Region:Global

Author(s):Dev

Product Code:KRAB0472

Pages:97

Published On:August 2025

By Type:The surgical equipment market is segmented into various types, including surgical instruments, surgical sutures and staplers, electrosurgical devices, energy-based devices, endoscopy and minimally invasive instruments, surgical robots and navigation systems, surgical imaging and visualization, anesthesia and patient monitoring equipment, wound closure and hemostats, disposable drapes and surgical consumables, sterilization and reprocessing equipment, and others. Among these, surgical instruments, particularly handheld tools like scalpels and forceps, dominate the market due to their essential role in various surgical procedures. Broader category sizing in recent analyses highlights handheld instruments, sutures/staplers, and electrosurgery as major revenue contributors, with rapid growth in minimally invasive/robotics.

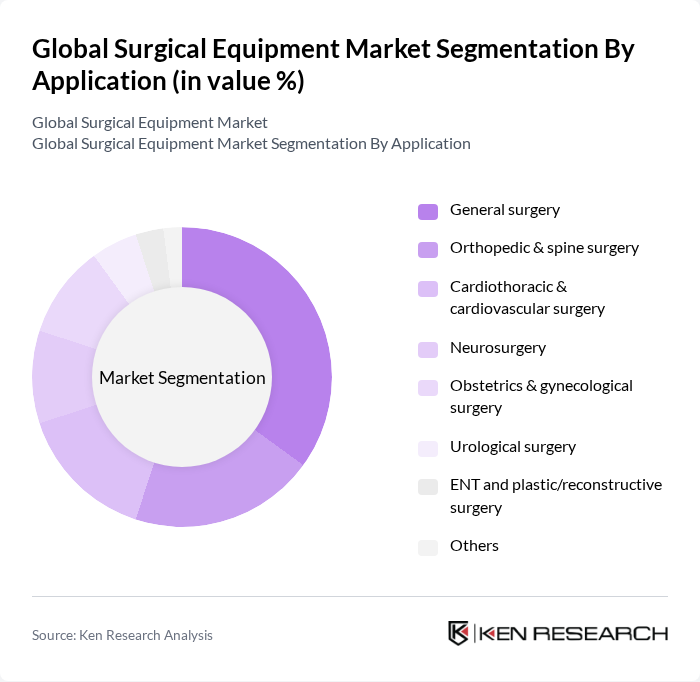

By Application:The market is also segmented by application, which includes general surgery, orthopedic and spine surgery, cardiothoracic and cardiovascular surgery, neurosurgery, obstetrics and gynecological surgery, urological surgery, ENT and plastic/reconstructive surgery, and others. General surgery remains the leading application area, driven by the high volume of procedures performed and the continuous need for surgical interventions across various medical conditions. Orthopedics and minimally invasive specialties are notable growth areas in recent market tracking due to aging populations and technology adoption.

The Global Surgical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (Ethicon & DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., B. Braun Melsungen AG, Boston Scientific Corporation, Smith & Nephew plc, Olympus Corporation, CONMED Corporation, Hologic, Inc., Terumo Corporation, Intuitive Surgical, Inc., Karl Storz SE & Co. KG, STERIS plc, 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical equipment market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centered care. As healthcare systems evolve, the integration of artificial intelligence and robotics in surgical procedures is expected to enhance precision and efficiency. Additionally, the rise of outpatient surgical centers is likely to reshape service delivery, making surgeries more accessible. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical instruments (handheld: scalpels, forceps, scissors, retractors) Surgical sutures & staplers Electrosurgical devices (generators, pencils, accessories) Energy-based devices (ultrasonic, advanced bipolar, RF ablation) Endoscopy & minimally invasive instruments (trocars, insufflators) Surgical robots & navigation systems Surgical imaging & visualization (OR imaging, headlights, cameras) Anesthesia & patient monitoring equipment Wound closure & hemostats (sealants, adhesives) Disposable drapes & surgical consumables Sterilization & reprocessing equipment Others |

| By Application | General surgery Orthopedic & spine surgery Cardiothoracic & cardiovascular surgery Neurosurgery Obstetrics & gynecological surgery Urological surgery ENT and plastic/reconstructive surgery Others |

| By End-User | Hospitals Ambulatory surgical centers Specialty clinics Academic & research institutions Others |

| By Distribution Channel | Direct sales to providers Third-party distributors Group purchasing organizations (GPOs) E-commerce/online procurement platforms Retail and hospital pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low-cost equipment Mid-range equipment Premium equipment |

| By Brand Reputation | Established brands Emerging brands Private label brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgical Equipment | 120 | Surgeons, Operating Room Managers |

| Minimally Invasive Surgical Tools | 100 | Healthcare Practitioners, Surgical Technologists |

| Robotic Surgery Systems | 80 | Surgeons, Hospital Administrators |

| Surgical Imaging Equipment | 70 | Radiologists, Imaging Technicians |

| Surgical Consumables | 90 | Procurement Officers, Supply Chain Managers |

The Global Surgical Equipment Market is valued at approximately USD 20 billion, reflecting growth driven by advancements in surgical technologies, increasing chronic disease prevalence, and a rise in surgical procedures worldwide.