Global Styrene Ethylene Butylene Styrene (SEBS) Market Overview

- The Global Styrene Ethylene Butylene Styrene (SEBS) Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the rising demand for high-performance thermoplastic elastomers in automotive, healthcare, and consumer goods applications. SEBS offers excellent elasticity, durability, and processability, making it a preferred material for manufacturers seeking alternatives to traditional rubbers and PVC. The market’s expansion is further supported by innovations in processing technologies and the increasing use of SEBS in sustainable product formulations .

- Key players in this market are predominantly located in North America, Europe, and Asia-Pacific. The United States, Germany, and China lead the market, supported by advanced manufacturing capabilities, robust automotive and healthcare sectors, and significant investments in research and development. These regions benefit from strong supply chains and a growing demand for innovative, sustainable materials .

- The European Union’s Directive (EU) 2019/904, issued by the European Parliament and Council, sets binding requirements for reducing the impact of certain plastic products on the environment. This directive includes operational guidelines for the use of thermoplastic elastomers like SEBS, encouraging the development of sustainable materials, promoting recycling initiatives, and requiring manufacturers to adapt production processes to meet environmental compliance thresholds .

Market.png)

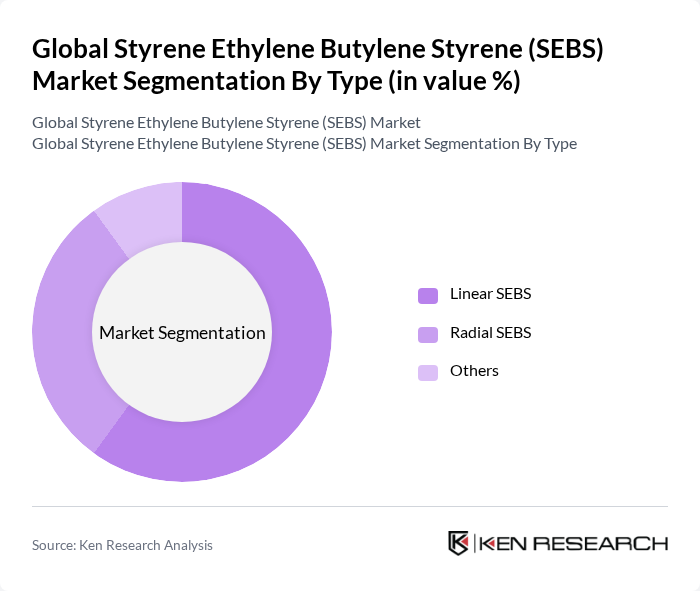

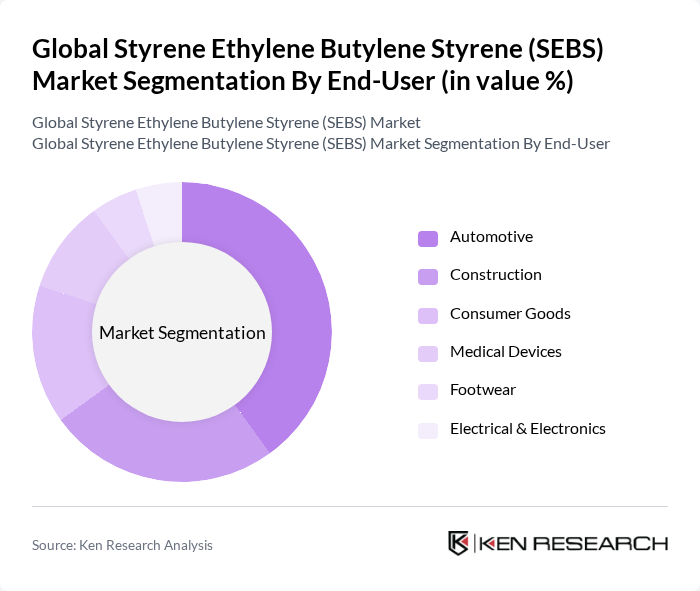

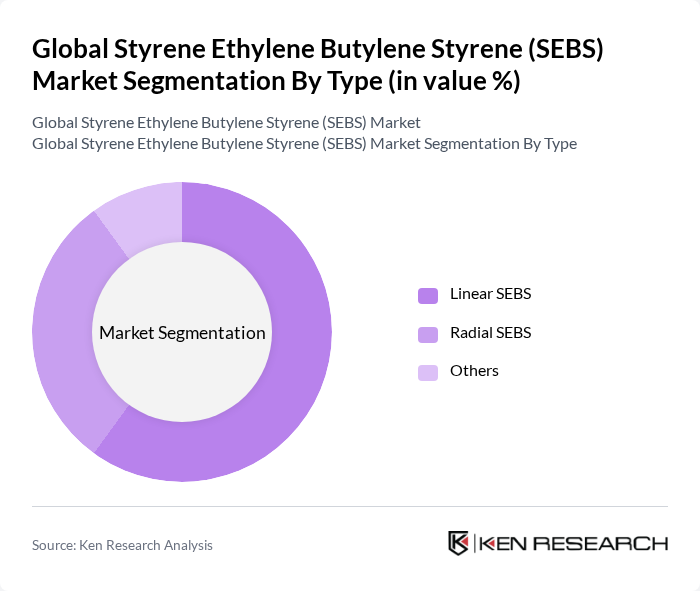

Global Styrene Ethylene Butylene Styrene (SEBS) Market Segmentation

By Type:The market is segmented into Linear SEBS, Radial SEBS, and Others. Linear SEBS is gaining traction due to its superior mechanical properties, ease of processing, and suitability for a wide range of applications, including automotive and medical devices. Radial SEBS is primarily used in specialized applications requiring enhanced resilience and performance. The "Others" category encompasses niche SEBS grades tailored for specific industrial requirements, such as adhesives and specialty coatings .

By End-User:The end-user segmentation includes Automotive, Construction, Consumer Goods, Medical Devices, Footwear, and Electrical & Electronics. The automotive sector is the largest consumer of SEBS, driven by the need for lightweight, flexible, and durable materials in vehicle components such as weather seals, gaskets, and interior trims. The construction industry is a significant contributor, utilizing SEBS for electrical components, sealants, and waterproofing membranes. Consumer goods and medical devices also represent important segments, with SEBS used in flexible tubing, personal care products, and packaging due to its biocompatibility and safety profile .

Global Styrene Ethylene Butylene Styrene (SEBS) Market Competitive Landscape

The Global Styrene Ethylene Butylene Styrene (SEBS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kraton Corporation, LCY Chemical Corp., Asahi Kasei Corporation, Kuraray Co., Ltd., Chevron Phillips Chemical Company LLC, LG Chem Ltd., TotalEnergies SE, China Petroleum & Chemical Corporation (Sinopec), TSRC Corporation, Eni S.p.A., Versalis S.p.A., Repsol S.A., INEOS Styrolution Group GmbH, Dynasol Elastomers S.A., Wanhua Chemical Group Co., Ltd., Ningbo Changhong Polymer Scientific & Technical Co., Ltd., Zhejiang Zhongli Synthetic Materials Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Styrene Ethylene Butylene Styrene (SEBS) Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry:The automotive sector is projected to consume approximately 1.6 million tons of SEBS in future, driven by the need for lightweight materials that enhance fuel efficiency. With global vehicle production expected to reach 92 million units, the demand for SEBS in applications such as bumpers and interior components is surging. This trend is supported by the automotive industry's shift towards more sustainable materials, aligning with consumer preferences for eco-friendly vehicles.

