Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0600

Pages:86

Published On:December 2025

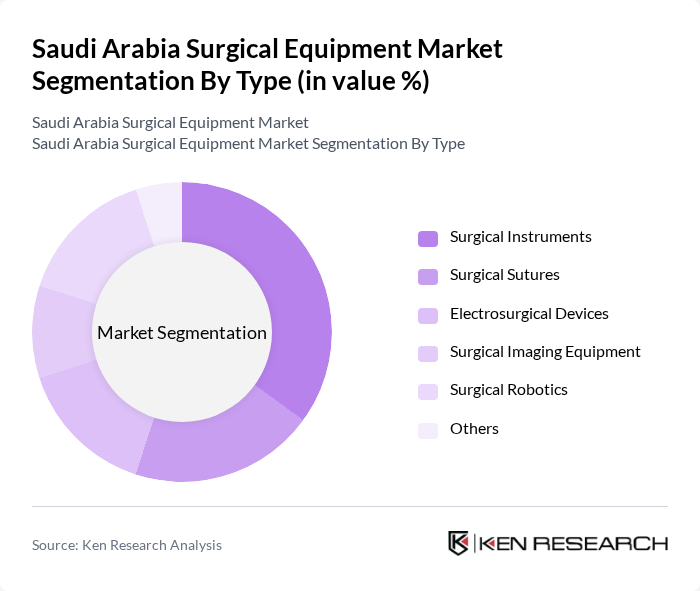

By Type:The surgical equipment market is segmented into various types, including surgical instruments, surgical sutures, electrosurgical devices, surgical imaging equipment, surgical robotics, and others. Among these, surgical instruments hold a significant share due to their essential role in various surgical procedures. The demand for advanced surgical instruments is driven by the increasing number of surgeries and the trend towards minimally invasive techniques, which require specialized tools for precision and efficiency.

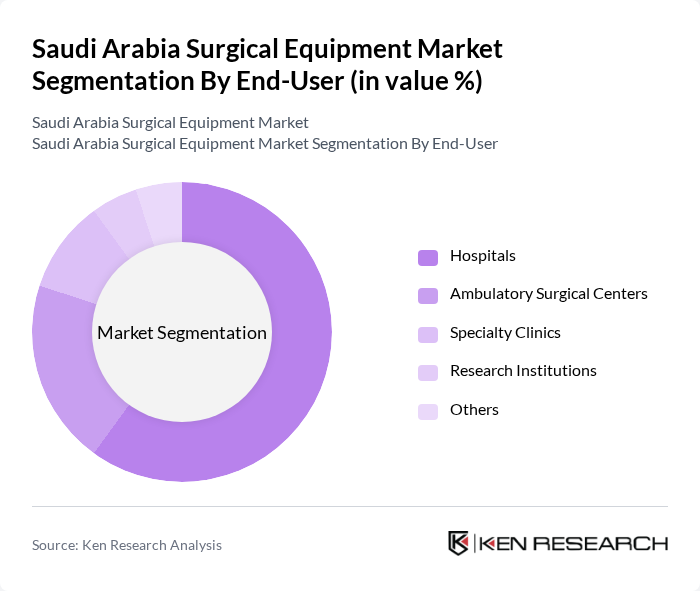

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty clinics, research institutions, and others. Hospitals dominate this segment due to their comprehensive surgical services and higher patient volumes. The increasing number of surgical procedures performed in hospitals, coupled with advancements in surgical technologies, drives the demand for surgical equipment in this setting.

The Saudi Arabia Surgical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Medtronic, Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG, GE Healthcare, Philips Healthcare, Boston Scientific, Zimmer Biomet, Abbott Laboratories, Olympus Corporation, Smith & Nephew, Terumo Corporation, Hologic, Inc., and Intuitive Surgical contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical equipment market in Saudi Arabia appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As the government continues to prioritize healthcare improvements, the demand for innovative surgical solutions is expected to rise. Additionally, the increasing prevalence of chronic diseases will necessitate more surgical interventions, further propelling market growth. The integration of artificial intelligence and robotic technologies will likely enhance surgical precision and efficiency, shaping the future landscape of surgical procedures in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Instruments Surgical Sutures Electrosurgical Devices Surgical Imaging Equipment Surgical Robotics Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Institutions Others |

| By Application | General Surgery Orthopedic Surgery Cardiovascular Surgery Neurosurgery Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Traditional Surgical Techniques Minimally Invasive Techniques Robotic Surgery Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Procurement | 100 | Procurement Managers, Hospital Administrators |

| Private Surgical Centers | 80 | Clinical Directors, Operations Managers |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Surgeon Insights | 75 | Orthopedic Surgeons, General Surgeons |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Experts |

The Saudi Arabia Surgical Equipment Market is valued at approximately USD 250 million, reflecting a significant growth driven by increasing demand for advanced surgical technologies and government investments in healthcare infrastructure under Vision 2030.