Region:Global

Author(s):Shubham

Product Code:KRAC4271

Pages:93

Published On:October 2025

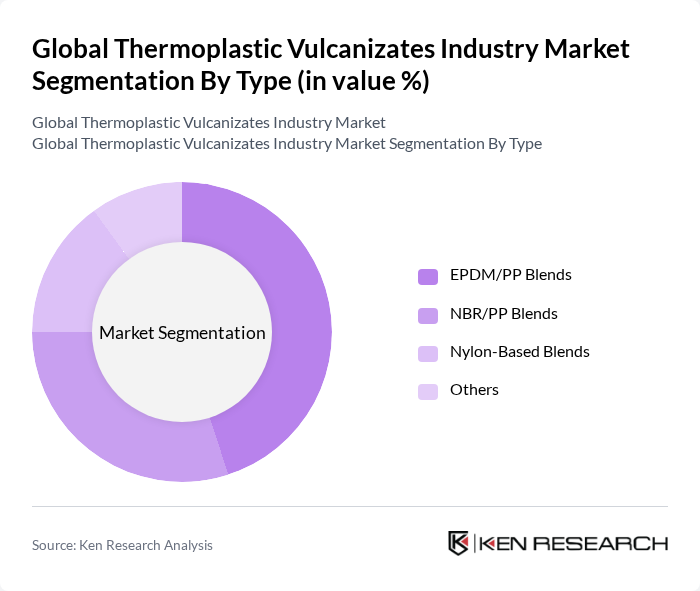

By Type:The thermoplastic vulcanizates market is segmented into EPDM/PP blends, NBR/PP blends, nylon-based blends, and others. Each type serves distinct applications and industries, with specific properties that cater to diverse consumer needs. EPDM/PP blends are particularly popular due to their superior weather resistance, flexibility, and performance in automotive and construction applications. NBR/PP blends offer oil resistance, making them suitable for industrial and fluid handling uses. Nylon-based blends provide enhanced mechanical strength for demanding engineering applications.

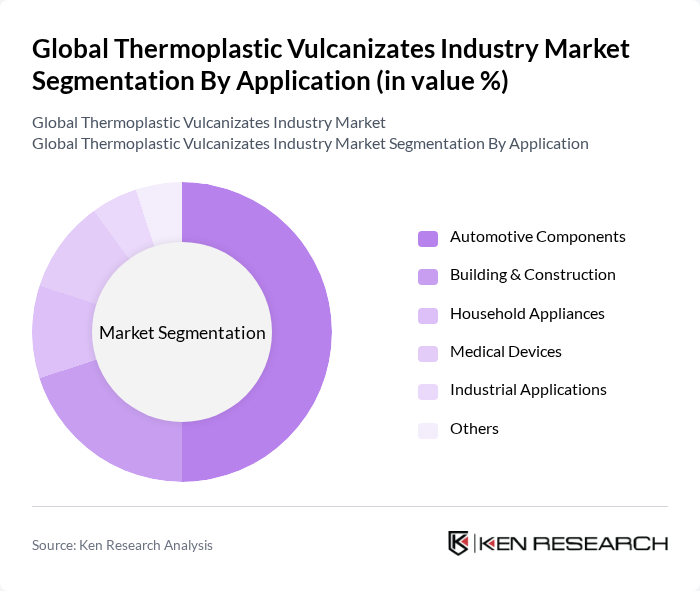

By Application:The applications of thermoplastic vulcanizates are diverse, including automotive components, building & construction, household appliances, medical devices, industrial applications, and others. The automotive sector is the largest consumer, driven by the need for lightweight materials that enhance fuel efficiency, reduce emissions, and improve design flexibility. TPVs are widely used in sealing systems, interior trim, and under-the-hood parts. The construction industry utilizes TPVs for their durability and resistance to environmental factors, while medical devices benefit from their biocompatibility and sterilization capability.

The Global Thermoplastic Vulcanizates Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Kuraray Co., Ltd., DuPont de Nemours, Inc., LG Chem Ltd., RTP Company, Mitsubishi Chemical Corporation, BASF SE, Celanese Corporation, SABIC, Covestro AG, Avient Corporation, Solvay S.A., Huntsman Corporation, Kraton Corporation, Teknor Apex Company, Mitsui Chemicals, Inc., Dynasol Elastomers, Toyoda Gosei Co., Ltd., Zeon Corporation, Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermoplastic vulcanizates market appears promising, driven by technological advancements and increasing environmental awareness. As manufacturers invest in innovative production techniques, the efficiency and sustainability of TPVs are expected to improve significantly. Additionally, the rise of electric vehicles and the demand for lightweight materials will further propel market growth. Companies that adapt to these trends and focus on sustainable practices are likely to gain a competitive edge in the evolving landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | EPDM/PP Blends NBR/PP Blends Nylon-Based Blends Others |

| By Application | Automotive Components Building & Construction Household Appliances Medical Devices Industrial Applications Others |

| By End-User | Automotive Consumer Goods Healthcare Industrial Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Granules Sheets Films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Consumer Goods Sector | 70 | Brand Managers, Supply Chain Analysts |

| Medical Device Manufacturing | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Industrial Applications | 60 | Operations Managers, Technical Directors |

| Research & Development Insights | 40 | R&D Managers, Innovation Leads |

Thermoplastic vulcanizates (TPVs) are a class of materials that combine the properties of rubber and thermoplastics. They offer excellent elasticity, weather resistance, flexibility, and recyclability, making them suitable for various applications, particularly in automotive and consumer goods sectors.