- Growth in Construction Sector:The construction industry is anticipated to utilize around 1.3 million tons of SEBS in future, fueled by rising infrastructure investments. Governments worldwide are expected to allocate over $11 trillion towards infrastructure projects, particularly in emerging markets. SEBS's properties, such as flexibility and durability, make it ideal for applications in roofing, flooring, and sealants, thus driving its demand in this sector significantly.

- Rising Adoption in Consumer Goods:The consumer goods sector is projected to account for approximately 850,000 tons of SEBS usage in future, as manufacturers increasingly incorporate it into products like adhesives, sealants, and packaging. The global consumer goods market is expected to reach $16 trillion, with a growing emphasis on high-performance materials that offer enhanced functionality. This trend is further supported by consumer preferences for durable and sustainable products, driving SEBS adoption.

Market Challenges

- Volatility in Raw Material Prices:The SEBS market faces significant challenges due to fluctuating raw material prices, particularly styrene and butadiene. In future, styrene prices surged by 32% due to supply chain disruptions and increased demand from Asia. This volatility can lead to unpredictable production costs, impacting profit margins for manufacturers and potentially leading to higher prices for end consumers, which may hinder market growth.

- Environmental Regulations:Stricter environmental regulations are posing challenges for SEBS manufacturers. In future, the European Union is expected to implement new regulations that limit the use of certain chemicals in production processes. Compliance with these regulations may require significant investment in cleaner technologies, which could increase operational costs and affect the competitive landscape, particularly for smaller manufacturers struggling to adapt.

Global Styrene Ethylene Butylene Styrene (SEBS) Market Future Outlook

The future of the SEBS market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in bio-based SEBS production are expected to gain traction, aligning with global sustainability goals. Additionally, the expansion of e-commerce platforms is likely to enhance product accessibility, facilitating market growth. As industries increasingly prioritize eco-friendly materials, SEBS is well-positioned to meet the evolving demands of various sectors, including automotive and construction.

Market Opportunities

- Innovations in Product Development:The SEBS market presents opportunities for innovation, particularly in developing high-performance, bio-based alternatives. Companies investing in R&D can create products that meet stringent environmental standards, appealing to eco-conscious consumers and industries. This focus on innovation can lead to enhanced market share and profitability for forward-thinking manufacturers.

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing rapid industrialization and urbanization. This growth is expected to drive demand for SEBS in various applications, including construction and automotive. Companies that strategically enter these markets can capitalize on the increasing need for advanced materials, positioning themselves for long-term success.

Market.png)