Region:Asia

Author(s):Rebecca

Product Code:KRAC2266

Pages:94

Published On:January 2026

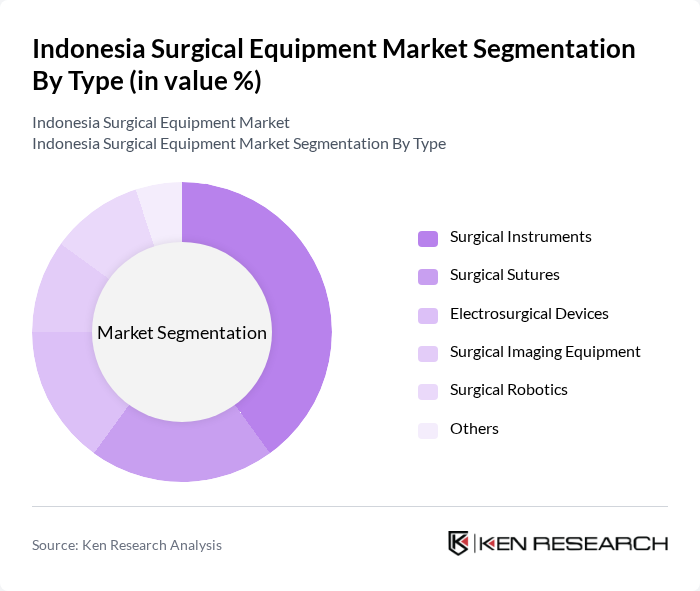

By Type:The market is segmented into various types of surgical equipment, including surgical instruments, surgical sutures, electrosurgical devices, surgical imaging equipment, surgical robotics, and others. Among these, surgical instruments hold a significant share due to their essential role in various surgical procedures. The demand for advanced surgical instruments is driven by the increasing number of surgeries performed and the growing preference for minimally invasive techniques.

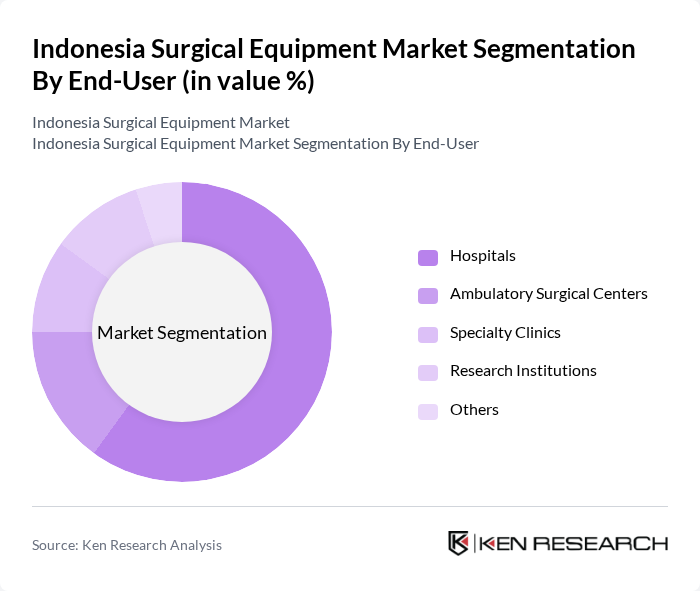

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty clinics, research institutions, and others. Hospitals are the leading end-users, accounting for a substantial portion of the market. The increasing number of surgical procedures performed in hospitals, coupled with the rising demand for advanced surgical technologies, drives the growth of this segment.

The Indonesia Surgical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Medikaloka Hermina Tbk, PT. Sumber Berkat Medika, PT. Indofarma Tbk, PT. Kimia Farma Tbk, PT. Surya Medika, PT. Mitra Keluarga Karyasehat Tbk, PT. Adi Sarana Armada Tbk, PT. Siloam International Hospitals Tbk, PT. Sejahtera Bintang Abadi, PT. Global Mediacom Tbk, PT. Medika Sarana Tbk, PT. Anugerah Pharmindo Lestari, PT. Duta Medika, PT. Bina Sehat Lestari, PT. Citra Medika contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia surgical equipment market appears promising, driven by ongoing investments in healthcare infrastructure and technological innovations. As the government continues to prioritize healthcare reforms, the expansion of private healthcare facilities is expected to enhance access to advanced surgical services. Additionally, the integration of telemedicine and remote surgical capabilities will likely transform patient care, making surgical interventions more accessible, especially in underserved areas, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Instruments Surgical Sutures Electrosurgical Devices Surgical Imaging Equipment Surgical Robotics Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Institutions Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi |

| By Application | General Surgery Orthopedic Surgery Cardiothoracic Surgery Neurosurgery Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Lifecycle Stage | New Products Mature Products Declining Products |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospitals Surgical Equipment Usage | 100 | Hospital Administrators, Procurement Officers |

| Private Clinics and Surgical Centers | 80 | Clinic Owners, Surgeons |

| Medical Device Distributors | 60 | Sales Managers, Distribution Heads |

| Healthcare Policy Makers | 50 | Government Officials, Health Policy Analysts |

| Surgeons Specializing in Various Disciplines | 90 | Orthopedic Surgeons, General Surgeons, Cardiologists |

The Indonesia Surgical Equipment Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing healthcare expenditure, advancements in surgical technologies, and a rising demand for minimally invasive surgeries.