Region:Global

Author(s):Harsh Saxena

Product Code:KR1538

Pages:90

Published On:September 2025

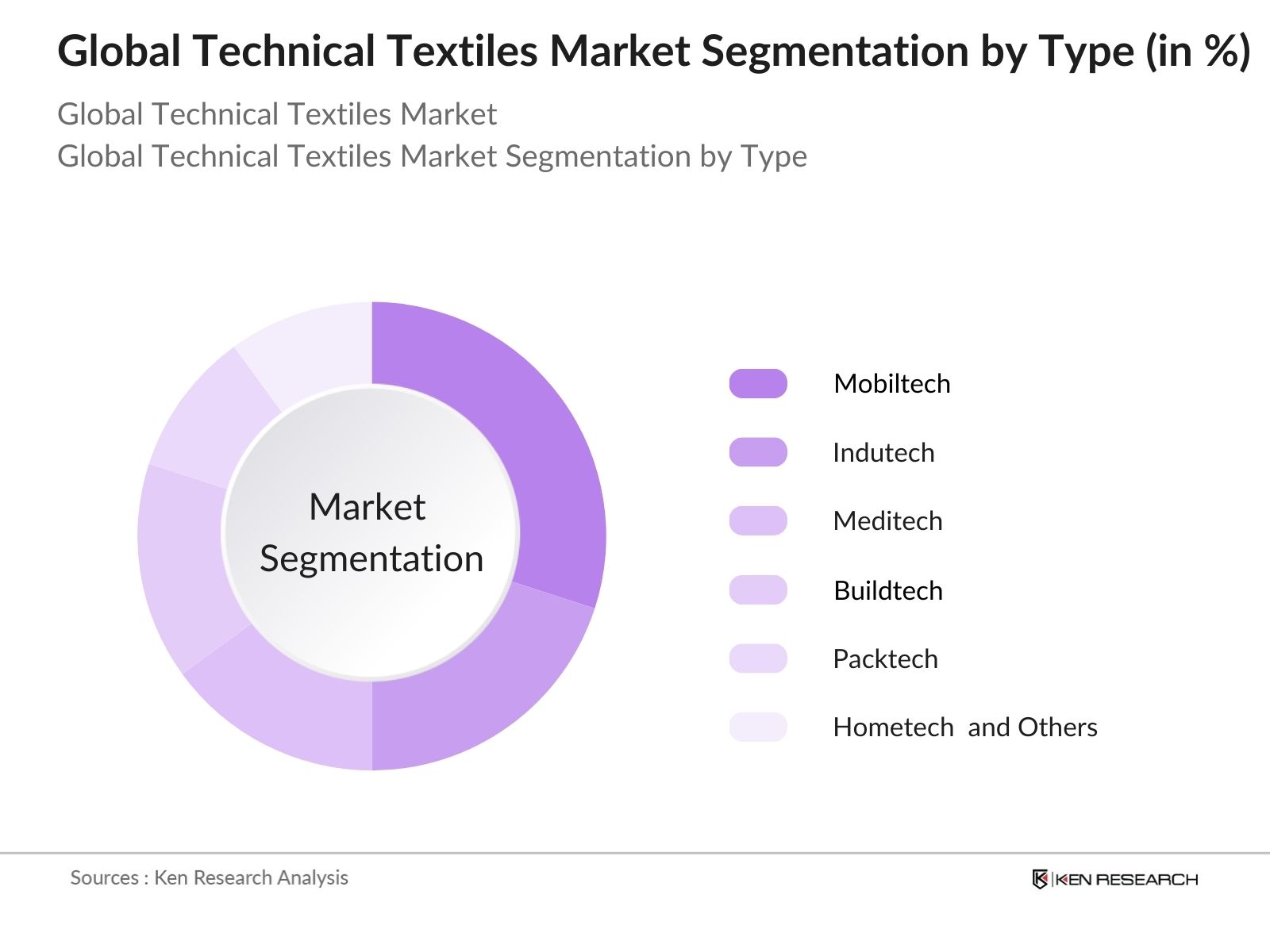

By Type:The market is segmented into Mobiltech, Indutech, Meditech, Buildtech, Packtech, Hometech, and Others. Mobiltech is the leading segment, driven by the automotive sector’s growing need for lightweight, high-strength technical textiles—such as airbags, seatbelts, and thermal insulation—especially for electric vehicles (EVs), where weight reduction is critical. Stricter emission regulations and performance demands reinforce the segment’s dominance.

The Global Technical Textiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont, BASF SE, Lenzing Group, Rieter, and Karl Mayer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the technical textiles market appears promising, driven by ongoing innovations and a growing emphasis on sustainability. As industries increasingly adopt smart textiles integrated with IoT technologies, the demand for multifunctional materials is expected to rise. Furthermore, the expansion into emerging markets, particularly in Asia-Pacific and Latin America, will provide new avenues for growth. Companies that prioritize research and development will likely lead the way in creating innovative solutions that meet evolving consumer needs and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | StartFragmentMobiltechEndFragment StartFragmentIndutechEndFragment StartFragmentMeditechEndFragment StartFragmentBuildtechEndFragment StartFragmentPacktechEndFragment StartFragmentHometech and OthersEndFragment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Technical Textiles | 100 | Product Engineers, Procurement Managers |

| Medical Textiles Applications | 80 | Healthcare Product Managers, R&D Specialists |

| Protective Clothing Materials | 70 | Safety Officers, Compliance Managers |

| Construction and Geotextiles | 90 | Project Managers, Material Engineers |

| Smart Textiles Innovations | 60 | Technology Developers, Innovation Managers |

The Global Technical Textiles Market is valued at approximately USD 220 billion, reflecting a significant growth trend driven by the increasing demand for high-performance textiles across various industries such as automotive, healthcare, and construction.