Region:Global

Author(s):Shubham

Product Code:KRAA3123

Pages:94

Published On:August 2025

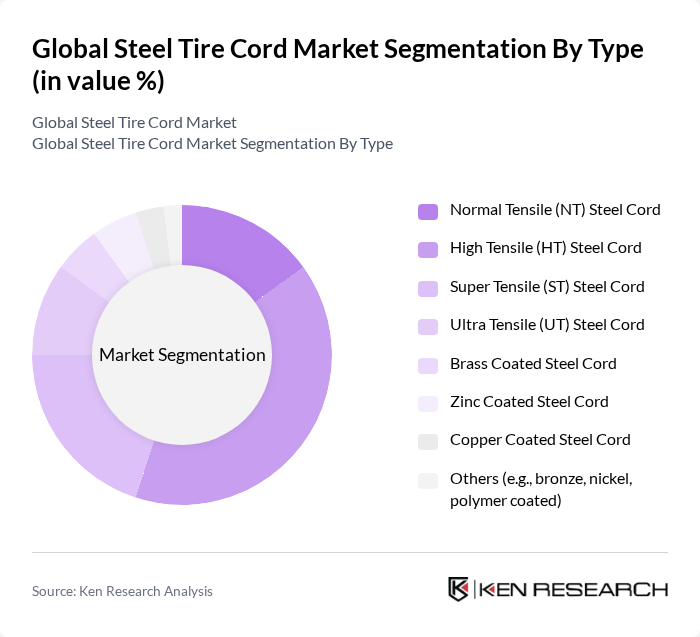

By Type:The market is segmented into various types of steel tire cords, including Normal Tensile (NT), High Tensile (HT), Super Tensile (ST), Ultra Tensile (UT), Brass Coated, Zinc Coated, Copper Coated, and Others. Among these,High Tensile (HT)steel cords dominate the market due to their superior strength, durability, and ability to meet stringent safety and performance standards required for modern tires. The growing demand for fuel-efficient, long-lasting tires in both passenger and commercial vehicles is driving the preference for HT steel cords, especially as electric vehicles and high-performance vehicles become more prevalent.

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Aircraft, Industrial Vehicles, and Others. ThePassenger Vehiclessegment leads the market, driven by increasing global car production, rising consumer preference for high-performance and fuel-efficient tires, and urbanization trends that boost vehicle ownership. Commercial vehicles also represent a significant share due to the need for durable tires in logistics and heavy-duty applications. The demand for steel tire cords in electric vehicles and premium segments is rising, reflecting broader shifts in mobility and sustainability.

The Global Steel Tire Cord Market is characterized by a dynamic mix of regional and international players. Leading participants such as NV Bekaert SA, ArcelorMittal S.A., Hyosung Advanced Materials Corporation, Kiswire Ltd., Shandong Xingda Steel Cord Co., Ltd., Jiangsu Hongji Wire & Cable Co., Ltd., Bridgestone Corporation, Michelin, Sumitomo Electric Industries, Ltd., Tokusen Kogyo Co., Ltd., Henan Hengxing Science & Technology Co., Ltd., Zhejiang Tianli Steel Cord Co., Ltd., Pirelli & C. S.p.A., Snton Steel Cord Group Co., Ltd., Shandong Daye Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the steel tire cord market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers adopt innovative production techniques, the efficiency and performance of tire cords are expected to improve significantly. Additionally, the increasing integration of smart technologies in vehicles will likely create new demand for specialized tire products, further enhancing market dynamics. The focus on eco-friendly materials will also shape product development, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Normal Tensile (NT) Steel Cord High Tensile (HT) Steel Cord Super Tensile (ST) Steel Cord Ultra Tensile (UT) Steel Cord Brass Coated Steel Cord Zinc Coated Steel Cord Copper Coated Steel Cord Others (e.g., bronze, nickel, polymer coated) |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Aircraft Industrial Vehicles Others |

| By Application | Passenger Car Tires Truck Tires Bus Tires Aircraft Tires Industrial Tires Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, Italy, France, Rest of Europe) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Price Range | Economy Mid-Range Premium |

| By Material Source | Domestic Sourcing Imported Materials Recycled Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Tire Manufacturers | 100 | Production Managers, Quality Assurance Heads |

| Commercial Vehicle Tire Producers | 80 | Supply Chain Managers, Product Development Engineers |

| Raw Material Suppliers for Tire Cord | 60 | Procurement Directors, Sales Managers |

| Automotive Industry Analysts | 50 | Market Analysts, Research Directors |

| Regulatory Bodies and Standards Organizations | 40 | Policy Makers, Compliance Officers |

The Global Steel Tire Cord Market is valued at approximately USD 7.6 billion, driven by increasing demand for high-performance tires, rising vehicle production, and the expansion of construction and logistics industries.