Region:Global

Author(s):Rebecca

Product Code:KRAA2938

Pages:88

Published On:August 2025

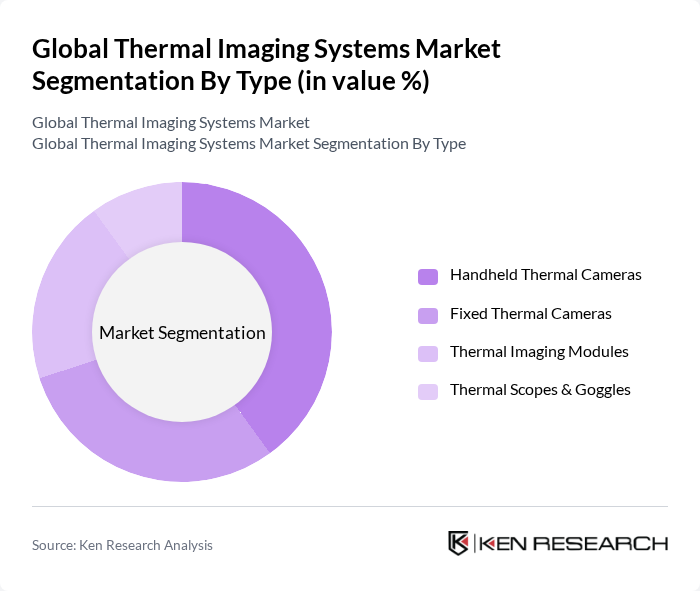

By Type:The thermal imaging systems market is segmented into four main types: Handheld Thermal Cameras, Fixed Thermal Cameras, Thermal Imaging Modules, and Thermal Scopes & Goggles. Among these, Handheld Thermal Cameras are gaining significant traction due to their portability, ease of use, and adoption in applications such as building inspections, firefighting, and field diagnostics. Fixed Thermal Cameras are widely used in security, surveillance, and industrial monitoring. Thermal Imaging Modules are increasingly integrated into other devices for enhanced functionality in sectors such as automotive and consumer electronics. Thermal Scopes & Goggles remain essential in military, law enforcement, and defense applications, contributing to their steady demand .

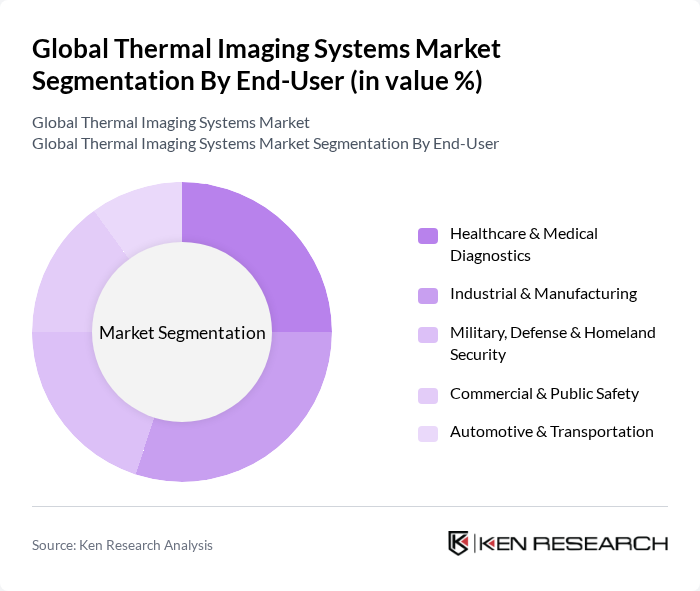

By End-User:The end-user segmentation includes Healthcare & Medical Diagnostics, Industrial & Manufacturing, Military, Defense & Homeland Security, Commercial & Public Safety, and Automotive & Transportation. The Healthcare sector is witnessing a surge in demand for thermal imaging systems for non-invasive diagnostics, patient monitoring, and fever screening. The Industrial sector utilizes these systems for predictive maintenance, equipment monitoring, and process optimization. Military and Defense sectors leverage thermal imaging for surveillance, reconnaissance, and targeting. The Commercial & Public Safety sector is driven by the need for advanced security and surveillance solutions in urban and critical infrastructure environments. The Automotive sector is increasingly adopting thermal imaging for advanced driver-assistance systems (ADAS) and night vision applications .

The Global Thermal Imaging Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teledyne FLIR LLC, FLUKE Corporation, Testo SE & Co. KGaA, L3Harris Technologies, Inc., Opgal Optronic Industries Ltd., Seek Thermal, Inc., RTX Corporation (formerly Raytheon Technologies Corporation), BAE Systems plc, Axis Communications AB, NEC Corporation, Hikvision Digital Technology Co., Ltd., Zhejiang Dali Technology Co., Ltd., AMETEK, Inc., InfiRay Technologies Co., Ltd., Thermoteknix Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of thermal imaging systems is promising, driven by technological advancements and increasing applications across various sectors. As smart city initiatives gain momentum, the integration of thermal imaging for urban safety and energy efficiency will become more prevalent. Additionally, the healthcare sector's ongoing digital transformation will further enhance the adoption of thermal imaging solutions, particularly for remote patient monitoring and diagnostics, creating a robust market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Handheld Thermal Cameras Fixed Thermal Cameras Thermal Imaging Modules Thermal Scopes & Goggles |

| By End-User | Healthcare & Medical Diagnostics Industrial & Manufacturing Military, Defense & Homeland Security Commercial & Public Safety Automotive & Transportation |

| By Application | Security & Surveillance Building & Electrical Inspection Firefighting & Rescue Thermography / Predictive Maintenance Personal Vision Systems Automotive ADAS Others |

| By Distribution Channel | Direct Sales Online Retail Distributors & System Integrators Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia & NZ, ASEAN, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, Turkey, South Africa, Nigeria, Rest of MEA) |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Uncooled Thermal Imaging (LWIR) Cooled Thermal Imaging (MWIR, SWIR) Multispectral & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Defense Applications | 100 | Military Procurement Officers, Defense Analysts |

| Healthcare Sector | 80 | Medical Equipment Managers, Radiologists |

| Industrial Applications | 70 | Plant Managers, Safety Officers |

| Firefighting and Rescue Operations | 50 | Fire Chiefs, Emergency Response Coordinators |

| Research and Development | 40 | R&D Managers, Product Development Engineers |

The Global Thermal Imaging Systems Market is valued at approximately USD 6.75 billion, driven by advancements in technology and increasing demand across various sectors, including healthcare, industrial, and automotive applications.