Region:Global

Author(s):Shubham

Product Code:KRAA3173

Pages:97

Published On:August 2025

By Type:The market is segmented into various types of software solutions that cater to different aspects of supply chain management. The primary subsegments include Transportation Management Software, Warehouse Management Software, Inventory Management Software, Order Management Software, Supply Chain Planning Software, Supplier Relationship Management Software, Procurement Software, Demand Forecasting Software, and Others. Each of these subsegments plays a crucial role in enhancing operational efficiency and visibility across the supply chain. Transportation Management Software and Warehouse Management Software are particularly prominent, reflecting the growing demand for logistics optimization and inventory control in global supply chains .

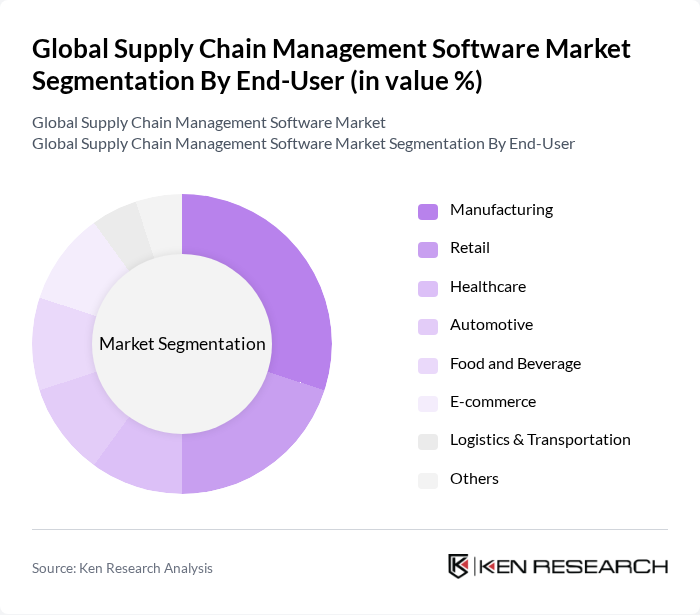

By End-User:The end-user segmentation includes various industries that utilize supply chain management software to optimize their operations. Key segments include Manufacturing, Retail, Healthcare, Automotive, Food and Beverage, E-commerce, Logistics & Transportation, and Others. Each sector has unique requirements and challenges, driving the demand for tailored software solutions. Manufacturing and retail sectors are the largest adopters, reflecting the need for integrated supply chain visibility and automation in these industries .

The Global Supply Chain Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Infor, Inc., Kinaxis Inc., IBM Corporation, Microsoft Corporation, Coupa Software Incorporated, Epicor Software Corporation, E2open Parent Holdings, Inc., Logility, Inc., Descartes Systems Group Inc., Körber AG, Magaya Corporation, Solvoyo, StockIQ Technologies Inc., Webgility Inc., Cybozu Inc., Sonata Software Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of supply chain management software is poised for transformative growth, driven by technological advancements and evolving market demands. The integration of artificial intelligence and machine learning will enhance predictive analytics capabilities, enabling companies to optimize their supply chains more effectively. Additionally, the increasing emphasis on sustainability will push organizations to adopt greener practices, further shaping software development. As businesses seek to improve resilience and adaptability, the focus on collaborative networks will also gain traction, fostering innovation and efficiency in supply chain operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Inventory Management Software Order Management Software Supply Chain Planning Software Supplier Relationship Management Software Procurement Software Demand Forecasting Software Others |

| By End-User | Manufacturing Retail Healthcare Automotive Food and Beverage E-commerce Logistics & Transportation Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Functionality | Demand Planning Supply Planning Production Planning Logistics Management Performance Management Risk Management Compliance Management Others |

| By Sales Channel | Direct Sales Distributors Online Sales Resellers |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Software | 100 | Supply Chain Managers, IT Directors |

| Retail Inventory Management Solutions | 70 | Logistics Coordinators, Operations Managers |

| Transportation Management Systems | 60 | Fleet Managers, Procurement Specialists |

| Warehouse Management Software | 50 | Warehouse Supervisors, IT Managers |

| Supply Chain Analytics Tools | 40 | Data Analysts, Business Intelligence Managers |

The Global Supply Chain Management Software Market is valued at approximately USD 27.5 billion, reflecting significant growth driven by the need for operational efficiency, e-commerce expansion, and real-time data analytics in supply chain processes.