Region:Global

Author(s):Geetanshi

Product Code:KRAA2734

Pages:93

Published On:August 2025

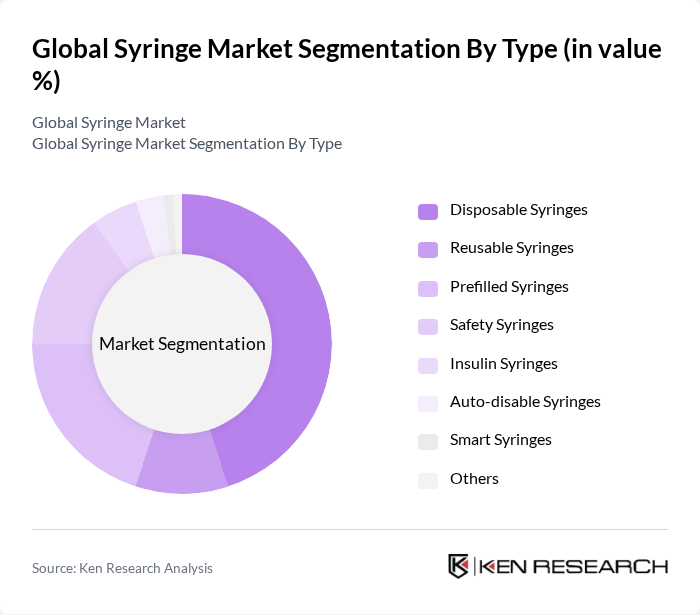

By Type:The syringe market can be segmented into various types, including disposable syringes, reusable syringes, prefilled syringes, safety syringes, insulin syringes, auto-disable syringes, smart syringes, and others. Among these, disposable syringes are the most widely used due to their convenience, infection control benefits, and regulatory emphasis on single-use devices in healthcare settings .

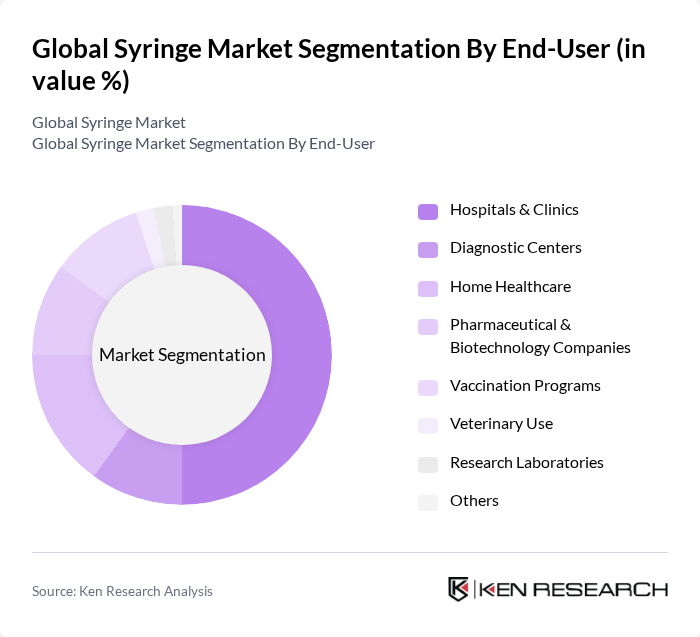

By End-User:The end-user segmentation includes hospitals & clinics, diagnostic centers, home healthcare, pharmaceutical & biotechnology companies, vaccination programs, veterinary use, research laboratories, and others. Hospitals and clinics are the leading end-users, driven by the high volume of procedures requiring syringes, particularly in vaccination campaigns and chronic disease management. The growing trend of home healthcare and self-administration of injectable medications is also expanding the demand for syringes in non-hospital settings .

The Global Syringe Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Terumo Corporation, Smiths Medical (ICU Medical, Inc.), Nipro Corporation, Medtronic plc, Fresenius Kabi AG, Gerresheimer AG, Baxter International Inc., Hindustan Syringes & Medical Devices Ltd. (HMD), Amsino International, Inc., SCHOTT AG, B. Braun Melsungen AG, Retractable Technologies, Inc., Shanghai Kindly Enterprise Development Group Co., Ltd., Medline Industries, LP contribute to innovation, geographic expansion, and service delivery in this space.

The future of the syringe market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the demand for vaccinations and chronic disease management continues to rise, manufacturers are likely to focus on developing innovative syringe solutions. Additionally, the expansion of healthcare infrastructure in emerging markets will create new opportunities for growth, enabling better access to essential medical supplies and enhancing patient care across diverse populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Syringes Reusable Syringes Prefilled Syringes Safety Syringes Insulin Syringes Auto-disable Syringes Smart Syringes Others |

| By End-User | Hospitals & Clinics Diagnostic Centers Home Healthcare Pharmaceutical & Biotechnology Companies Vaccination Programs Veterinary Use Research Laboratories Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Pharmacies Others |

| By Material | Plastic (Polypropylene, Polyethylene, etc.) Glass Metal Biodegradable Materials Others |

| By Application | Vaccination Blood Collection Drug Delivery Flushing/IV Line Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 80 | Procurement Managers, Supply Chain Coordinators |

| Pharmaceutical Companies | 60 | Product Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 90 | Doctors, Nurses, Medical Technicians |

| Medical Device Distributors | 50 | Sales Representatives, Distribution Managers |

| Public Health Organizations | 40 | Health Policy Analysts, Program Coordinators |

The Global Syringe Market is valued at approximately USD 25 billion, driven by factors such as the increasing prevalence of chronic diseases, vaccination programs, and the demand for safe drug delivery systems.