Region:Global

Author(s):Dev

Product Code:KRAA3050

Pages:84

Published On:August 2025

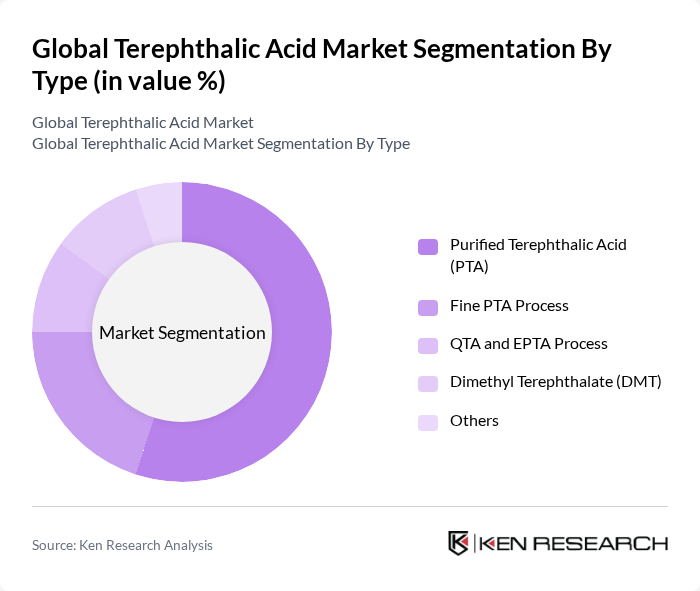

By Type:The market is segmented into various types, including Purified Terephthalic Acid (PTA), Fine PTA Process, QTA and EPTA Process, Dimethyl Terephthalate (DMT), and Others. Among these, Purified Terephthalic Acid (PTA) is the leading subsegment, primarily due to its extensive use in the production of polyester fibers and PET resins. The demand for PTA is driven by the growing textile and packaging industries, which are increasingly focusing on high-quality and sustainable materials. The Fine PTA Process and QTA and EPTA Process are also gaining traction, but PTA remains the dominant choice due to its versatility and efficiency in production.

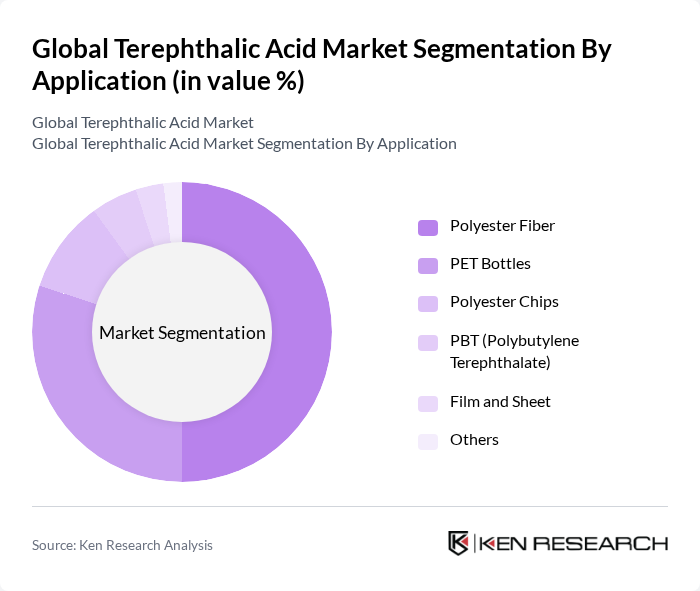

By Application:The applications of terephthalic acid are diverse, including Polyester Fiber, PET Bottles, Polyester Chips, PBT (Polybutylene Terephthalate), Film and Sheet, and Others. The Polyester Fiber segment is the largest application area, driven by the booming textile industry, which demands high-quality fibers for clothing and home textiles. PET Bottles are also a significant application, fueled by the increasing consumption of bottled beverages and the push for sustainable packaging solutions. Other applications like Polyester Chips and PBT are growing but are overshadowed by the dominant demand in fibers and bottles.

The Global Terephthalic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Indorama Ventures Public Company Limited, Reliance Industries Limited, China Petroleum & Chemical Corporation (Sinopec), Mitsubishi Chemical Corporation, Eastman Chemical Company, BASF SE, Formosa Plastics Corporation, Lotte Chemical Corporation, Alpek S.A.B. de C.V., Jiangsu Sanfangxiang Group Co., Ltd., Hunan Deli Group Co., Ltd., Far Eastern New Century Corporation, Nan Ya Plastics Corporation, SK Chemicals Co., Ltd., Hengli Petrochemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the terephthalic acid market appears promising, driven by the increasing focus on sustainability and innovation. As industries shift towards eco-friendly practices, the demand for recycled PET and biodegradable alternatives is expected to rise. Additionally, advancements in production technologies will enhance efficiency and reduce environmental impact. Companies that adapt to these trends and invest in sustainable practices are likely to gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Purified Terephthalic Acid (PTA) Fine PTA Process QTA and EPTA Process Dimethyl Terephthalate (DMT) Others |

| By Application | Polyester Fiber PET Bottles Polyester Chips PBT (Polybutylene Terephthalate) Film and Sheet Others |

| By End-User | Textile Industry Packaging Industry Automotive Industry Electronics & Electrical Construction Industry Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada, Mexico) South America (Brazil, Argentina, Rest of South America) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) |

| By Price Range | Low Price Medium Price High Price |

| By Product Form | Granules Powder Liquid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Stakeholders | 80 | Procurement Managers, Production Supervisors |

| Plastics Manufacturing Sector | 60 | Operations Managers, Product Development Engineers |

| Automotive Component Manufacturers | 50 | Supply Chain Managers, Quality Assurance Leads |

| Consumer Goods Producers | 40 | Marketing Directors, Product Managers |

| Research Institutions and Academia | 40 | Research Scientists, Industry Analysts |

The Global Terephthalic Acid Market is valued at approximately USD 80 billion, driven by the increasing demand for polyester products, particularly in the textile and packaging industries, as well as a growing preference for sustainable materials.