Region:Global

Author(s):Dev

Product Code:KRAA2615

Pages:93

Published On:August 2025

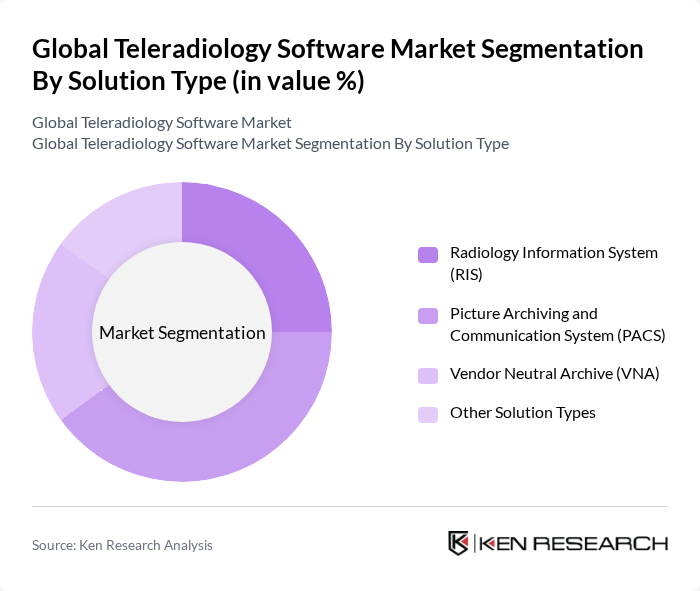

By Solution Type:The solution type segment includes various sub-segments such as Radiology Information System (RIS), Picture Archiving and Communication System (PACS), Vendor Neutral Archive (VNA), and Other Solution Types. Among these, thePicture Archiving and Communication System (PACS)is currently dominating the market due to its ability to store, retrieve, and share medical images efficiently. The increasing need for digital imaging and the transition from film-based systems to digital solutions are driving the adoption of PACS in hospitals and diagnostic centers. These trends are reinforced by the integration of artificial intelligence and machine learning for image analysis, which further enhances the utility and adoption of PACS.

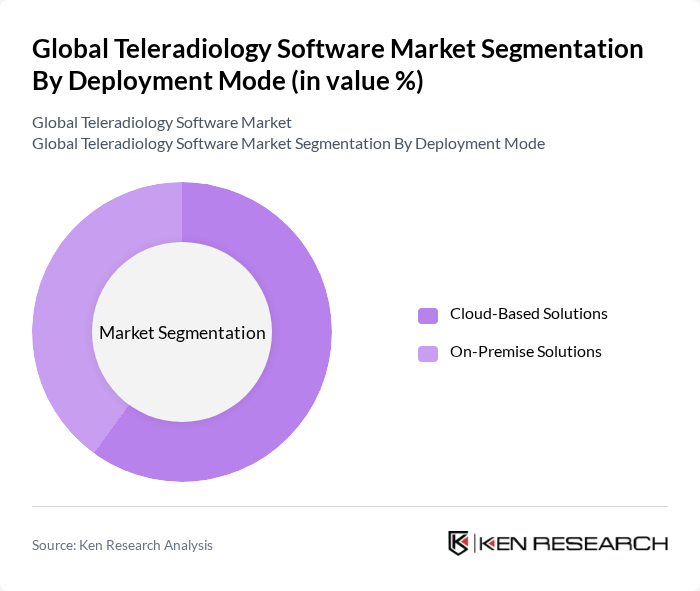

By Deployment Mode:The deployment mode segment consists of Cloud-Based Solutions and On-Premise Solutions.Cloud-Based Solutionsare leading the market due to their scalability, cost-effectiveness, and ease of access from remote locations. The growing trend of telemedicine and the need for real-time data access are further enhancing the demand for cloud-based teleradiology solutions, making them the preferred choice for many healthcare providers. The shift towards cloud-based solutions is also driven by improved collaboration, enhanced data security, and the increasing integration of teleradiology software with other healthcare IT systems.

The Global Teleradiology Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Agfa HealthCare, Fujifilm Medical Systems, Sectra AB, Carestream Health, eRAD, Inc., INFINITT Healthcare, RamSoft, Inc., MedWeb, Teleradiology Solutions, Qure.ai, Telerad Tech, Medsynaptic Pvt Ltd, Imagebytes Private Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology software market appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence and machine learning is expected to enhance diagnostic accuracy and efficiency, while the shift towards cloud-based solutions will facilitate easier access to imaging data. Additionally, the growing acceptance of telemedicine will further propel the adoption of teleradiology, making it an integral part of modern healthcare delivery systems, particularly in remote and underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Radiology Information System (RIS) Picture Archiving and Communication System (PACS) Vendor Neutral Archive (VNA) Other Solution Types |

| By Deployment Mode | Cloud-Based Solutions On-Premise Solutions |

| By Imaging Modality Supported | X-ray Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Nuclear Imaging (PET/SPECT) |

| By End-User | Hospitals Diagnostic Imaging Centers Research & Academic Institutions Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Site | Onshore Offshore |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 100 | Radiology Directors, IT Managers |

| Telehealth Service Providers | 60 | Telehealth Coordinators, Operations Managers |

| Diagnostic Imaging Centers | 50 | Center Administrators, Radiologists |

| Healthcare IT Consultants | 40 | Consultants, Technology Advisors |

| Insurance Providers | 40 | Claims Managers, Policy Analysts |

The Global Teleradiology Software Market is valued at approximately USD 2.6 billion, driven by the increasing demand for remote radiology services and advancements in telemedicine methodologies.