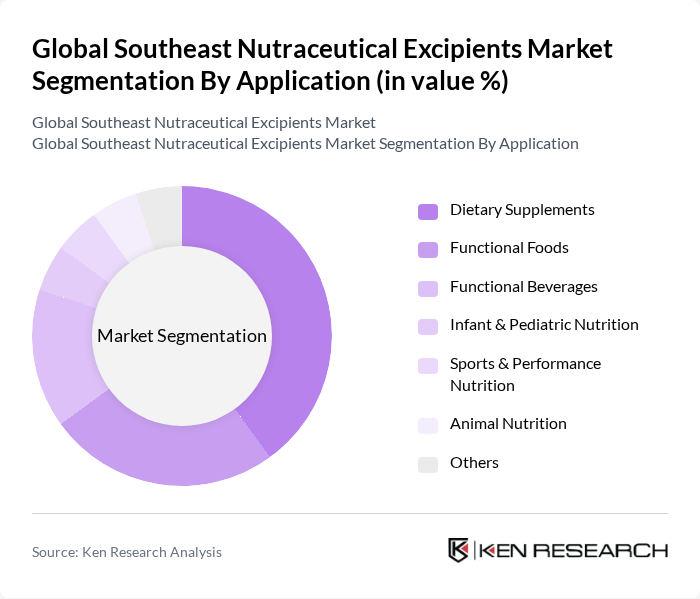

By Application:The market is also segmented by application, which includes dietary supplements, functional foods, functional beverages, infant & pediatric nutrition, sports & performance nutrition, animal nutrition, and others. The dietary supplements segment leads the market, driven by a growing consumer preference for health-enhancing products such as vitamins, minerals, probiotics, and botanical supplements, with preventive healthcare and self-directed wellness playing central roles in purchasing decisions. This trend is supported by increasing awareness of immune support, healthy aging, digestive health, and mental well-being, as well as the rapid uptake of dosage forms like gummies, chewables, and ready-to-mix powders that rely heavily on specialized excipients for palatability, stability, and controlled or modified release.

The Global Southeast Nutraceutical Excipients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Evonik Industries AG, Ingredion Incorporated, Kerry Group plc, Roquette Frères, Ashland Inc., Dow Chemical Company, Colorcon, Inc., JRS PHARMA GmbH & Co. KG, Cargill, Incorporated, Sensient Technologies Corporation, SPI Pharma, Inc., Barentz International B.V., Behn Meyer Group contribute to innovation, geographic expansion, and service delivery in this space, offering a broad range of excipients for tablets, capsules, powders, gummies, and functional food and beverage applications.

The future of the nutraceutical excipients market appears promising, driven by technological advancements and evolving consumer preferences. As personalization in product offerings becomes more prevalent, companies are expected to invest heavily in R&D, with global spending projected to reach $220 billion. Additionally, the integration of digital platforms for e-commerce is anticipated to enhance market accessibility, particularly in emerging markets, fostering growth and innovation in product development.

| Segment | Sub-Segments |

|---|---|

| By Function | Fillers & Diluents Binders Disintegrants Coating Agents (Film & Functional Coatings) Lubricants & Glidants Flavoring & Sweetening Agents Preservatives & Antioxidants Others (Colorants, Emulsifiers, Stabilizers) |

| By Application | Dietary Supplements Functional Foods Functional Beverages Infant & Pediatric Nutrition Sports & Performance Nutrition Animal Nutrition Others |

| By Dosage Form | Tablets Capsules & Softgels Powders & Granules Gummies & Chewables Liquids & Suspensions Others |

| By Distribution Channel | Business-to-Business (B2B) Direct Sales to Manufacturers Distributors & Traders Online Ingredient Marketplaces Others |

| By Country (Southeast Asia) | Singapore Malaysia Thailand Indonesia Vietnam Philippines Cambodia Myanmar Laos Brunei |

| By Source | Synthetic Plant-Based Animal-Based Mineral Others |

| By Functionality / Product Claims | Clean-Label & Organic Allergen-Free & Gluten-Free Modified-Release & Targeted Delivery Enhanced Bioavailability Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Product Development | 60 | Formulators, R&D Managers |

| Quality Assurance in Manufacturing | 50 | Quality Control Managers, Compliance Officers |

| Supply Chain Management for Excipients | 40 | Supply Chain Directors, Procurement Managers |

| Market Trends in Nutraceuticals | 50 | Market Analysts, Business Development Managers |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Specialists, Legal Advisors |

The Global Southeast Nutraceutical Excipients Market is valued at approximately USD 970 million, reflecting a significant growth driven by increasing consumer demand for dietary supplements and functional foods in the region.